Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

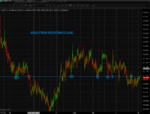

I've been biased to the short side for a long time. Markets tend to fall faster and further than they rise so I see shorting as having better chance of success in a short period of time. Just my opinion though.

Peter

id agree for the indices but not for forex,surely as pairs are expressed different ways that cant apply. Most retail traders trade eur/gbp but a lot of banks trade the gbp/eur