Fundamental and Technical Analysis

Pairs traders employ either fundamental or technical analysis, or a combination of the two, to make decisions regarding which instruments to pair, and when to get in and out of trades. Many pairs traders apply technical analysis techniques and then confirm the findings using fundamentals. This extra “layer” of analysis can be used simply to ensure that the trade “makes sense”. For instance, if all technical analysis points to taking a long position in stock ABC and a short in XYZ, but the fundamentals show that stock ABC will have a weak earnings report, the position may need to be reconsidered.

Fundamental factors

Fundamental analysis examines related economic, financial and other qualitative and quantitative factors to evaluate a security’s value, and to determine which security will perform better in the short-term. Fundamental analysts may consider a number of growth and value factors when identifying opportunities for pairs trading. These include (but are not limited to):

Technical factors

Technical analysis, on the other hand, is a method of evaluating securities by analyzing statistics generated by market activity; in particular, historical price and volume. Rather than attempting to measure a security’s intrinsic value, technical analysis seeks to identify patterns to predict future price movements.

Pairs traders call on a variety of tools and technical indicators to identify trading opportunities. The technical analyst may use, for example:

Other metrics may be useful to pairs traders as well. Consider beta, for example. Market risk can be measured by beta: a measure of a stock’s volatility relative to the market. The market has a beta of 1.0, and each individual stock is ranked based on how much it deviates from the market. If a stock swings more than the market over time, it will have a beta above 1.0; conversely, if a stock moves less than the market, its beta will be less than 1.0. High-beta stocks are considered riskier but tend to provide the potential for higher returns. Low-beta stocks have less risk, accompanied by lower potential returns. Ideally, the securities in a pairs trade have betas that are stable over time.

Deciding to implement a fundamental or technical approach is a matter of personal preference. Many pairs traders, and in particular short-term traders, prefer a technical approach. Some conduct technical analysis and look for confirmation using certain fundamentals, while others may use fundamental analysis exclusively. As with any investment strategy, finding the right combination of analysis tools and methodology takes research, historical modeling and testing.

Trade Example

As with nearly any investment, taking a pairs trade involves more than just hitting the buy and sell button. Here we examine, in very broad terms, the steps required to enter and exit a pairs trade.

Assemble a list of potentially related pairs

Just as long-only stock traders scan the markets for suitable securities, a pairs trader must start with a list of potentially related pairs. This entails conducting research to find securities that have something in common – whether the relationship is due to sector (such as the auto sector) or to asset (for example, bonds). While any random pair could theoretically be correlated, it is more likely that we will find correlation in securities that have something in common to begin with.

