Hey very good job on catching what the 123's really are, thats exactly what it is. Nobody has seen that its the a-b-c correction before, at least nobody has mentioned it on T2W. When I first was learning the 123 system is was with the elliott wave, however I was never all that good trading the whole elliott wave. Also the 123's seem to have a really high probability all by themselves regardless if the elliott was looked good or not, so I disregarded everything and ended up with the 123's system I trade now.

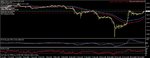

The 123's in the GBP/USD pair seems to have the highest probability, at least in the currencies I've traded. I traded about 6 months last year and the system generated about 40%. Its just too bad it doesn't setup once a week! 🙄

I am impressed that you were able to put that trade in the GBP/JPY. I spent about 2 years trading price action in that pair. But I'm a systems trader, I need something like the 123's to give me price direction. I also tried my 123's but it seemed that that pair is just too loose and fast moving for my 123's, perhaps my criterion was too tight.