This problem pops up for me sometimes. Probably six times in the last week or so I have had a great profit on an option trade and not exited and of course you guys know what happens next! Profit gone and I have a loss. I know this is greed telling me if I hang on I can make more. I’m gonna implement an old strategy of mine which is to immediately put a limit sell order at a predetermined profit right after I enter a trade. And just let the computer do the discipline work that I can’t seem to do currently. Does anyone else struggle with us?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

da-net

Member

- Messages

- 77

- Likes

- 4

Yes, I do as well John. Looking over my winning trades, I found that I lacked conviction about where price was going and exited far too early on winning trades. This resulted in leaving at lot of money on the table as well as thinking counter trend had started which was not there. I decided I needed to find something that I could have more confidence in. I am currently in training on Elliottwave + Fibonacci, but have only progressed to daily time frame with conviction. The other thing I've noticed is the market chop, requires faster decision making which has caught me a few times.

Generally speaking, failures associated with entry, exit and stopout are the result of 1) lack of understanding of how your market typically acts

and after that, not having a volume based method for determining when larger forces are stepping in to change or alter a trend move.

This is characteristic of retail traders everywhere. "Conviction" has to be based on some objective standard. Most professionals use volume

based data points. "Just having a strong feeling" does not work.

Reverse Engineering

One method for developing a better understanding of your market is to reverse engineer successful trades, and that means to work from

the high or low of a trend move back towards the point at which you would be entering. Those who try this soon discover that their target

market moves in specific increments repeatedly. It is also possible to learn how to position stop loss in the same way. Finally, skilled traders

can (also) determine whether they have a system with a reasonable statistical edge, and this is done by the same analysis of at least twenty

(20) preferably thirty (30) trades. In my market that covers about a month.

Timing

In the market I specialize in, a scalp is 3+ and a swing almost always moves in increments of +10. My typical stop is 3-4. The final key to

the puzzle for me is timing. I know the approximate time(s) at which my market is likely to move AND how long typically, the moves will

last.

Good luck

and after that, not having a volume based method for determining when larger forces are stepping in to change or alter a trend move.

This is characteristic of retail traders everywhere. "Conviction" has to be based on some objective standard. Most professionals use volume

based data points. "Just having a strong feeling" does not work.

Reverse Engineering

One method for developing a better understanding of your market is to reverse engineer successful trades, and that means to work from

the high or low of a trend move back towards the point at which you would be entering. Those who try this soon discover that their target

market moves in specific increments repeatedly. It is also possible to learn how to position stop loss in the same way. Finally, skilled traders

can (also) determine whether they have a system with a reasonable statistical edge, and this is done by the same analysis of at least twenty

(20) preferably thirty (30) trades. In my market that covers about a month.

Timing

In the market I specialize in, a scalp is 3+ and a swing almost always moves in increments of +10. My typical stop is 3-4. The final key to

the puzzle for me is timing. I know the approximate time(s) at which my market is likely to move AND how long typically, the moves will

last.

Good luck

Last edited:

sideways-sid

Active member

- Messages

- 136

- Likes

- 24

Place Closing orders at your expected profit level ASAP after Opening orders fill....I have had a great profit on an option trade ...

If position size is sufficient, you can place orders to take risk off / reduce VaR and work up/down to your expected profit.

da-net

Member

- Messages

- 77

- Likes

- 4

I hope that I can offer you some help that I found very useful. I'm barely into re-education, but have experienced more winners and got out at decent prices, even though sometimes early. I'll be happy with gains in the middle and not shoot for tops or bottoms. Here's where I've gotten some help;

Wade @ tradeats.com has a free course and it's worth your time to watch 2X minimum.

Aldo @ technical analysis institute has a free 5 lesson EW & Fib course by email. I opted to take his mentoring which is helping more and not expensive.

Bella @ SMB trading has lots of good content on youtube and they offer their in-house trade strategies as downloads for free. They also have an excellent course if you think you might be prop trader material, but you might object to the cost..

Hope these things help.

Wade @ tradeats.com has a free course and it's worth your time to watch 2X minimum.