Determining the correlation level

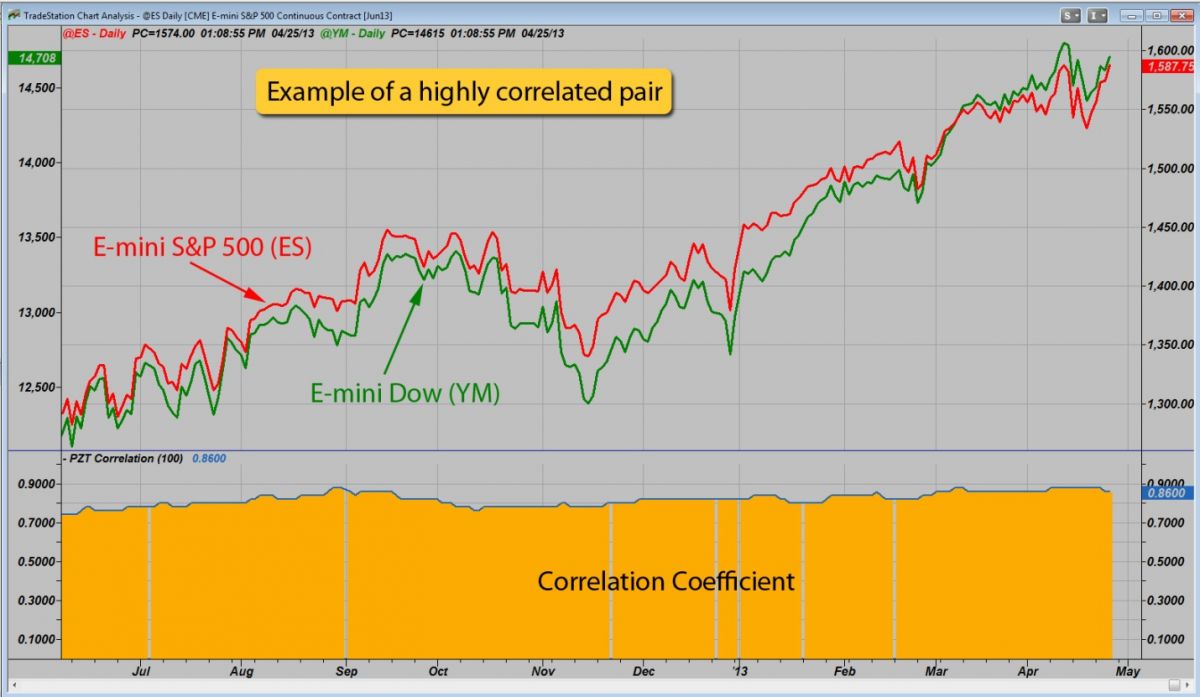

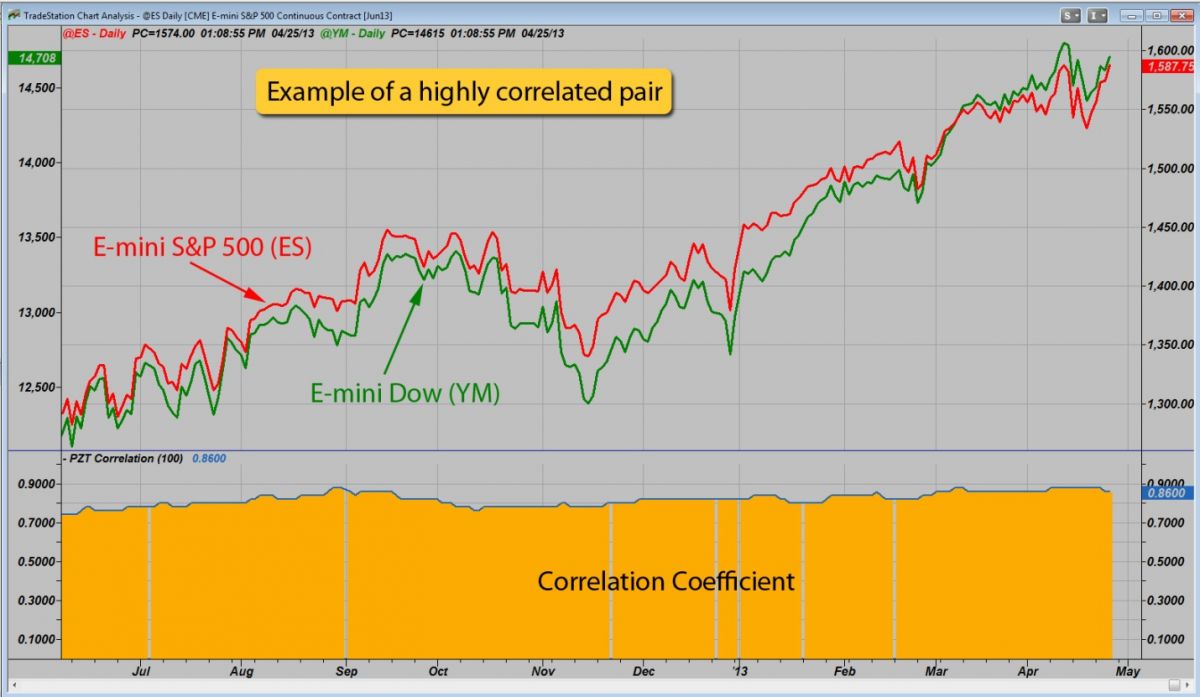

The next step acts as a filter, or a means by which we can reduce the number of potential pairs in our quiver. One way is to use a correlation coefficient to determine how closely two instruments are related. Figure 4 shows a daily chart of the e-mini S&P 500 contract (in red) and the e-mini Dow contract (in green). Below the price chart is an indicator that shows the correlation coefficient (in yellow). We can see from the chart that during the time period evaluated, the ES and YM are highly correlated, with values hovering around 0.9. We will keep the ES/YM pair on our list of potential pairs candidates.

Figure 4 The e-mini S&P 500 contract (in red) and the e-mini Dow (in green) show potential as a pairs trade. Visual confirmation of price, backed by quantitative results from the correlation coefficient (in yellow), show that the two instruments are highly correlated. Image created with TradeStation.

