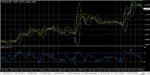

Yesterday EURUSD rose with a wide range and closed near the high of the day, in addition managed to close above the previous day high also engulfing the previous four days suggesting a strong bullish momentum.

The pair continues to trade above the 10, 50 and the 200-day moving averages that are acting as dynamic support.

According to Janet Yellen the economic activity has been expanding at a moderate pace however lowered the GDP growth plus inflation estimates for this year and 2017.

The key levels to watch are: A daily resistance at 1.1556, other daily resistance at 1.1459, the year high at 1.1376 (resistance), a daily support at 1.1237, the 10-day moving average at 1.1121 (support) and a daily support at 1.1097.

The pair continues to trade above the 10, 50 and the 200-day moving averages that are acting as dynamic support.

According to Janet Yellen the economic activity has been expanding at a moderate pace however lowered the GDP growth plus inflation estimates for this year and 2017.

The key levels to watch are: A daily resistance at 1.1556, other daily resistance at 1.1459, the year high at 1.1376 (resistance), a daily support at 1.1237, the 10-day moving average at 1.1121 (support) and a daily support at 1.1097.