Aldo @ technical analysis institute has a free 5 lesson EW & Fib course by email. I opted to take his mentoring which is helping more and not expensive.

Bella @ SMB trading has lots of good content on youtube and they offer their in-house trade strategies as downloads for free. They also have an excellent course if you think you might be prop trader material, but you might object to the cost..

Hope these things help.

I really like your emphasis on anlayisng and understanding the structure of your winning trades.Generally speaking, failures associated with entry, exit and stopout are the result of 1) lack of understanding of how your market typically acts

and after that, not having a volume based method for determining when larger forces are stepping in to change or alter a trend move.

This is characteristic of retail traders everywhere. "Conviction" has to be based on some objective standard. Most professionals use volume

based data points. "Just having a strong feeling" does not work.

Reverse Engineering

One method for developing a better understanding of your market is to reverse engineer successful trades, and that means to work from

the high or low of a trend move back towards the point at which you would be entering. Those who try this soon discover that their target

market moves in specific increments repeatedly. It is also possible to learn how to position stop loss in the same way. Finally, skilled traders

can (also) determine whether they have a system with a reasonable statistical edge, and this is done by the same analysis of at least twenty

(20) preferably thirty (30) trades. In my market that covers about a month.

Timing

In the market I specialize in, a scalp is 3+ and a swing almost always moves in increments of +10. My typical stop is 3-4. The final key to

the puzzle for me is timing. I know the approximate time(s) at which my market is likely to move AND how long typically, the moves will

last.

Good luck

So many traders place all their emphasis on their losers, as if they feel that if only they didn't have so many losers they would be a profitable trader. This is a fallacy, the win rate of a strategy is almost intrinsic to the strategy and very hard to significantly improve. Far more effective to improve the individual performance of winners than to convert losers into winners.

ChrisDouthit

Member

- Messages

- 60

- Likes

- 12

This is a problem that everyone deals with, and you'll deal with it forever. Sometimes it feels like whatever you decide to do is wrong. If you sell, the position increases; if you hold, it drops. For shorter-term swings, the best thing you can do is use technical analysis. If you want to break it down a little more, I recommend using Elliott Wave technical analysis. This is the best for learning how to time trades.

Hello TomortonI really like your emphasis on anlayisng and understanding the structure of your winning trades.

So many traders place all their emphasis on their losers, as if they feel that if only they didn't have so many losers they would be a profitable trader. This is a fallacy, the win rate of a strategy is almost intrinsic to the strategy and very hard to significantly improve. Far more effective to improve the individual performance of winners than to convert losers into winners.

Thanks for your kind comment. This last month I was teaching a class and could not reply. My obligation ended last Friday and

as a courtesy I wanted to add a followup

Item 1

I teach new hires at commercial firms. Also on occasion I am asked to try to help if traders are having difficulty and want to consider

possible alternatives. This is a very competitive profession and if one of those alternatives is to find a new job, traders are usually willing

to at least listen to what I have to say.

Item 2

I start by analyzing a sequence of trades. By "sequence" I mean at least a week (preferably a month). What I am looking for are patterns

Because of privacy considerations I won't go into details however the pattern I often see, is traders failing to see (and incorporate) the

broader context. Usually when readers see this, they assume I am talking about the impact of specific economic reports. I am not

The top 10 firms (banks & funds) that control the markets, have the ability to move the market whenever and wherever they want

Those that are publicly traded have the obligation to report on a quarterly basis, and if you look at their performance you will discover

that they almost never fail to report big profits. The bottom line is that skilled professionals know how to anticipate when the markets

are most likely to move and in which direction. In contrast, most amateurs have no clue or just guess based on what they read.

Item 3

When I see a sequence of trades that is "out of synch" with the broad market, I know that 1) this trader doesn't understand the full picture

and 2) that his "edge" (if he has one) isn't "stable". What he may have is known as a "seasonal" edge, that appears and disappears and that is why he

is having problems

Solutions

I don't want to know what the trader's system is. Couldn't care less. If what he does is inconsistent, what good is it really. Instead I ask one

simple question. On any single trade, what is your exit rule (what is the rationale)? AND then I substitute my own systematic approach using

one of several exit styles

We backtest the new exit and (what a surprise) the result is often (almost always) immediate improvement. Changing one thing

Once they see that initial improvement, we move on to the broader problem (how to "see the market").