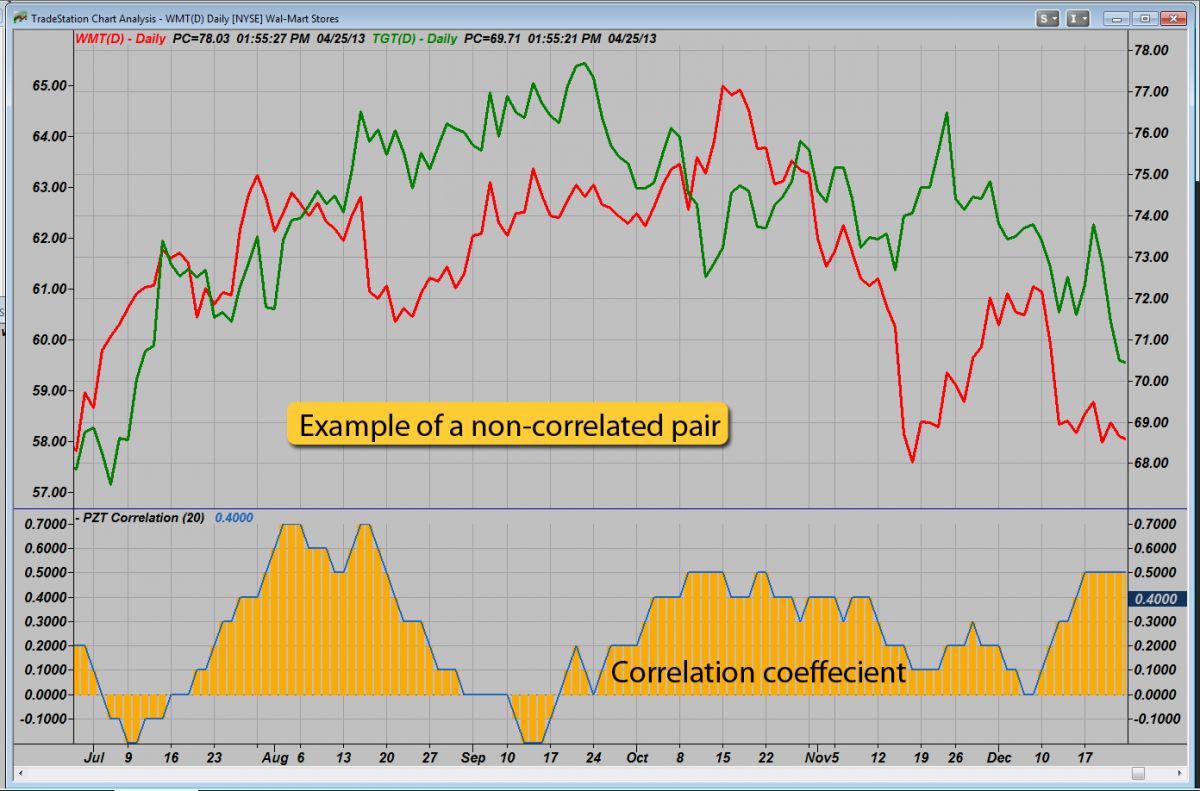

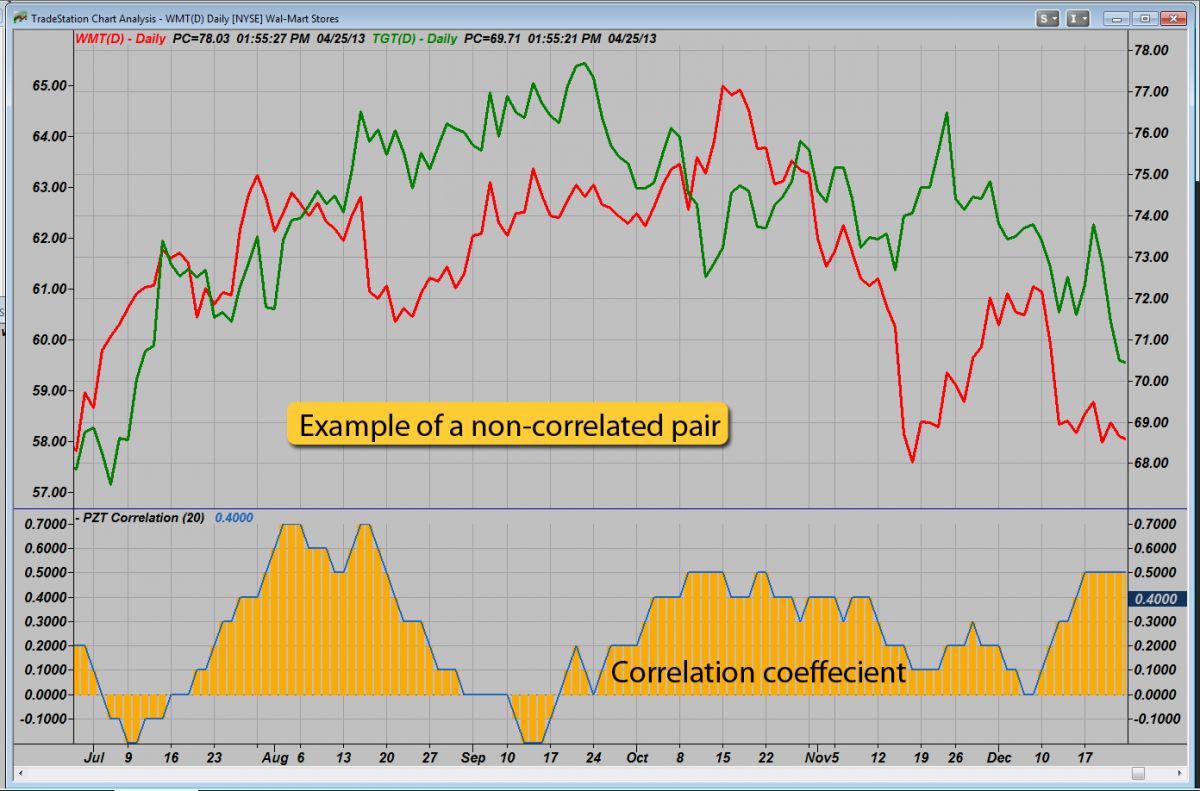

Another chart, shown in Figure 5, illustrates a pair that is not correlated. In this example, a daily chart of Wal-mart (in red) and Target (in green) shows little correlation between the two instruments, despite the fact that they “have something in common”. Here, the correlation coefficient (in yellow) demonstrates that the relationship is scattered, ranging from high values of about 0.7 to values below zero, indicating a lack of correlation. In this case, we can remove the WMT/TGT pair from our list of potential pairs candidates.

Figure 5 This daily chart of WMT (in red) and TGT (in green) shows that this is not an ideal pair (at least not during the time period tested). A visual review of prices, confirmed by results from the correlation coefficient (in yellow) indicate a lack of correlation between the two stocks. Image created with TradeStation.

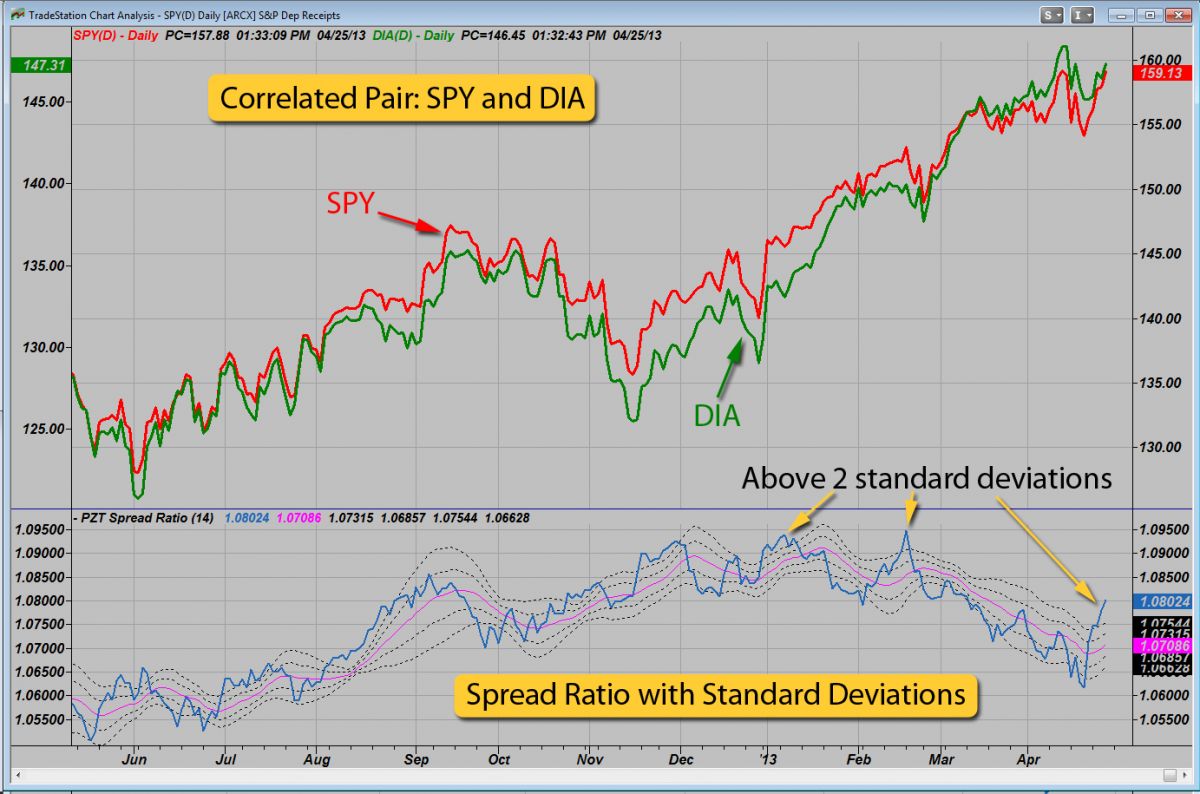

Use modeling to determine specific rules

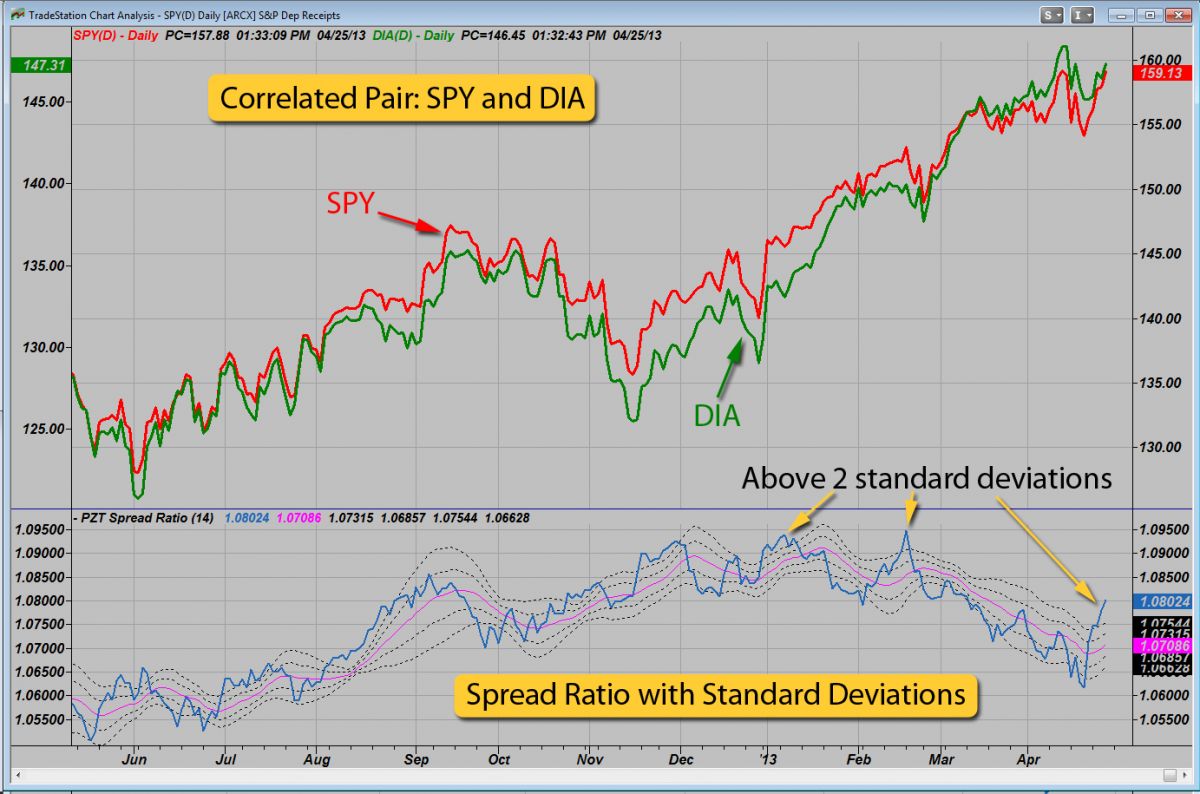

An ongoing component of the process is to research and test trading ideas and determine absolute methods of evaluating pairs and defining divergence. Traders will have to answer questions like What constitutes “enough” divergence from the trend to initiate a trade? and How will this be evaluated (for example, using data from a price ratio indicator with standard deviation overlays). In general, traders should focus on quantifiable data: i.e., “I will enter a pairs trade when price ratio exceeds two standard deviations.” Figure 6 shows two ETFs – SPY (in red) and DIA (in green) – on a daily chart. Below the price chart is a spread ratio indicator (in blue), with a +/- one and two standard deviation overlay (dotted lines). The mean appears in pink.

