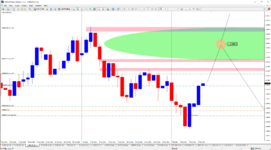

EUR/USD has shown a Stop Loss Hunting at (1.2000 to 1.19400 Levels) where 2 types of traders affected.

Type 1: This is the level where Many Traders who trade below H1 got consume into Downtrend Movements and went Short.

Type 2: Those who follow Long Term Trend, which is Uptrend also cut loss because of the Pullback.

If anyone can see, the Drop and the Recovery indicating “V Shape Recovery”. This means the Buyers Momentum is Picking up and Those who shorting will exit in Panic.

My trading ideas

My Focus always on protecting the downside and I want to be prepared for all the possibilities. In 12 years of trading experience, I realize taking care of the downside is the ultimate skill any trader should master.

I’m long till 1.2260 level and I will fully HEDGE my buy positions (Locking Floating Profit) to minimize Downside Exposure when there is profit-taking. This is critical because from this point market has the potential to rally up another 300-500 pips or fall from there.

So, if it rises I will exit my sell trade with little loss and grow my profit from BUY trades.

If it drops, I will exit buy traders with breakeven and will switch to long term Downtrend Swing Trades

" You can’t predict, you can prepare ."

Regards

Partiban, Price Action Guru

Type 1: This is the level where Many Traders who trade below H1 got consume into Downtrend Movements and went Short.

Type 2: Those who follow Long Term Trend, which is Uptrend also cut loss because of the Pullback.

If anyone can see, the Drop and the Recovery indicating “V Shape Recovery”. This means the Buyers Momentum is Picking up and Those who shorting will exit in Panic.

My trading ideas

My Focus always on protecting the downside and I want to be prepared for all the possibilities. In 12 years of trading experience, I realize taking care of the downside is the ultimate skill any trader should master.

I’m long till 1.2260 level and I will fully HEDGE my buy positions (Locking Floating Profit) to minimize Downside Exposure when there is profit-taking. This is critical because from this point market has the potential to rally up another 300-500 pips or fall from there.

So, if it rises I will exit my sell trade with little loss and grow my profit from BUY trades.

If it drops, I will exit buy traders with breakeven and will switch to long term Downtrend Swing Trades

" You can’t predict, you can prepare ."

Regards

Partiban, Price Action Guru