barneydunn

Active member

- Messages

- 149

- Likes

- 39

Hello, I am looking for someone else who is spread betting in the UK and would like to discuss trades and trading ideas. I have been trading forex for just over 5 years and I'm just moving over to spread betting shares, indicies, etc.

I trade with GKFX and look at all available charts on mt4. I use mt4 because that is what I am used to from the forex. Also I can code in mql4 so I have all my money management tools already coded in mt4. I have ea's for trade management too.

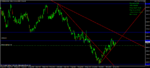

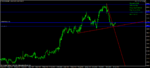

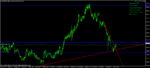

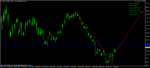

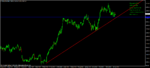

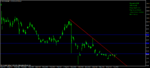

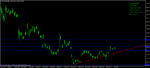

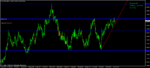

I only trade daily charts with pending orders in the direction of the trend which is something that has worked consistently well for me in forex.

If you are interested in getting in touch then either post here or pm me and hopefully we can meet on Skype.

Newbies are welcome as I can soon get you up to speed on the method.

I trade with GKFX and look at all available charts on mt4. I use mt4 because that is what I am used to from the forex. Also I can code in mql4 so I have all my money management tools already coded in mt4. I have ea's for trade management too.

I only trade daily charts with pending orders in the direction of the trend which is something that has worked consistently well for me in forex.

If you are interested in getting in touch then either post here or pm me and hopefully we can meet on Skype.

Newbies are welcome as I can soon get you up to speed on the method.