Figure 6 A daily chart of the ETFs SPY (in red) and DIA (in green). A spread ratio indicator appears below the price chart, along with a standard deviation overlay. Image created with TradeStation.

Determining position sizing

Many traders use a dollar-neutral approach to position sizing when trading pairs. Using this method, the long and short sides of the trade are entered with equal dollar amounts. For example, a trader wants to enter a pairs trade with stock A, trading at $100 per share, and stock B, trading at $50 per share. To achieve a dollar-neutral position, the trader will have to purchase two shares of stock B for every one share of stock A. For example:

Buy the underperformer and sell the overperformer

Once the trading rules are met, the trader will buy the underperforming security and simultaneously sell the overperforming security. In Figure 7, the spread ratio has exceeded two standard deviations, and a trading setup has occurred in our ES/YM pair. Here, a long position is entered with two ES contracts, and a simultaneous short position of two contracts is taken in the YM.

Figure 7 A trade is opened in the ES/YM pair. The order entry interface appears on the left side of the screen (one order entry box for the ES; one for the YM). The horizontal red and green lines at the top show the real-time P/L for each position. Image created with TradeStation.

Use sound money management principles to exit the trade

As with most investments, the timing of the exit is critical to the success of the trade. It is important to apply money management principles to pairs trades, including the use of protective stop-loss orders and profit targets. Optimal levels are typically determined through extensive historical modeling. Figure 8 shows the ES/YM trade, exited using a conservative net profit level.

Figure 8 The ES/YM trade is exited with a small net profit. Image created with TradeStation.

Despite exhaustive research, modeling and testing, a pairs trading strategy may fail to live up to expectations. Two risks that traders have are model risk and execution risk, introduced in the next section.

Risks

Although pure arbitrage is essentially a risk-free strategy, pairs trading (either as relative value arbitrage or StatArb) involves certain risks, including model risk and execution risk.

Model risk

As with nearly any investment that involves risk, pairs traders are exposed to model risk: a type of risk that occurs when the model used to create the strategy does not perform as expected. This can be due to a number of factors ranging from inaccurate research to flawed logic or calculations. The now-famous debacle that occurred at Long Term Capital Management (LTCM), for example, was attributed to model risk.

LTCM was a large hedge fund led by two Nobel Prize-winning economists and Wall Street traders. The firm’s primary strategy, based on sophisticated computer modeling, was to make convergence trades – pairs trades with a long position in a “cheap” security and short position in a “rich” one. Because they were looking for small price movements, leverage was a key component of LTCM’s strategy. At the start of 1998, the fund had $5 billion in equity and had borrowed more than $125 billion – a 30:1 leverage factor. LTCM believed the positions were very correlated, and thus, exposed to minimal risk.

FollowingRussia’s devaluation of the ruble (in which LTCM was highly leveraged in government bonds) and subsequent flight to quality, LTCM suffered massive losses of $4.6 billion and was in danger of defaulting on its loans. The fund was eventually bailed out with the hold of the Federal Reserve to thwart a global financial crisis.

Even the most carefully executed modeling can be flawed due to inaccurate research, unsound logic, changing circumstances and misinterpreted results.

Execution risk

This type of risk is another factor that can negatively impact the return for a pairs trade. Execution risk refers to the possibility that the strategy will not be executed as planned. For example, a trader may experience slippage in price or may receive a partial fill on an order, resulting in reduced profit potential. Slippage occurs when the price a trader receives for an order is less favorable than the one expected. For example, if we are going long on stock ABC and the current market price is $50.15, we might expect (or, more accurately, hope for) that price. We might get filled, however, at $50.25 due to slippage, taking an automatic 10-cent loss (per share) on the trade.

A trader might also receive a partial fill on an order. This occurs when a single order – for example, 1,000 shares of stock ABC – is broken down and filled at different prices. This particular trade might have 500 shares filled at $50.25 and the other 500 filled at $50.35 – or not at all if no shares are available.

Particularly if the pairs trading strategy relies on small price movements, a partial fill can significantly and negatively impact the potential for profits.

Disadvantages

Aside from the risks associated with pairs trading, there are a number of disadvantages to this investment technique of which traders should be aware. Perhaps the most obvious disadvantage is that each trade necessitates twice the commissions and fees. If an investor were to simply go long, he or she would pay one commission to enter and one to exit the trade. A pairs trader, however, must pay two commissions to enter and two commissions to exit each trade. Depending on the particular strategy employed, this can add up quickly. Commissions should be factored into any historical modeling to determine if the strategy can, in fact, make a profit.

