counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

I can't believe that the eur has done nothing but rise all day and everyone is gambling for the big tumble that still has not come....

Theres no reason for it to tumble, the markets are clearly in a "risk on" mode.

----------------------------------------------------------------------------------

post3208

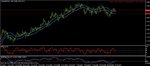

Ok here goes, if we assume that there are Two main market conditions, "risk on" and "risk off".

What we have since christmas, and it's speeding up, is a "risk on" type market condition. So this is to say, a flight to risk.

So in forex the Jpy has been weakening with no signs of a slowdown. Even the Usd has pummeled the Jpy.

Supporting evidence for this condition can also be seen in the stock index's, Dow S+P etc.

Also Europe is on the cusp of a decision concerning the Greek situation. To me the markets have already started pricing in a successful outcome ie, no default.

If a favorable decision is announced today or tomorrow...then the likes of Aud, Gbp, Eur, Chf and possibly even the Usd could fly North...big breakout style and the loser will continue to be the Jpy.