I don't know you Tomorton, but I suggest you begin by looking into (googling) Chuck LeBeau's "Chandelier Exit" as a starting point.

If you find something in that search that works (and I am not teaching a class) perhaps we can talk about more about the big picture.

Good luck

Hello Again

I am glad you liked my comment

I have completed work on a system that can be used by retail traders.

It uses two charts, a 5 minute chart to show context intraday and

a 3 minute chart to show a more granular view, to outline the setups

and to execute trades

As with any reasonable system, it's all about 1) learning to recognize opportunity

2) Executing on time, 3) intelligent management, and finally (and most importantly

3) Choosing the right exit based on volatility, time of day, and money (how much you

up or down).

These are the three skills that all traders have to obtain. If they fail on any one of them

they generally cannot create a viable business

In the next few days I will be live streaming my chart on Twitch so that interested persons

can see the way I operate. I will provide the details soon

Good luck

I am glad you liked my comment

I have completed work on a system that can be used by retail traders.

It uses two charts, a 5 minute chart to show context intraday and

a 3 minute chart to show a more granular view, to outline the setups

and to execute trades

As with any reasonable system, it's all about 1) learning to recognize opportunity

2) Executing on time, 3) intelligent management, and finally (and most importantly

3) Choosing the right exit based on volatility, time of day, and money (how much you

up or down).

These are the three skills that all traders have to obtain. If they fail on any one of them

they generally cannot create a viable business

In the next few days I will be live streaming my chart on Twitch so that interested persons

can see the way I operate. I will provide the details soon

Good luck

Attachments

A better options trader than me taught me ABC: Always Be ClosingI have had a great profit on an option trade and not exited and of course you guys know what happens next! Profit gone and I have a loss.

Try to treat option contracts like something you want to get off your hands at the earliest possible time. Easier said than done, of course. 🙁

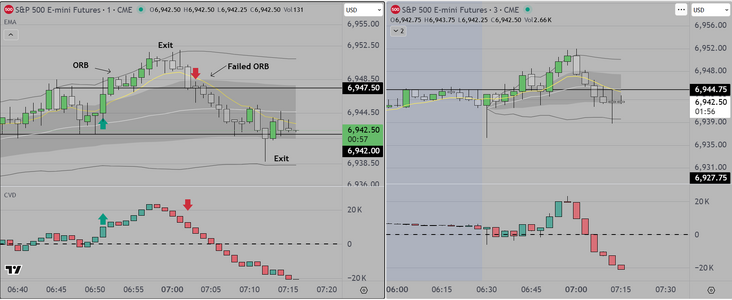

Good Afternoon

It is Wednesday 29 Oct the time is approximately 1am in the City (one assumes London time)

I have begun to provide a comment for traders interested in trading the London Session of the

S&P futures. Current Volatility is approximately 18 after spiking to 24. This event (for most professionals)

signals opportunity and that is what you will see in the attached chart.

I will provide a more detailed comment shortly so that traders interested in this market can evaluate the

opportunities. In my view we are probably going to see more sessions like this one and therefore it might

make sense to think about how to monetize it, providing you have the requisite skills

The chart uses 5 min candles and CVD and is about as simple as I can make it for retail traders. As a side not

most professionals would be reading order flow, however I have not see a retail trader do it successfully or

consistently (I am talking about reading "stack & pull"). I am willing to give it a go if someone wants to learn,

I just think this is much easier to learn and the rules are simple.

Finally, in a couple of days I will start livestreaming on Twitch. I will show the preparation process that leads to this

result. It requires about 30 minutes prior to the open, and is very simple. We simply review economic data, and create

three (3) scenarios, "Risk On, Risk Off, and Neutral". We also suggest that traders think about restricting their entries

to specific time frames, in order to give themselves the best chance of success.