The outcomes of execution risk are also a disadvantage in pairs trading. Slippage, partial fills and bid-ask spreads can reduce profits. The bid-ask spread is the amount by which the ask price exceeds the bid, or the difference in price between the price a buyer is willing to pay for a security (bid), and the and the price a seller wants for that security (ask). The trading volume of the securities greatly affects the bid-ask spread; instruments that trade under higher volume tend to have smaller bid-ask spreads, while those that are thinly traded often have larger bid-ask spreads.

Because many pairs trading strategies rely on exploiting very small price changes, the technique may be most efficient for traders who are well-capitalized and who have the ability to enter large positions (i.e., lots of trading capital and willingness to leverage positions). True to nearly any style of investing, smaller traders may need to take a different approach (and employ a different strategy) than the large, institutional pairs traders.

Advantages

Pairs trading is a market-neutral strategy that boasts several advantages:

Controlled risk

Central to pairs trading is the matching of a long position with a short position in a related, or correlated, instrument. This essentially creates an automatic hedge, where one leg of the trade acts as a hedge against the other. In this manner, risk is somewhat controlled. Consider an example where a trader is long on stock ABC and short on stock XYZ in a pairs trade. Since the two stocks are correlated, if the entire sector takes a hit, the price may fall for both stocks. In this example, any losses sustained through the long position will be mitigated by the gain in the short position. Therefore, even though the entire sector is down on the day, the trader’s net position may remain neutral because of the low correlation to the market averages.

Profit regardless of market direction

Another attractive feature of pairs trading is the ability to profit whether the market is going up, down or sideways. This is because the strategy does not depend on market direction, but on the relationship between the two instruments. To clarify, long-only traders (who are bullish) can only profit from rising markets. Short-only traders (who are bearish) profit when the markets are falling. To a pairs trader, the market direction does not matter; it’s the relative performance of the two instruments that determines each trade’s outcome.

No directional risk

Directional risk involves exposure to the direction of price movements. For example, a long position is exposed to the risk that stock prices will move down. In pairs trading, a second instrument acts as a hedge against the first, thereby removing the directional risk. Because profits depend on the difference in price change between the two instruments, rather than from the direction in which each moves, directional risk is removed.

Smaller drawdowns

A drawdown is a peak-to-trough decline in an open investment’s value. For example, if a trade reached unrealized profits of $10,000 one day, and the next day fell to $6,000, that would indicate a $4,000 drawdown. While drawdowns do not necessarily dictate whether a trade will ultimately be a winner, managing drawdowns is important because it’s money that is at risk of being lost. In addition, a strategy’s maximum expected drawdown (based on historical modeling) will determine how much money a trader needs to allocate to that particular strategy. For example, if a strategy has a maximum drawdown of $5,000, we would need access to at least $5,000 to cover any potential losses. Because losses from a losing position are tempered by gains in a winning position, pairs trading generally involves smaller net drawdowns.

In Summary

Pairs trading is a market-neutral investment strategy that seeks profits from the difference in price change between two related instruments. Having well-researched strategies, based on accurate historical modeling and the proper interpretation of results, can help ensure that traders identify truly correlated pairs, locate high-probability trading setups, and use proper money management to exit trades and look for the next pairs trading opportunity.

Jean Folger can be contacted at PowerZoneTrading

Pairs traders employ either fundamental or technical analysis, or a combination of the two, to make decisions regarding which instruments to pair, and when to get in and out of trades. Many pairs traders apply technical analysis techniques and then confirm the findings using fundamentals. This extra “layer” of analysis can be used simply to ensure that the trade “makes sense”. For instance, if all technical analysis points to taking a long position in stock ABC and a short in XYZ, but the fundamentals show that stock ABC will have a weak earnings report, the position may need to be reconsidered.

Fundamental factors

Fundamental analysis examines related economic, financial and other qualitative and quantitative factors to evaluate a security’s value, and to determine which security will perform better in the short-term. Fundamental analysts may consider a number of growth and value factors when identifying opportunities for pairs trading. These include (but are not limited to):

- Changes in operating margins

- Discounted cash flow

- Dividend discount model

- Dividend yield

- Excess cash flow

- Float

- Price/earnings to growth (PEG ratio)

- Price-earnings ratio (P/E ratio)

- Price-to-book ratio (P/B ratio)

- Price-to-cash-flow ratio (price/cash)

- Price-to-sales ratio (price/sales)

- Return on equity

- Total assets over sales.

Technical factors

Technical analysis, on the other hand, is a method of evaluating securities by analyzing statistics generated by market activity; in particular, historical price and volume. Rather than attempting to measure a security’s intrinsic value, technical analysis seeks to identify patterns to predict future price movements.

Pairs traders call on a variety of tools and technical indicators to identify trading opportunities. The technical analyst may use, for example:

- Chart patterns (i.e., candlestick charting)

- Commercial indicators

- Moving averages

- On-balance volume (OBV)

- Relative strength index (RSI)

- Stochastics

- Support and resistance

- Trend lines.

Other metrics may be useful to pairs traders as well. Consider beta, for example. Market risk can be measured by beta: a measure of a stock’s volatility relative to the market. The market has a beta of 1.0, and each individual stock is ranked based on how much it deviates from the market. If a stock swings more than the market over time, it will have a beta above 1.0; conversely, if a stock moves less than the market, its beta will be less than 1.0. High-beta stocks are considered riskier but tend to provide the potential for higher returns. Low-beta stocks have less risk, accompanied by lower potential returns. Ideally, the securities in a pairs trade have betas that are stable over time.

