Good Afternoon All,

First of all I hope you are all having a profitable day.

Last night I took 2 additional trades, for those who are interested, one failed, whilst the other came to fruition. I had to head out for a few drinks, and a few became too many, thus did not get a chance to post those with the pip count shown, and since I can't show a pip count on a chart, I shall disregard posting about those trades, as it's best to go on charts with pip counts seen evidently, rather than ones word.

Last night I was wondering about going in at 2% risk, and woke up this morning with the same thought, and there was no reason why not to, so I decided thus would be the case, and if anything, I would only need half my usual pips and still make a fantastic return.

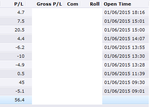

First trade, as seen below, the reasoning was if price hits the dotted line, and retraces, we are short from a double bottom. Price went through, and I was not fully awake, but fully greedy, and decided to short, well that's what I thought I was doing, unfortunately I put in a buy order, 😡😡😡, and by the time I realized, I am closing a trade with a 11.2 pip loss(-4.5% loss).

I'm very mad at myself, but being mad can wait till later, and so I composed myself, and waited for the next opportunity.

The next trade, as seen below was taken as a level of resistance followed by support was seen, a double top then followed, thus trade taken, price retraced, but didn't take out the double top, and then capitulated in my direction(if price had broke through double top, trade would have been closed), out for +23.2 pips(+9%).

The last trade, as seen below was a straightforward short of a double top for +18.6 pips(+7.4%)

Naturally, it's been a very profitable week, premiership wages, without a smoking, or drinking ban(albeit, near the lower rung of the premiership, but next week I shall be on 2% risk hopefully, so I can move up the wages table. 👍).

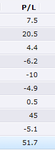

total for the day is +30 pips(+12% for the day). Pip could, and should have been higher, but I was aware of looking at the P&L column a lot today, when a satisfactory level was reached, I pulled out.

One thing I would say is that there is probably more information within the T2W site, that caters for all, to the point where you can save yourself so much money, by not going on most of the pointless courses out there, sure it may take a little digging around, but it will save you money, and even worse, that feeling of being ripped off.

There is no big secret, no need to pay, there's no secret smuggled out of Nazi Germany, no holy grail, all it takes is hard work, and patience. "What you put in, is what you get out", and hard work seldom goes unrewarded.

All thoughts, comments, and questions welcome.

Have an amazing day trading Y'all.

Best

John.

First of all I hope you are all having a profitable day.

Last night I took 2 additional trades, for those who are interested, one failed, whilst the other came to fruition. I had to head out for a few drinks, and a few became too many, thus did not get a chance to post those with the pip count shown, and since I can't show a pip count on a chart, I shall disregard posting about those trades, as it's best to go on charts with pip counts seen evidently, rather than ones word.

Last night I was wondering about going in at 2% risk, and woke up this morning with the same thought, and there was no reason why not to, so I decided thus would be the case, and if anything, I would only need half my usual pips and still make a fantastic return.

First trade, as seen below, the reasoning was if price hits the dotted line, and retraces, we are short from a double bottom. Price went through, and I was not fully awake, but fully greedy, and decided to short, well that's what I thought I was doing, unfortunately I put in a buy order, 😡😡😡, and by the time I realized, I am closing a trade with a 11.2 pip loss(-4.5% loss).

I'm very mad at myself, but being mad can wait till later, and so I composed myself, and waited for the next opportunity.

The next trade, as seen below was taken as a level of resistance followed by support was seen, a double top then followed, thus trade taken, price retraced, but didn't take out the double top, and then capitulated in my direction(if price had broke through double top, trade would have been closed), out for +23.2 pips(+9%).

The last trade, as seen below was a straightforward short of a double top for +18.6 pips(+7.4%)

Naturally, it's been a very profitable week, premiership wages, without a smoking, or drinking ban(albeit, near the lower rung of the premiership, but next week I shall be on 2% risk hopefully, so I can move up the wages table. 👍).

total for the day is +30 pips(+12% for the day). Pip could, and should have been higher, but I was aware of looking at the P&L column a lot today, when a satisfactory level was reached, I pulled out.

One thing I would say is that there is probably more information within the T2W site, that caters for all, to the point where you can save yourself so much money, by not going on most of the pointless courses out there, sure it may take a little digging around, but it will save you money, and even worse, that feeling of being ripped off.

There is no big secret, no need to pay, there's no secret smuggled out of Nazi Germany, no holy grail, all it takes is hard work, and patience. "What you put in, is what you get out", and hard work seldom goes unrewarded.

All thoughts, comments, and questions welcome.

Have an amazing day trading Y'all.

Best

John.