Hello Imogen

I happened to see your post and thought this might help you

with some reservations as follows

1) I have no business connection to "TraderDale". I was in contact with him

long ago, but have not spoken to him since. He has a reasonably good understanding

of how trading works

2) He does sell products that include indicators. Interestingly he (in the attached video)

suggests that indicators don't work. We agree on that

3) I was trained by an institutional trader long ago. He taught me a basic system

gave me a couple of tools based on volume, and let me watch as he traded his own account

4) I was a slow learner. Now years later I think I have a sense of what it takes to create a sustainable

business trading. When my mentor passed on recently, he asked me to "Pay It Forward" by

showing "a few" others how to trade. That is why I am posting.

5) I created a thread entitled "A professional approach to trading" If you decide to look at it

I suggest you only look at the most recent posts, since they show what I intend to present

to help traders struggling to make profit in this difficult business.

In response to my mentor's request I developed a simplified method just for Retail traders

I have been testing it and it seems to work quite well. In the coming days I will present a

LiveStream on Twitch and YouTube, that struggling traders might find useful. I will post on

my thread when that is about to go live.

Here is the Internet Link to a video from TraderDale, in case you would like to listen to what he

has to say, not only about indicators, but how he would proceed if he were to "start over today"

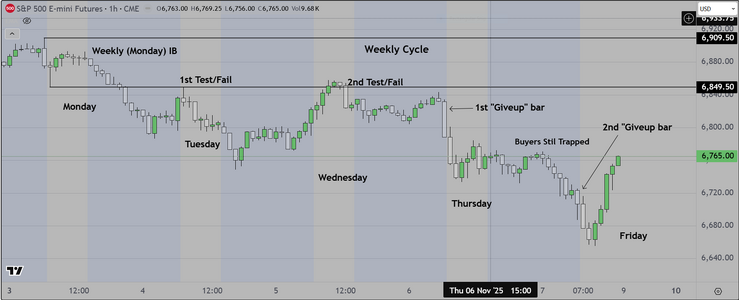

I use Volume Profile, but not in the same way that he does. His approach is known as "Swing

Trading" and requires a longer time frame approach. I trade the New York Session of the S&P

500 Futures on a daily basis (I am a daytrader).

Do you want ME to help YOU with your trading? Learn my proven Volume Profile & Order Flow trading strategies! Get my proprietary indicators and start making progress. We even set the indicators up for you so you can hit the ground running TODAY! Start Learning to Trade Now! Video Transcript: Hi...

www.trader-dale.com

I wish you the best of luck in all that you do

Steven