Deciding to implement a fundamental or technical approach is a matter of personal preference. Many pairs traders, and in particular short-term traders, prefer a technical approach. Some conduct technical analysis and look for confirmation using certain fundamentals, while others may use fundamental analysis exclusively. As with any investment strategy, finding the right combination of analysis tools and methodology takes research, historical modeling and testing.

Trade Example

As with nearly any investment, taking a pairs trade involves more than just hitting the buy and sell button. Here we examine, in very broad terms, the steps required to enter and exit a pairs trade.

Assemble a list of potentially related pairs

Just as long-only stock traders scan the markets for suitable securities, a pairs trader must start with a list of potentially related pairs. This entails conducting research to find securities that have something in common – whether the relationship is due to sector (such as the auto sector) or to asset (for example, bonds). While any random pair could theoretically be correlated, it is more likely that we will find correlation in securities that have something in common to begin with.

Determining the correlation level

The next step acts as a filter, or a means by which we can reduce the number of potential pairs in our quiver. One way is to use a correlation coefficient to determine how closely two instruments are related. Figure 4 shows a daily chart of the e-mini S&P 500 contract (in red) and the e-mini Dow contract (in green). Below the price chart is an indicator that shows the correlation coefficient (in yellow). We can see from the chart that during the time period evaluated, the ES and YM are highly correlated, with values hovering around 0.9. We will keep the ES/YM pair on our list of potential pairs candidates.

Figure 4 The e-mini S&P 500 contract (in red) and the e-mini Dow (in green) show potential as a pairs trade. Visual confirmation of price, backed by quantitative results from the correlation coefficient (in yellow), show that the two instruments are highly correlated. Image created with TradeStation.

Another chart, shown in Figure 5, illustrates a pair that is not correlated. In this example, a daily chart of Wal-mart (in red) and Target (in green) shows little correlation between the two instruments, despite the fact that they “have something in common”. Here, the correlation coefficient (in yellow) demonstrates that the relationship is scattered, ranging from high values of about 0.7 to values below zero, indicating a lack of correlation. In this case, we can remove the WMT/TGT pair from our list of potential pairs candidates.

Figure 5 This daily chart of WMT (in red) and TGT (in green) shows that this is not an ideal pair (at least not during the time period tested). A visual review of prices, confirmed by results from the correlation coefficient (in yellow) indicate a lack of correlation between the two stocks. Image created with TradeStation.

Use modeling to determine specific rules

An ongoing component of the process is to research and test trading ideas and determine absolute methods of evaluating pairs and defining divergence. Traders will have to answer questions like What constitutes “enough” divergence from the trend to initiate a trade? and How will this be evaluated (for example, using data from a price ratio indicator with standard deviation overlays). In general, traders should focus on quantifiable data: i.e., “I will enter a pairs trade when price ratio exceeds two standard deviations.” Figure 6 shows two ETFs – SPY (in red) and DIA (in green) – on a daily chart. Below the price chart is a spread ratio indicator (in blue), with a +/- one and two standard deviation overlay (dotted lines). The mean appears in pink.

Figure 6 A daily chart of the ETFs SPY (in red) and DIA (in green). A spread ratio indicator appears below the price chart, along with a standard deviation overlay. Image created with TradeStation.

Determining position sizing

Many traders use a dollar-neutral approach to position sizing when trading pairs. Using this method, the long and short sides of the trade are entered with equal dollar amounts. For example, a trader wants to enter a pairs trade with stock A, trading at $100 per share, and stock B, trading at $50 per share. To achieve a dollar-neutral position, the trader will have to purchase two shares of stock B for every one share of stock A. For example:

- Long 100 shares of stock A = $10,000; and

- Short 200 shares of stock B = $10,000.

Buy the underperformer and sell the overperformer

Once the trading rules are met, the trader will buy the underperforming security and simultaneously sell the overperforming security. In Figure 7, the spread ratio has exceeded two standard deviations, and a trading setup has occurred in our ES/YM pair. Here, a long position is entered with two ES contracts, and a simultaneous short position of two contracts is taken in the YM.

Figure 7 A trade is opened in the ES/YM pair. The order entry interface appears on the left side of the screen (one order entry box for the ES; one for the YM). The horizontal red and green lines at the top show the real-time P/L for each position. Image created with TradeStation.

Use sound money management principles to exit the trade

As with most investments, the timing of the exit is critical to the success of the trade. It is important to apply money management principles to pairs trades, including the use of protective stop-loss orders and profit targets. Optimal levels are typically determined through extensive historical modeling. Figure 8 shows the ES/YM trade, exited using a conservative net profit level.

Figure 8 The ES/YM trade is exited with a small net profit. Image created with TradeStation.

Despite exhaustive research, modeling and testing, a pairs trading strategy may fail to live up to expectations. Two risks that traders have are model risk and execution risk, introduced in the next section.

Risks

Although pure arbitrage is essentially a risk-free strategy, pairs trading (either as relative value arbitrage or StatArb) involves certain risks, including model risk and execution risk.

Model risk

As with nearly any investment that involves risk, pairs traders are exposed to model risk: a type of risk that occurs when the model used to create the strategy does not perform as expected. This can be due to a number of factors ranging from inaccurate research to flawed logic or calculations. The now-famous debacle that occurred at Long Term Capital Management (LTCM), for example, was attributed to model risk.

