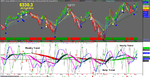

The Triple Trend Oscillator (TTO) (www.eqtrend.blogspot.com) is a trend following oscillator devised to identify the exact technical strength of a stock or indices over multiple timeframes and can also be used as a trend and momentum indicator. The sole purpose of this indicator is to keep positions on the right side of trend and at the same time indicate trend quality.

Like many other technical indicators, Trile Trend Oscillator, oscillates around a zero line but with a difference. It incorporates trend oscillators which mimic the trend momentum across three timeframes, plotting them simultaneously, thus giving an overall view of the trend position. Thus it provides a better indication of trend strength which is not possible when trends are viewed in isolation.

The main components of TTO are the three trend oscillators, which plot the three trends : Major, Intermediate and Minor trend. As indicated by TTO, a stock would be extreme bullish when all the three trend lines are above zero and extreme bearish when they are below zero. Between the extreme bullish/bearish phases, TTO exhibits varying degree of trend quality depending on the position of the three trend oscillators. Each sub-trend oscillates around its main trend, denoting the period of uptrend/downtrend in the main trend. Thus if the sub-trend rises above the main trend and remain there for an extended period, it has the effect of pulling up the main trend upward and vice-versa.

Within the major and intermediate trends, TTO shows trend swings which are indicated by the trigger line, which acts as a leading indicator. Trading position can be taken in the direction of the larger trend based on the zero crossover of the trigger line. When trigger line crosses zero from bottom, a buy signal is generated and vice versa. An increasing value of the trigger line would depict increasing momentum and topping or reversal when it starts approaching zero line. One should be prepared to exit his position on zero crossover. Also, divergences between price and trigger line may indicate a reversal of trend.

Unlike other oscillators, Triple Trend Oscillator does not have an overbought or oversold zone as these zones tend to over-extend and may remain in overbought or oversold territory for a long period till the trend is reversed. TTO relies on the trend reversal which is indicated by crossover of the shorter term trend lines. What it means is if the shorter term trend line crosses the longer term trend, a reversal is indicated. In the absence of such a crossover, the trend is assumed to continue. This logic applies to all the three time frames included in the TTO. If a lower degree trend line falls below or moves above a higher degree trend line, either the trend is weakening and reversal is impending.

http://www.eqtrend.blogspot.com

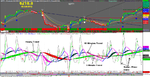

Like many other technical indicators, Trile Trend Oscillator, oscillates around a zero line but with a difference. It incorporates trend oscillators which mimic the trend momentum across three timeframes, plotting them simultaneously, thus giving an overall view of the trend position. Thus it provides a better indication of trend strength which is not possible when trends are viewed in isolation.

The main components of TTO are the three trend oscillators, which plot the three trends : Major, Intermediate and Minor trend. As indicated by TTO, a stock would be extreme bullish when all the three trend lines are above zero and extreme bearish when they are below zero. Between the extreme bullish/bearish phases, TTO exhibits varying degree of trend quality depending on the position of the three trend oscillators. Each sub-trend oscillates around its main trend, denoting the period of uptrend/downtrend in the main trend. Thus if the sub-trend rises above the main trend and remain there for an extended period, it has the effect of pulling up the main trend upward and vice-versa.

Within the major and intermediate trends, TTO shows trend swings which are indicated by the trigger line, which acts as a leading indicator. Trading position can be taken in the direction of the larger trend based on the zero crossover of the trigger line. When trigger line crosses zero from bottom, a buy signal is generated and vice versa. An increasing value of the trigger line would depict increasing momentum and topping or reversal when it starts approaching zero line. One should be prepared to exit his position on zero crossover. Also, divergences between price and trigger line may indicate a reversal of trend.

Unlike other oscillators, Triple Trend Oscillator does not have an overbought or oversold zone as these zones tend to over-extend and may remain in overbought or oversold territory for a long period till the trend is reversed. TTO relies on the trend reversal which is indicated by crossover of the shorter term trend lines. What it means is if the shorter term trend line crosses the longer term trend, a reversal is indicated. In the absence of such a crossover, the trend is assumed to continue. This logic applies to all the three time frames included in the TTO. If a lower degree trend line falls below or moves above a higher degree trend line, either the trend is weakening and reversal is impending.

http://www.eqtrend.blogspot.com

Attachments

Last edited: