So, Ken...did you every do the homework that was required by the course? Here's the email (attached) I sent to Ken because of his incessant whining and unwillingness to apply what I (attempted) to teach. The guy paid the money, did the Fundamentals course but couldn't figure out how to do some basic, grade school graphing (Yesterday's Trade Module I).

My response

here, with copies of PayPal transactions and a "noncompliance" email I sent out to Ken last February. Notice the blogger (Ken) doesn't ever state that the stuff I teach doesn't work...

...because he never studied or learned it.

Ken does bring up an issue regarding a "live trading advisor". I actually did that for 3 months years ago. It didn't work. The guys on the Skype conference did not learn how to trade, they just endlessly talked about the daytrading chart instead of applying the concepts of mechanical trading and taking the dang trade.

If someone is geniunely interested in hearing the other side from subscribers that actually DO HOMEWORK, send an

email and I will forward it to some happy subscribes that use the methodology every day. The

DayRaider Upgrade is being deployed now..and will take the One Minute Methodology to a "nirvana" type level, imo. If a subscriber wants it, they pay me $100 for two months...wow I MUST be in this for the money, huh??

No, it's there as an

alternative if subscribers want to progress to a higher level. If not, they stay at the

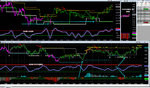

DayRaider 2.2 level, no problem. I've enclosed a screen grab of part of 6/30 -- if the cyan line goes UP ya buy..if the yellow line goes DOWN ya sell..risk maybe ten ticks max...(yeah, it's a little more complicated than that but not too difficult). You have mechanical time and price rules along with indicators that never lie -- they indicate whether the overbought or oversold condition is likely to end. If the condition is not in the process of ending, you stay with the current trade.

Daytrading is not for complainers. It is for the rugged individualist that wants to go farther than the crowd and take responsibility for their own actions. Scammed By Stuart blog is by a typical person in America (unfortunately) that doesn't want to get off their duff and make it happen. There are lots of people that DO want the opportunity, but you'll always find one or two that are whiners.

Funny, but the only people that are whining are the ones that I gave half prices specials because this was their last chance at daytrading before their wife (or ex-wife) cut off their credit line..lol !!

😱

Happy Trading and Cheers to Everyone...and... I do enjoy training and helping people be successful only for those that want to take responsibility for their own actions.

Stuart

The Mechanical Day Trader

[email protected]