Yanezez

Junior member

- Messages

- 11

- Likes

- 0

Hello all,

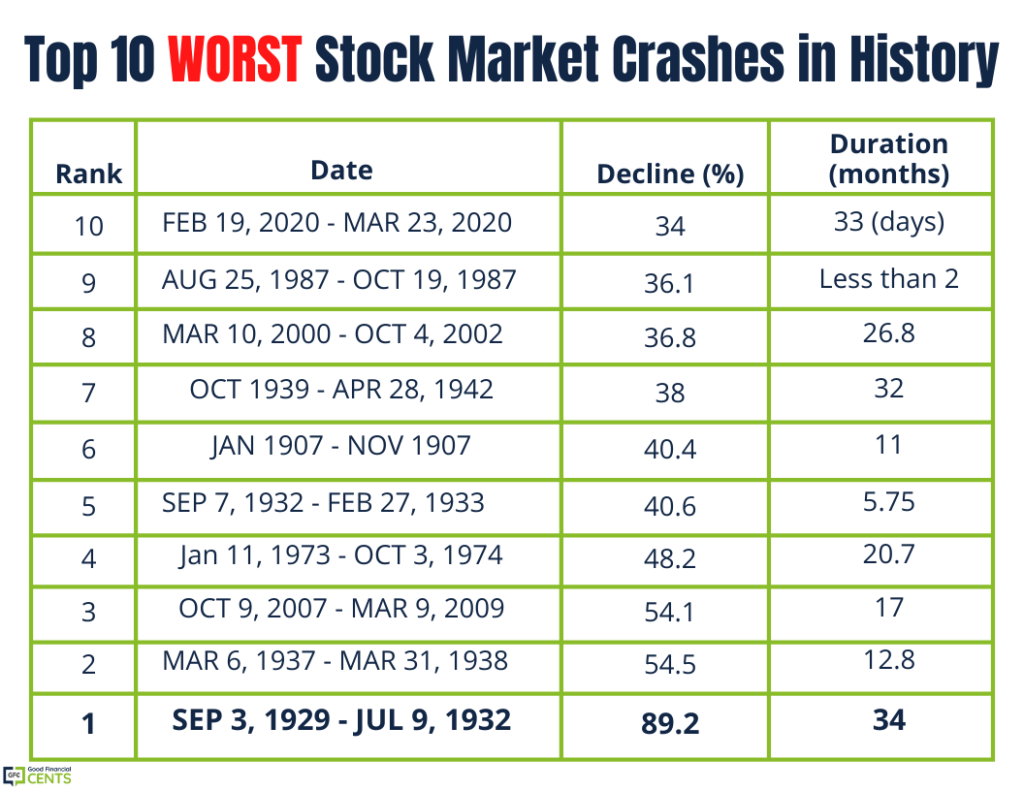

I am not expert enough to even date to say what is going to happen. So I listen to the experts and some have stated that there will be a significant correction Q42021 or Early 2022. However, some have even mentioned the possibility of a crash 'ala 2007/8'.

My question is, apart from VIX'es and those sort of instruments, which stocks or ETFs would you recommend to not necessarily hedge, but continue growing during these times?

Thank you all

I am not expert enough to even date to say what is going to happen. So I listen to the experts and some have stated that there will be a significant correction Q42021 or Early 2022. However, some have even mentioned the possibility of a crash 'ala 2007/8'.

My question is, apart from VIX'es and those sort of instruments, which stocks or ETFs would you recommend to not necessarily hedge, but continue growing during these times?

Thank you all