ForexBrokerInc Friday Market Update 22/05

EURUSD faced a test below 1.11 heading towards Wednesday’s publication of Minutes from Federal Open Market Committee Meeting but since the report was understood by traders as dovish, volumes picked up and Euro started to recover. Our expectation for the Euro-Dollar remains unchanged and as the move below 1.11 didn’t really attract sellers, we continue to see Euro-Dollar being traded at 1.15 – 1.16 rate in the coming weeks providing the market doesn’t break the key support at 1.10 – 1.1020.

The RSI,14 on H4 chart bounces off of the oversold area and daily RSI shows a bounce from the mid-point signaling a good support and plenty room for Euro-Dollar to move up.

Heads of a few central banks are due to speak today with ECB’s Mario Draghi scheduled for 9:30 EST.

For this reason we expect high liquidity during and after the speech.

GBPUSD

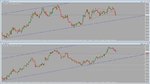

Pound-Dollar goes in-line with our expectations this week and remains in the raising channel.

The nine members of Bank of England’s Monetary Policy Committee voted to keep interest rate unchanged. Despite lower than expected inflation numbers in the UK, the retail sales data soared. This could’ve been expected as lower inflation is better for an average consumer, as this simply lets them buy more.

Today, Bank of England’s governor Carney is due to speak, at the same time as Mario Draghi from ECB at 9.30 EST.

Technically speaking, Pound-Dollar is expected to raise towards 1.60 with 1.50-55 remaining a solid support.

Oil

Oil too, in line with our expectations reached 58.50 and found a good support at this price level. Oil buyers who missed opportunity to buy at 58.50 could receive another chance at around 59.50 where the market is likely to move before another bull run is expected.

Traders should also be aware and ready for FED’s Yellen speech at 1 in the afternoon EST time.

With also Bank of Japan’s governor Kuroda speech scheduled for today (9:30 AM EST time), today looks to be a very busy day for traders. With high volatility expected, we recommend using Stop Orders on all open orders or minimize the exposure to avoid disappointment.

Subscribe to ForexbrokerInc's Youtube Channel to view this Analysis Live!