You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

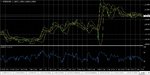

The EUR/USD lost a bit from what was gained during the last two days of the previous week. Nevertheless, the pair is now trading in the uptrend channel and looks ready to test the first support at 1.1080. If this support holds, then the pair might attempt to test first resistance which appears to be the last high of 1.1220.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

Eur/Usd found the immediate support level back to 1.1100 neighbourhood, the pair probably continue stay within the range between 1.105 to 1.1200.

It will likely break below the support at 1.1100, considering the hanging man candlestick on the daily time frame below the resistance at 1.1200.

fxstrategist

Established member

- Messages

- 603

- Likes

- 17

Eurusd

The EURUSD has found a good support on the 1.1100 level, the pair is actually pulling back down after the recent rally to the 1.1200 level.

The EURUSD has found a good support on the 1.1100 level, the pair is actually pulling back down after the recent rally to the 1.1200 level.

The pair continued its decline for a second day, as the euro has depreciated by about 50 pips to closing price of 1.1101. The extreme values were recorded respectively at 1.1175 and 1.1077. The index of relative strength retreated to neutral territory, but the graphics continues to develop over the moving averages as levels at 1.1070 appear to be additional support downwards.

Yesterday EURUSD fell with a narrow range and closed near the low of the day, however managed to close within the Friday day range, suggesting a weak bearish momentum.

The pair is still trading above the 10, 50 and the 200-day moving averages that are acting as dynamic support.

The pair is retesting the 1.1097 daily support and if the price holds it could signal another leg up.

The key levels to watch are: The year high at 1.1376 (resistance), a daily resistance at 1.1237, daily support at 1.1097, the 10-day moving average at 1.1072 (support), the 200-day moving average at 1.1027 (support) and the 50-day moving average at 1.1026 (support).

The pair is still trading above the 10, 50 and the 200-day moving averages that are acting as dynamic support.

The pair is retesting the 1.1097 daily support and if the price holds it could signal another leg up.

The key levels to watch are: The year high at 1.1376 (resistance), a daily resistance at 1.1237, daily support at 1.1097, the 10-day moving average at 1.1072 (support), the 200-day moving average at 1.1027 (support) and the 50-day moving average at 1.1026 (support).

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

The pair has been consolidating all day. I think the consolidation will continue until the FOMC statement on Wednesday, even if it breaks below 1.1100.

fxstrategist

Established member

- Messages

- 603

- Likes

- 17

Eurusd

Another day of indecision on the EURUSD as the market awaits the FED’s announcement.

Another day of indecision on the EURUSD as the market awaits the FED’s announcement.

The pair traded in a narrow range during yesterday's session and remained without any significant changes at a level of 1.1105. The extreme values were recorder at 1.1124 and 1.1071. The index of relative strength remains in neutral territory but the chart continues to develop over moving averages. Keeping the the support at 1.1070 creates conditions for the renewal of the upward movement.

Yesterday EURUSD went back and forward without any clear direction with a narrow range and closed in the middle of the daily range, however managed to close within the previous day range, suggesting lack momentum and indecision in the market.

The pair is still trading above the 10, 50 and the 200-day moving averages that are acting as dynamic support.

Today we will have the FOMC Economic projections and Fed interest rate decision that should bring a lot of volatility to the market. However the market is not expecting any interest rate hike for this month.

The key levels to watch are: The year high at 1.1376 (resistance), a daily resistance at 1.1237, daily support at 1.1097, the 10-day moving average at 1.1079 (support), the 50-day moving average at 1.1030 (support) and the 200-day moving average at 1.1027 (support).

The pair is still trading above the 10, 50 and the 200-day moving averages that are acting as dynamic support.

Today we will have the FOMC Economic projections and Fed interest rate decision that should bring a lot of volatility to the market. However the market is not expecting any interest rate hike for this month.

The key levels to watch are: The year high at 1.1376 (resistance), a daily resistance at 1.1237, daily support at 1.1097, the 10-day moving average at 1.1079 (support), the 50-day moving average at 1.1030 (support) and the 200-day moving average at 1.1027 (support).

Euro/dollar was volatile yesterday. The outlook remains bearish for now, but as long as the price holds above 1.1065, the pair is still in the upward phase targets near the trend line resistance, localized around 1.1300. On the downside, a clear break below 1.1065 will become a threat to the bullish phase targets near 1.1000 or lower. Resistance for the day is 1.1125 (yesterday's high). A clear break above it could trigger further bullish pressure testing 1.1200. The main technical outlook remains neutral.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

EUR/USD will probably reach 1.1020, but we still have to wait and see what effect Fed will have on the market later today.

fxstrategist

Established member

- Messages

- 603

- Likes

- 17

Eurusd

The EURUSD breaks above the 1.1200 level and it may try to reach the 1.1300 level.

The EURUSD breaks above the 1.1200 level and it may try to reach the 1.1300 level.

The single currency recorded a significant growth against the dollar yesterday after the Federal Reserve left interest rates unchanged. Extreme values were reached at 1.1241 and 1.1057. The main technical outlook remains neutral, but as long as stays above 1.1065, the price is still in the upward phase.