You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

arabianights

Legendary member

- Messages

- 6,721

- Likes

- 1,380

Set stops where you are wrong about getting into the trade and adjust size accordingly. Applies to spread trades too.

lancenicolase

Active member

- Messages

- 219

- Likes

- 4

It is critical to have a game plan that includes exit strategies. I don’t like to assign fixed dollar or percentages to my stops because every asset and every situation is different. I use major trendlines, moving avereages and horizontal support/resistance as my guides. In essence, these breaches force me to admit when I am wrong and I have to exit the trade. I have written many articles on stops. Please use the search feature in my blog and enter keyword “stops”.

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

trailing stops

Try using Wells Wilder’s “Parabolic,” as a trailing stop, except when a cycle is due. It runs to close for cycle peaks. See if it is not simpler and gets great results.

Use the new signal to average up.

Try using Wells Wilder’s “Parabolic,” as a trailing stop, except when a cycle is due. It runs to close for cycle peaks. See if it is not simpler and gets great results.

Use the new signal to average up.

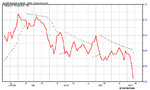

Bigcharts.com said:Parabolic Time/Price

The Parabolic Time/Price System, developed by Welles Wilder, is used to set trailing price stops and is sometimes referred to as the "SAR" (stop-and-reversal), Parabolic SAR is more popular for setting stops than for establishing direction or trend. Wilder recommended establishing the trend first, and then trading with Parabolic SAR in the direction of the trend. If the trend is up, buy when the indicator moves below the price. If the trend is down, sell when the indicator moves above the price.

The formula is quite complex and beyond the scope of this definition, but interpretation is relatively straightforward. The dotted lines below the price establish the trailing stop for a long position and the lines above establish the trailing stop for a short position. At the beginning of the move, the Parabolic SAR will provide a greater cushion between the price and the trailing stop. As the move gets underway, the distance between the price and the indicator will shrink, thus making for a tighter stop-loss as the price moves in a favorable direction.

If you are long (i.e., the price is above the SAR), the SAR will move up every day, regardless of the direction the price is moving. The amount the SAR moves up depends on the amount that prices move.

There are two variables: the step and the maximum step. The higher the step is set, the more sensitive the indicator will be to price changes. If the step is set too high, the indicator will fluctuate above and below the price too often, making interpretation difficult. The maximum step controls the adjustment of the SAR as the price moves. The lower the maximum step is set, the further the trailing stop will be from the price. Wilder recommends setting the step at .02 and the maximum step at .20.

For additional information along with the calculation please refer to "New Concepts in Technical Trading Systems" by Welles Wilder.

Attachments

fixed fraction of capital ? any other methods?

Quickg were you thinking solely about setting stops or momey management overall for spreadtrading?

I've very new to spreadtrading (currently waiting for some ordered books to be delivered so i can learn more), and one of my areas of thought has been about money management issues and position sizing.

Given that spreads tend to be lower risk that outrights, does this mean a trader can use a greater portion of capital (and so risk a greater portion) for each trade whilst still keeping a sensible and sustainable money management regime in place?

Have any experienced spreadtraders got any advice?

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

Position sizing

First off you are already hedged. You are long and short preferably in the same commodity.

Using a multiple of margin has the advantage of volatility being a part of the equation. People who have money on the line in your trade produce margin requirements.

Last October Andy Jorden wrote:

When they are following the pattern build a position, when they are not following the pattern reduce the position.

Why complicate something so simple?

Your risk is your stop plus slippage. You have no way of knowing where the next trade will actually be. The exchange thinks it will be within the range of required margin.

1 Use Mony you can afford to lose

Playing with the houses chips gives you more freedom.

2 Start small

One calendar spread per $1,000.00 equity.

Look here is the thing. When you trade spreads, the return on margins can easily give you back your original capital on successful trades. Just move cautiously until you can take your original capital out. Then pad your margins and trade your experience.

Spread Trading Rules

First off you are already hedged. You are long and short preferably in the same commodity.

Currently I have a position on in Bean Oil. Margin is about $200 us. If I was trading double margins that would be $400 per spread. I have suggested keeping $1,000.00 per spread for trading.Given that spreads tend to be lower risk that outrights, does this mean a trader can use a greater portion of capital (and so risk a greater portion) for each trade whilst still keeping a sensible and sustainable money management regime in place?