Check it out if you will.

Updates to follow shortly

Good luck

It is Wednesday 29 Oct the time is approximately 1am in the City (one assumes London time)

I have begun to provide a comment for traders interested in trading the London Session of the

S&P futures. Current Volatility is approximately 18 after spiking to 24. This event (for most professionals)

signals opportunity and that is what you will see in the attached chart.

I will provide a more detailed comment shortly so that traders interested in this market can evaluate the

opportunities. In my view we are probably going to see more sessions like this one and therefore it might

make sense to think about how to monetize it, providing you have the requisite skills

The chart uses 5 min candles and CVD and is about as simple as I can make it for retail traders. As a side not

most professionals would be reading order flow, however I have not see a retail trader do it successfully or

consistently (I am talking about reading "stack & pull"). I am willing to give it a go if someone wants to learn,

I just think this is much easier to learn and the rules are simple.

Finally, in a couple of days I will start livestreaming on Twitch. I will show the preparation process that leads to this

result. It requires about 30 minutes prior to the open, and is very simple. We simply review economic data, and create

three (3) scenarios, "Risk On, Risk Off, and Neutral". We also suggest that traders think about restricting their entries

to specific time frames, in order to give themselves the best chance of success.

Check it out if you will.

Updates to follow shortly

Good luck

Attachments

Last edited:

The attached chart shows my exits based on several data points

The first being the behavior of price at the 2nd Standard Deviation Band

(of the VWAP envelope)

The second is the day of week and price behavior (context). Specifically the price

action is such that I am willing to wait until the end of the Euro/US overlap to see

how traders re-balance books. This is often the time when the market will start

to trend. About one (1) more hour before we see that result

Good luck

The first being the behavior of price at the 2nd Standard Deviation Band

(of the VWAP envelope)

The second is the day of week and price behavior (context). Specifically the price

action is such that I am willing to wait until the end of the Euro/US overlap to see

how traders re-balance books. This is often the time when the market will start

to trend. About one (1) more hour before we see that result

Good luck

Attachments

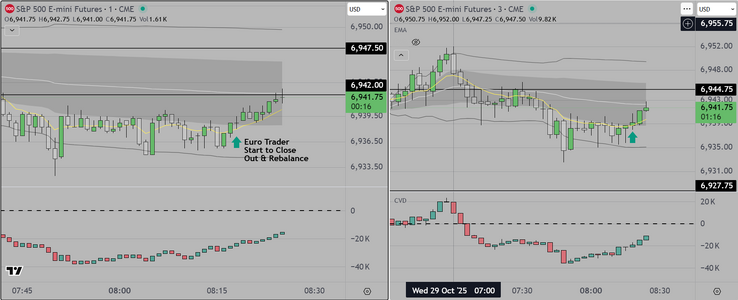

and this last chart shows the approximate timing of

the Euro Rebalance and Close of Books

No idea if it will have legs or not, however it is reliable

for traders looking for at least a small additional profit

The next "timed event" is known by professionals as the

"Power Hour" and is the last hour of the session. We suggest

that retail trader stay away but it is an opportunity to score

more points, Simply look at bar 78 or 79 on a chart using 5 min bars

You may notice the significant spike in volume as institutions close

out by placing MOC orders

Tom I realize you are dealing with options. In future I may be able to

translate this into something that an options trader can use to trade

the longer time frame

That's it for me

the Euro Rebalance and Close of Books

No idea if it will have legs or not, however it is reliable

for traders looking for at least a small additional profit

The next "timed event" is known by professionals as the

"Power Hour" and is the last hour of the session. We suggest

that retail trader stay away but it is an opportunity to score

more points, Simply look at bar 78 or 79 on a chart using 5 min bars

You may notice the significant spike in volume as institutions close

out by placing MOC orders

Tom I realize you are dealing with options. In future I may be able to

translate this into something that an options trader can use to trade

the longer time frame

That's it for me

Attachments

Similar threads

- Replies

- 6

- Views

- 2K

F

- Replies

- 6

- Views

- 3K