JonnyT thats who...

Given all the flak have been given, I'm going to give you all something for free that should be worth 20 points per day on the Dow.

Mr Marcus has broached the subject about what happens at what times on the Dow and sugested this is important. It is.

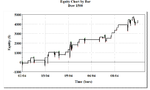

Well 3'O Clock, more correctly 10am in the US gives a high probability scalping opportunity.

Simply use a 1 minute chart and look at the latest price action up to this time. It's a high probability that the market will turn around this time and give a 20 points plus trading opportunity.

I'm not giving you a system but rather food for thought, you should be able to consistently make money.

HTH

JonnyT

Given all the flak have been given, I'm going to give you all something for free that should be worth 20 points per day on the Dow.

Mr Marcus has broached the subject about what happens at what times on the Dow and sugested this is important. It is.

Well 3'O Clock, more correctly 10am in the US gives a high probability scalping opportunity.

Simply use a 1 minute chart and look at the latest price action up to this time. It's a high probability that the market will turn around this time and give a 20 points plus trading opportunity.

I'm not giving you a system but rather food for thought, you should be able to consistently make money.

HTH

JonnyT