Good discussion so far...not sure what I will be testing next, but to keep the discussion going a bit:

There maybe more of an edge if you added the parameter of a breakout past previous highs (13, 26 or 52 wk)

Your only consideration is how to screen and choose which ones to buy, which leaves me thinking about stocks for instance that are making new highs? i.e a stock that has gone up in price for one day only, but has also made a new high. Another round of testing maybe...?

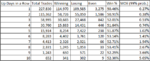

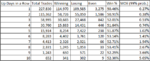

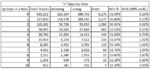

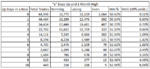

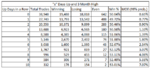

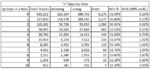

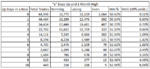

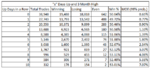

There is no edge to this either. At least none for the definition of trend I have used. Just finished up some more testing. I didn't really think my results would be any different but it was easy enough to run while I was out. I am including the original set of testing for completeness again in this post. I also ran a baseline with 0 days up (i.e. every stock purchased and sold each day the baseline criteria met).

The other testing I did was the same basic "x" up days, but with an additional requirement of the signal day high must be the 1 month high (~4 week), and the signal day high must be the 3 month high (~13 week).

To me the additional baseline parameters do not appear to have any statistically significant impact. As I am essentially looking at a shorter term trend, going out further than 3 months seemed unnecessary. Also, I am thoroughly convinced that there is nothing to be gained by further testing in this manner.

to add to cbrads comment, i have backtested systems of a break of 52week highs with 70% success rates across the entire FTSE going back 15 years. Trend trading does work, with a significant edge

Also if you could define a stop loss level in terms of recent price action, eg. Previous closes, lows, medians, highs etc. then the successful trade's gain could be evaluated in R:R terms and a 50% win rate could still make you money

In order to try and discern if something has an impact on a system, it is important to isolate that thing and test it free of other parameters. I was not so much trying to develop a system with this (although that is always the end goal), but more trying to quantify a concept and check the validity of it. At least to me, this has shown that with a very short term outlook (1 day), trading with the immediate trend has no edge.

I don't think I could ever look at a chart and see the previous 8 days as up days and conclude that the stock is not trending in the short term. Perhaps that it has no momentum, yes. To that point, I probably should not have lumped momentum in with this.

Malaguti: Perhaps there are other parts of your system(s) that are responsible for the positive results? Or perhaps trading with the trend offers some advantage on longer timescales?

Price doesn't often go straight up without any pullback which is perhaps indicated by the steep fall off in the number of trades as the number of consecutive ups increases.

Is there overlap in your results? For the case that there were 10 days up and the next was up, does this count as 2 successes for the 9 days in a row system, 3 successes for the 8 days in a row etc.

Actually, with the original test, the reason that the trades are cut approximately in half each time is quite simply because in the previous iteration, only approximately 50% had up days. So, yes, in the original system if a stock had 11 up days in a row followed by a down day, it would be considered 1 win in the x=10 system, and 10 wins in the x=1 system (and all other variants in between). I wouldn't really consider this overlap since I don't know the next direction in the series (up or down). How would you do it (and why)?

If I am understanding your post correctly, in part at least, you are dealing with the concept of probability. Prior to when you start counting your number of 'up days' you are not paying any attention to what has happened prior to day 1 in terms of determining whether the stock price is in any kind of trend.

Given that on any given day a stock price can go up, stay the same, or go down. With equal weighting of probability, the chance a stock will go up in price is 33%. So if you have calculated that by using your method you can achieve 50%+ wins, then that is pretty good?

The assumption that a stock staying the same price is equally weighted with going up or down is a bad assumption. I have included a baseline test to illustrate this point in this post where each stock was simply bought and sold each day, no filtering. From this there were 6,276 even trades of 423,213 total, or approximately 1.5%. I would say that is a pretty accurate weight that should be given to even days. I attribute the slight upward skew in my results simply to the fact that the market was up overall during my test period. Perhaps that is an incorrect conclusion...makes sense to me though.

As you are aware Im sure, Trend and Momentum do not necessarily occur together. Trend being the direction, Momentum being the speed, while importantly the other part of the equation, in my opinion, is Gravity, hence the likes of consolidation periods, and pullbacks.

Valid point regarding trend and momentum not being the same. The way I have set up my test would be more a test of trend than momentum.

I think the idea you have is one where the price keeps going up the longer its been going up, whereas if you think of the stock price as a bouncing ball (its the best I can come up with at this time of night...) If you bounce the ball away from you hard onto the floor, it rises up, quickly at first, but then tapers off as gravity takes a hold, before hitting the ground and taking off again in an upward direction etc....The longer its up in the air the less likely it is for it to continue being up in the air without coming down.

But if this were true, then my results would indicate that as "x" increases, the % win would drop notably below 50%. This is not the case.

A coin as we know has no memory, so statistically it can be flipped for years constantly and each outcome is totally independent of any prior or subsequent outcomes. Something that was touched on in one of the threads earlier this week however, is conditional probablility. I think this may well come into play here because for each additional day the price goes up, the likelyhood of it going up again the following day decreases, as I have just suggested above. This can Im sure be demonstrated statistically, but also consider that unlike the coin flip, sentiment, psychology and a whole load of other factors come in to play with stock prices.

This is not correct. Although the probability of having 3 up days in a row would be less than 50% (since there are 8 possible outcomes with 3 up days only being 1 of the possible outcomes), the probability of the 3rd day being up would still be 50% (since there are only 2 possible outcomes).

Wouldn't you consider trend as a longer term thing, i.e. not just the next day/bar. If the trend is up, I wouldn't necessarily think we'll be up on the next day, but maybe up 20 days from now.

Trend can be defined on any timescale. I expected that by looking at the immediate stock trend (with up to 10 days, we would be looking at 2 weeks max), I would be able to gain some meaningful insight into the next day/bar. I think I have fairly thoroughly proved that this is not the case (with my definition of trend).

More to the point: if you wait long enough, you can

almost always be "right". I suppose I could do another round of testing looking at this on longer time frames.

Also it's worth thinking that something can be up 50% and down 50% of the time, and still be trending upwards. There is the extent of the move.

There could be some importance to this very point but I will leave that to you to test.

For instance if the move is growing then the likelyhood is of continuing and conversely if the move is getting smaller then it is likely to reverse.

This is a good point. Although I didn't really set my tests up to check for this, from looking at the results of the backtests, I would guess that if I did do a proper test of this I would find that the stocks traveled up in magnitude just about as much as down in magnitude...but I can't really conclusively say that. Perhaps I will do a bit more testing properly factoring in momentum...not very motivated to at the moment though.

The problem with OP's analysis is that it doesn't take account of the true nature of trends. This has been alluded to by Barjon at #5 and IceMan's #6 bouncing ball analogy. Price trends are a summation of individual price cycles each having phase, amplitude and wavelength and when present take a sinusoidal form. If the ongoing sums of cycle amplitudes are increasing then it is highly likely that an uptrend is present (converse for a downtrend). However, the distance between peaks (wavelength) of the daily cycle which is what I think your analysis was attempting to measure, is unlikely to show the trend.

Again, I would say trends can be defined on any timescale, but I would agree that the usefulness of them on shorter timescales in naught as demonstrated by this exercise.

The best explanation I have found of the nature of trends and cycles within them is in Millard's book "Channels & Cycles" which expands on the work previously done by JM Hurst.

I might check that out, thanks for that.