Using a multiple of margin has the advantage of volatility being a part of the equation. People who have money on the line in your trade produce margin requirements.

Last October Andy Jorden wrote:

This is money management. Keep it simple you are already hedged. Stops are “close only,” stops, based on weather or not prices are following the seasonal pattern.I don't think I understand the question.

First, I don't know what the margin or double margin has to do with the risk. Why not using 1/2 or 1/4 of the margin?

Second, why using 1% of your margin account and not 3%, 6% or more to define the risk you are willing to take on each trade.

As you can see, it all depends on your own parameters.

I am not sure if you really need a $200,000 or $400,000 dollar account to take a risk of $2,000.

All you really NEED is the margin. All the rest is up to the money management of each trader.

Andy

When they are following the pattern build a position, when they are not following the pattern reduce the position.

Why complicate something so simple?

Your risk is your stop plus slippage. You have no way of knowing where the next trade will actually be. The exchange thinks it will be within the range of required margin.

1 Use Mony you can afford to lose

Playing with the houses chips gives you more freedom.

2 Start small

One calendar spread per $1,000.00 equity.

Look here is the thing. When you trade spreads, the return on margins can easily give you back your original capital on successful trades. Just move cautiously until you can take your original capital out. Then pad your margins and trade your experience.

Spread Trading Rules

Hi Gold Trader

Thanks for the reply.

I understand that a spread trade is hedged by it’s very nature and what you are saying re stop placement. I also agree with your point about starting small. But there are a few things I’m not clear on.

1. It’s clear what is at risk on a single leg position, the gap to your stop loss at best and your entire stake at worse. But in spread trading, it’s not so straight forward for a novice to assess the level and size of risk. Is there anyway you could shed some light on this?

2. On money management, you say to start with $1000 on a single spread trade. Should a spreadtrader utilise the same short of money management techniques as an outright position trader, or being that a spread is implicitly hedged, should a spreadtrader take advantage of this and place a higher percentage of their overall trading capital on each spread they trade? If so, what kind of models do new (and experienced) spreadtraders use?

Regards

Syn

Thanks for the reply.

I understand that a spread trade is hedged by it’s very nature and what you are saying re stop placement. I also agree with your point about starting small. But there are a few things I’m not clear on.

1. It’s clear what is at risk on a single leg position, the gap to your stop loss at best and your entire stake at worse. But in spread trading, it’s not so straight forward for a novice to assess the level and size of risk. Is there anyway you could shed some light on this?

2. On money management, you say to start with $1000 on a single spread trade. Should a spreadtrader utilise the same short of money management techniques as an outright position trader, or being that a spread is implicitly hedged, should a spreadtrader take advantage of this and place a higher percentage of their overall trading capital on each spread they trade? If so, what kind of models do new (and experienced) spreadtraders use?

Regards

Syn

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

True Risk is unknowable

You do not know your true risk on any one trade. You can get an idea overall, looking at a lot of data. But you cannot know ahead of time how the next trade will be filled. So you do not know your risk.

Risk is one thing, margin is another. Basically the risk of exiting a trade is unknowable ahead of time. Margin is how much your partner in this game wants to cover their risk. Margin is knowable.

How can you know where you will be filled, it could be at a better price?It’s clear what is at risk on a single leg position,

You do not know your true risk on any one trade. You can get an idea overall, looking at a lot of data. But you cannot know ahead of time how the next trade will be filled. So you do not know your risk.

The worst is losing your position. Getting stopped out just before the market goes limit up for nine days. When you are liquidating do not underestimate unexpected slippage. There is no reverse slippage, slip is never in your favor.the gap to your stop loss at best and your entire stake at worse.

Still the same. Look at a chart and use stop plus slippage as the risk. Who ever suggested the spread, should have given you a last chance desperate get me out stop. Use one closer. When you get in on Stochastic, within a week parabolic should work well as a trailing stop on calendar spreads.But in spread trading, it’s not so straightforward for a novice to assess the level and size of risk.

Risk is one thing, margin is another. Basically the risk of exiting a trade is unknowable ahead of time. Margin is how much your partner in this game wants to cover their risk. Margin is knowable.

Well some multiple of margin is a good idea. Low risk calendar spreads are often under a thousand margin per spread. On something like grains where the margin required can be under a $100.00 you might run a little less.2. On money management, you say to start with $1000 on a single spread trade.