LTCM was a large hedge fund led by two Nobel Prize-winning economists and Wall Street traders. The firm’s primary strategy, based on sophisticated computer modeling, was to make convergence trades – pairs trades with a long position in a “cheap” security and short position in a “rich” one. Because they were looking for small price movements, leverage was a key component of LTCM’s strategy. At the start of 1998, the fund had $5 billion in equity and had borrowed more than $125 billion – a 30:1 leverage factor. LTCM believed the positions were very correlated, and thus, exposed to minimal risk.

FollowingRussia’s devaluation of the ruble (in which LTCM was highly leveraged in government bonds) and subsequent flight to quality, LTCM suffered massive losses of $4.6 billion and was in danger of defaulting on its loans. The fund was eventually bailed out with the hold of the Federal Reserve to thwart a global financial crisis.

Even the most carefully executed modeling can be flawed due to inaccurate research, unsound logic, changing circumstances and misinterpreted results.

Execution risk

This type of risk is another factor that can negatively impact the return for a pairs trade. Execution risk refers to the possibility that the strategy will not be executed as planned. For example, a trader may experience slippage in price or may receive a partial fill on an order, resulting in reduced profit potential. Slippage occurs when the price a trader receives for an order is less favorable than the one expected. For example, if we are going long on stock ABC and the current market price is $50.15, we might expect (or, more accurately, hope for) that price. We might get filled, however, at $50.25 due to slippage, taking an automatic 10-cent loss (per share) on the trade.

A trader might also receive a partial fill on an order. This occurs when a single order – for example, 1,000 shares of stock ABC – is broken down and filled at different prices. This particular trade might have 500 shares filled at $50.25 and the other 500 filled at $50.35 – or not at all if no shares are available.

Particularly if the pairs trading strategy relies on small price movements, a partial fill can significantly and negatively impact the potential for profits.

Disadvantages

Aside from the risks associated with pairs trading, there are a number of disadvantages to this investment technique of which traders should be aware. Perhaps the most obvious disadvantage is that each trade necessitates twice the commissions and fees. If an investor were to simply go long, he or she would pay one commission to enter and one to exit the trade. A pairs trader, however, must pay two commissions to enter and two commissions to exit each trade. Depending on the particular strategy employed, this can add up quickly. Commissions should be factored into any historical modeling to determine if the strategy can, in fact, make a profit.

The outcomes of execution risk are also a disadvantage in pairs trading. Slippage, partial fills and bid-ask spreads can reduce profits. The bid-ask spread is the amount by which the ask price exceeds the bid, or the difference in price between the price a buyer is willing to pay for a security (bid), and the and the price a seller wants for that security (ask). The trading volume of the securities greatly affects the bid-ask spread; instruments that trade under higher volume tend to have smaller bid-ask spreads, while those that are thinly traded often have larger bid-ask spreads.

Because many pairs trading strategies rely on exploiting very small price changes, the technique may be most efficient for traders who are well-capitalized and who have the ability to enter large positions (i.e., lots of trading capital and willingness to leverage positions). True to nearly any style of investing, smaller traders may need to take a different approach (and employ a different strategy) than the large, institutional pairs traders.

Advantages

Pairs trading is a market-neutral strategy that boasts several advantages:

Controlled risk

Central to pairs trading is the matching of a long position with a short position in a related, or correlated, instrument. This essentially creates an automatic hedge, where one leg of the trade acts as a hedge against the other. In this manner, risk is somewhat controlled. Consider an example where a trader is long on stock ABC and short on stock XYZ in a pairs trade. Since the two stocks are correlated, if the entire sector takes a hit, the price may fall for both stocks. In this example, any losses sustained through the long position will be mitigated by the gain in the short position. Therefore, even though the entire sector is down on the day, the trader’s net position may remain neutral because of the low correlation to the market averages.

Profit regardless of market direction

Another attractive feature of pairs trading is the ability to profit whether the market is going up, down or sideways. This is because the strategy does not depend on market direction, but on the relationship between the two instruments. To clarify, long-only traders (who are bullish) can only profit from rising markets. Short-only traders (who are bearish) profit when the markets are falling. To a pairs trader, the market direction does not matter; it’s the relative performance of the two instruments that determines each trade’s outcome.

No directional risk

Directional risk involves exposure to the direction of price movements. For example, a long position is exposed to the risk that stock prices will move down. In pairs trading, a second instrument acts as a hedge against the first, thereby removing the directional risk. Because profits depend on the difference in price change between the two instruments, rather than from the direction in which each moves, directional risk is removed.

Smaller drawdowns

A drawdown is a peak-to-trough decline in an open investment’s value. For example, if a trade reached unrealized profits of $10,000 one day, and the next day fell to $6,000, that would indicate a $4,000 drawdown. While drawdowns do not necessarily dictate whether a trade will ultimately be a winner, managing drawdowns is important because it’s money that is at risk of being lost. In addition, a strategy’s maximum expected drawdown (based on historical modeling) will determine how much money a trader needs to allocate to that particular strategy. For example, if a strategy has a maximum drawdown of $5,000, we would need access to at least $5,000 to cover any potential losses. Because losses from a losing position are tempered by gains in a winning position, pairs trading generally involves smaller net drawdowns.

In Summary

Pairs trading is a market-neutral investment strategy that seeks profits from the difference in price change between two related instruments. Having well-researched strategies, based on accurate historical modeling and the proper interpretation of results, can help ensure that traders identify truly correlated pairs, locate high-probability trading setups, and use proper money management to exit trades and look for the next pairs trading opportunity.

Jean Folger can be contacted at PowerZoneTrading

Last edited by a moderator: