Hi guys,

I've been talking for several months with my accountant and Interactive Brokers about a big mismatch in some tax reports and having a further look this weekend I've found the figures that are causing this problem.

Wondering if any of you could have a clue about how Interactive Broker is calculating this figure to try and clarify the issue?

I'll attach 2 files:

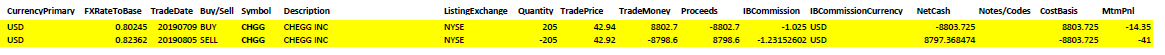

1- with the 'usd_transactions'

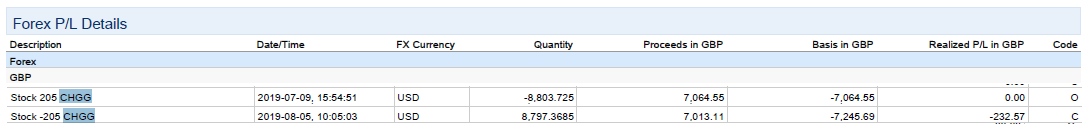

2- with the 'forex_pl_details_statement'

Basically, I've got an account funded in GBP but I trade in US stocks and tend to borrow USD from Interactive Brokers and pay interest on those. What I noticed is that on the transaction in the attachment we've got:

* BUY, Stock 205 CHGG 2019-07-09, 15:54:51

Quantity USD -8,803.725

Proceeds in GBP 7,064.55

Basis in GBP -7,064.55 0.00

which corresponds with a FXRateToBase from a Flex report of 0.80245

* SELL Stock -205 CHGG 2019-08-05, 10:05:03

Quantity USD 8,797.3685

Proceeds in GBP 7,013.11 (this is the value we don't know where it's coming from)

Basis in GBP -7,245.69

Realized PL in GBP -232.57

where the figure on the 'Basis in GBP' is using the correct FXRateToBase value for that day of '0.82362'.

But we don't know why the value under proceeds is different (at GBP 7013.11)?

My accountant is calculating this trade as follows:

* Purchase price in GBP = 7064.55

* Sell price in GBP = 7245.69

* Profit = GBP 181.14

However in the Forex PL report, we can see that Interactive Brokers has created a value of GBP 7013.11 (proceeds on GBP) for the sale (which we don't know where it's coming from, as the sell price for the day was USD 8,797.3685 x 0.82362 (the FX rate on the day of the sale) = GBP 7245.69 (not GBP 7013.11)

And the report then indicates that this transaction incurred a loss of GBP 232.57 (rather than the profit of GBP 181.14 that my accountant calculated).

1. Anyone has a clue how the proceeds value in GBP in this sale (7013.11) is calculated?

2. And would you know why Interactive brokers is using that valued and not the basis sale value of GBP 7245.69 to match it to its purchase price of GBP 7064.55?

Thank you!

I've been talking for several months with my accountant and Interactive Brokers about a big mismatch in some tax reports and having a further look this weekend I've found the figures that are causing this problem.

Wondering if any of you could have a clue about how Interactive Broker is calculating this figure to try and clarify the issue?

I'll attach 2 files:

1- with the 'usd_transactions'

2- with the 'forex_pl_details_statement'

Basically, I've got an account funded in GBP but I trade in US stocks and tend to borrow USD from Interactive Brokers and pay interest on those. What I noticed is that on the transaction in the attachment we've got:

* BUY, Stock 205 CHGG 2019-07-09, 15:54:51

Quantity USD -8,803.725

Proceeds in GBP 7,064.55

Basis in GBP -7,064.55 0.00

which corresponds with a FXRateToBase from a Flex report of 0.80245

* SELL Stock -205 CHGG 2019-08-05, 10:05:03

Quantity USD 8,797.3685

Proceeds in GBP 7,013.11 (this is the value we don't know where it's coming from)

Basis in GBP -7,245.69

Realized PL in GBP -232.57

where the figure on the 'Basis in GBP' is using the correct FXRateToBase value for that day of '0.82362'.

But we don't know why the value under proceeds is different (at GBP 7013.11)?

My accountant is calculating this trade as follows:

* Purchase price in GBP = 7064.55

* Sell price in GBP = 7245.69

* Profit = GBP 181.14

However in the Forex PL report, we can see that Interactive Brokers has created a value of GBP 7013.11 (proceeds on GBP) for the sale (which we don't know where it's coming from, as the sell price for the day was USD 8,797.3685 x 0.82362 (the FX rate on the day of the sale) = GBP 7245.69 (not GBP 7013.11)

And the report then indicates that this transaction incurred a loss of GBP 232.57 (rather than the profit of GBP 181.14 that my accountant calculated).

1. Anyone has a clue how the proceeds value in GBP in this sale (7013.11) is calculated?

2. And would you know why Interactive brokers is using that valued and not the basis sale value of GBP 7245.69 to match it to its purchase price of GBP 7064.55?

Thank you!