While most traders sometimes find themselves in a spread position. Spread traders in general should not even think about trading outrights. It requires a reckless do or die mentality that is unlike milking the markets, for long term gains. Overall outrights a do not compare to spreads on return on margin (Rom). Don’t trade outrights, if you can help it.Should a spread trader utilize the same sort of money management techniques as an outright position trader?

Yes, take advantage of the low margins and the higher return on margin offered by seasonal calendar spreads.being that a spread is implicitly hedged, should a spread trader take advantage of this?

How much unused capital is in my account this morning?If so, what kind of models do spread traders use?

Thanks for the reply GoldTrader

Forgive me, I was having a dim moment last time I wrote. I understand exactly what you are saying re risk management and stop placement on spreads.

I need to look into parabolics.

With the above, I was actually looking for some advice on the kinds of money management (% of capital per trade, etc) for spreadtrading. Should a trader apply similar approaches found in other areas of trading or given spreads often inherent lower risks, can a spreadtrader use a different approach to moneymanagement.

Cheers Syn

Still the same. Look at a chart and use stop plus slippage as the risk

Forgive me, I was having a dim moment last time I wrote. I understand exactly what you are saying re risk management and stop placement on spreads.

When you get in on Stochastic, within a week parabolic should work well as a trailing stop on calendar spreads.

I need to look into parabolics.

Should a spread trader utilize the same sort of money management techniques as an outright position trader?

With the above, I was actually looking for some advice on the kinds of money management (% of capital per trade, etc) for spreadtrading. Should a trader apply similar approaches found in other areas of trading or given spreads often inherent lower risks, can a spreadtrader use a different approach to moneymanagement.

From this statement it sounds like you are nearly always fully invested in the market. I know you say that you should only trade with money you are willing to loose. But being fully invested is dangerous when trading any other way, clearly have much to learn re spreadtrading.How much unused capital is in my account this morning?

Cheers Syn

I know you say that you should only trade with money you are willing to loose. But being fully invested is dangerous when trading any other way, clearly have much to learn re spreadtrading.

I think you should take another look at your overall investment strategy... Spreadtrading is for your *high risk* money... So, here are the two golden rules:

1) if you aren't already putting enough in your pension plan or you owe money to the credit card companies DON'T trade (spread or otherwise)

2) you don't trade with all your investment money, general rule of thumb is that you should put most (90%) of it somewhere safer than spreadbetting

In other words, the 10% of money that you've allocated to risky investments is there to do a specific job... to be in risky investments... there's no point in leaving it on the sidelines.

Hi

I appreciate the advice Jackolan. However, when i mention money management, i'm talking about the management of the capital you have specifically allocated to trading (and in this particular post, i was referring to the capital you have allocated to for spreadtrading, as part of a wider trading master strategy) aside from other investments, not your total personal capital.

Syn

I appreciate the advice Jackolan. However, when i mention money management, i'm talking about the management of the capital you have specifically allocated to trading (and in this particular post, i was referring to the capital you have allocated to for spreadtrading, as part of a wider trading master strategy) aside from other investments, not your total personal capital.

Syn

when i mention money management, i'm talking about the management of the capital you have specifically allocated to trading

In which case, your capital should be being used (unless of course, there's no clear move to make).

By "used" I mean it covers the margin requirements for your position plus a bit more for your own personal tastes, I like to have double my margin requirement available in the account.

In which case, your capital should be being used (unless of course, there's no clear move to make).

By "used" I mean it covers the margin requirements for your position plus a bit more for your own personal tastes, I like to have double my margin requirement available in the account.

That doesn't make any sense to me. Bascially you are talking about being virtually fully invested, i.e. having all your trading capital in the market at once. Unless you know something i don't, then this is a sure fire way to risk losing all your trading capital over a few bad trades and having to dig out funds from elsewhere to give you new seed capital for your trading. What am i missing in what you are saying?

Last edited:

I think you're missing the fact that spreadbetting is a leveraged product.

If you put on a trade of £1 a point on the FTSE100 at 4300 then you have "bought" the equivalent of £4300 worth of shares. Yet you only need the margin in your account to do this (£150, or in my case, double the margin, £300).

Yes... I am "risking" the entire £300 in the account, but actually, I'm really "risking" £4300.

In other words, don't forget to scale out the risk/reward ratio by the leverage.

Spreadbetting is for money you can afford to lose in the hope of a high reward. If you don't want to lose the money (yes, all of it) invest it in a safer instrument.

If you put on a trade of £1 a point on the FTSE100 at 4300 then you have "bought" the equivalent of £4300 worth of shares. Yet you only need the margin in your account to do this (£150, or in my case, double the margin, £300).

Yes... I am "risking" the entire £300 in the account, but actually, I'm really "risking" £4300.

In other words, don't forget to scale out the risk/reward ratio by the leverage.

Spreadbetting is for money you can afford to lose in the hope of a high reward. If you don't want to lose the money (yes, all of it) invest it in a safer instrument.

Last edited:

It's clear we are talking at crosspurposes. I am talking about trading spreads. Whereas you are talking about spreadbetting. One is a field of trading and the other is a mechanism for placing trades.

By the way, with the use of stop losses (some spreadbet providers even provide guaranteed stops - guaranteed even against gaps) you can limit your losses and with a good money management strategy and enough discipline to follow it, you don't have to treat all of your trading/betting capital as completely speculative.

Goldtrader, i'd be interested to hear you're thoughts on my post made above in reply to your most recent answer.

By the way, with the use of stop losses (some spreadbet providers even provide guaranteed stops - guaranteed even against gaps) you can limit your losses and with a good money management strategy and enough discipline to follow it, you don't have to treat all of your trading/betting capital as completely speculative.

Goldtrader, i'd be interested to hear you're thoughts on my post made above in reply to your most recent answer.

I am talking about trading spreads. Whereas you are talking about spreadbetting.

Oooppsss 😱 It was late, I was drunk, and then I didn't read the thread again this morning.... 😍

Oooppsss 😱 It was late, I was drunk, and then I didn't read the thread again this morning.... 😍

No problem. Hope the hangover isn't too bad! 🙂

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

Speculating is speculating.

When you get in a seasonal move, new capital comes in sometimes every day. What do you plan to do let it disappear in stocks or devalued currencies. What is a safe investment anyway?

Safety of principle, liquidity, chance of capital gain, some sort of income. Spreads offer at least partial safety of principle, liquidly, chance of capital gain, and where else can you average up with new earnings as easily?

A seasonal trend going your way is the only kind of safe speculation you need. Little initial capital big, often substantial gains.

I don’t get it?

Jackolan is right on here, sounds like a seasoned spread trader.

Ya sure there are risks, but that twice a year when you really hit a big one. Go out and buy a few luxuries you might have missed. The real risk is missing the big moves. Taking a $1,000.00 profit out of a move where you should have gained $100,000.00

Look what Jackolan has to say about this.From this statement it sounds like you are nearly always fully invested in the market.

You can’t be fully invested unless you have opportunities. Stochastics does not pop every day. But when it does, why hold back?In which case, your capital should be being used (unless of course, there's no clear move to make).

When you get in a seasonal move, new capital comes in sometimes every day. What do you plan to do let it disappear in stocks or devalued currencies. What is a safe investment anyway?

Safety of principle, liquidity, chance of capital gain, some sort of income. Spreads offer at least partial safety of principle, liquidly, chance of capital gain, and where else can you average up with new earnings as easily?

A seasonal trend going your way is the only kind of safe speculation you need. Little initial capital big, often substantial gains.

Preferably take your original capital out, from early profits, then get down to work seriously. You have a dollar waiting on a dime. Get over it.I know you say that you should only trade with money you are willing to loose.

100% of the 10% seems reasonable. Why not 100% of the 100%?In other words, the 10% of money that you've allocated to risky investments is there to do a specific job... to be in risky investments.

Dangerous like when you go home with a strange women, or crossing a busy street blindfolded, skydiving, flying a small plane. What are you talking about dangerous?But being fully invested is dangerous

I don’t get it?

Excellent!!By "used" I mean it covers the margin requirements for your position plus a bit more for your own personal tastes.

Jackolan is right on here, sounds like a seasoned spread trader.

I guess you need a reread of Reminiscences.risk losing all your trading capital .. and having to dig out funds from elsewhere to give you new seed capital for your trading.

Ya sure there are risks, but that twice a year when you really hit a big one. Go out and buy a few luxuries you might have missed. The real risk is missing the big moves. Taking a $1,000.00 profit out of a move where you should have gained $100,000.00

Same thing here for seasonal futures spreads.I think you're missing the fact that spreadbetting is a leveraged product.

Euro$ are Time Deposits having a principal value of USD $1,000,000 with a three-month maturity. By putting on a Euro$ spread you control at least a million dollars worth of something. The margin is often less than $300 dollars. Double margins $600.00. That would be money management. You illusionary risk is chart support.If you put on a trade of £1 a point on the FTSE100 at 4300 then you have "bought" the equivalent of £4300 worth of shares. Yet you only need the margin in your account to do this (£150, or in my case, double the margin, £300).

Following along I am putting up the whole $300 on the spread, but actually we are playing with a million.I am "risking" the entire £300 in the account, but actually, I'm really "risking" £4300.

Trade with what you can afford to lose, it hopes of doubling it.Spreadbetting is for money you can afford to lose in the hope of a high reward.

Speculating is speculating.I am talking about trading spreads. Whereas you are talking about spreadbetting.

Hi GoldTrader

Clearly you are a seasoned spreadtrader. I am not, and i have alot to learn re spreadtrading. As this is the case, i cannot yet truly understand your approach to position-sizing and money/risk management.

I have a very clear understanding of money and risk management in other forms of trading and i know very well how to manage my own total capital and trading capital. Many tenants of money management are universal in trading and apply in some degree to the majority of its forms. I wondered if this is the case for trading spreads.

However, your approach to money management is very different from the ones i have encountered previously, and at present (and perhaps because i am not yet very knowledgeable on spreadtrading) I simply don't understand it, it goes against what i currently know to be key to success in trading. A fundamental factor in trading is preservation of capital - allowing you to live till another day.

Personally i think good money management is absolutely vital to being a successful trader. I don't yet know how this is best done in trading spreads. But as i say i have a lot to learn re spreads and i will find out.

Syn

Clearly you are a seasoned spreadtrader. I am not, and i have alot to learn re spreadtrading. As this is the case, i cannot yet truly understand your approach to position-sizing and money/risk management.

I have a very clear understanding of money and risk management in other forms of trading and i know very well how to manage my own total capital and trading capital. Many tenants of money management are universal in trading and apply in some degree to the majority of its forms. I wondered if this is the case for trading spreads.

However, your approach to money management is very different from the ones i have encountered previously, and at present (and perhaps because i am not yet very knowledgeable on spreadtrading) I simply don't understand it, it goes against what i currently know to be key to success in trading. A fundamental factor in trading is preservation of capital - allowing you to live till another day.

Personally i think good money management is absolutely vital to being a successful trader. I don't yet know how this is best done in trading spreads. But as i say i have a lot to learn re spreads and i will find out.

Syn

However, your approach to money management is very different from the ones i have encountered previously, and at present (and perhaps because i am not yet very knowledgeable on spreadtrading) I simply don't understand it, it goes against what i currently know to be key to success in trading. A fundamental factor in trading is preservation of capital - allowing you to live till another day.

Personally i think good money management is absolutely vital to being a successful trader. I don't yet know how this is best done in trading spreads. But as i say i have a lot to learn re spreads and i will find out.

Again, you are failing to take into account that you are working with a leveraged investment. The margin you have in your account is only a fraction of the value of the investment you are making.

Using GT's figures, a $300 margin allows you to control $1,000,000 worth of investment. Your leverage is therefore a massive 3300 (rounded down for convenience!) If you invest $1,000,000 and make 0.03% your profit is $300... But since you have only "risked" $300 your rate of return on capital used is 100%.

I think the best way for you to look at it, given the more traditional approach you seem to be viewing it from, is that you are not investing $300... you are borrowing $1,000,000 with a guarantee to repay, and then you are investing the million.

If your investment is a good one, then when you close out you pay off the $1,000,000 loan and what's left is yours to keep. If your investment goes sour, then when you close out you have to find the cash to pay back the full $1,000,000. The $300 margin is just a deposit that you give the loan company in case you make a loss.

Yes, you can lose the entire $300... very often... and sometimes you can lose more... but the upside is that you can win a lot of money as well.

Only put into a leveraged product the amount of money you are prepared to lose (completely). Because the amount of money you could lose (theoretically) is 3,300 times that.

Last edited:

Similar threads

- Replies

- 2

- Views

- 1K

- Replies

- 0

- Views

- 2K

- Replies

- 16

- Views

- 8K

B

- Replies

- 17

- Views

- 5K