You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pervaz said:Finally got around to automating my methodology, rather than using a quill !!

Heres some stocks to monitor within the next week - the criteria is based on trend reversals using some bar counting + volume.

Hi Pervaz,

Can you explain a little about how you got these stocks.

Cheers,

S

S.

I identify a set of patterns which usually (about 85%) lead to a new swing occuring and then I calculate the fib levels to set the prices - the second can takes the results and calculates the risk/reward ratio - and then runs against a set of criteria for me e.g I dont want stock which is above a certian price or not in certtain sectors.

I've cut down my time in stupid tasks like setting fib levels etc and alerts which allow me to look at a chart and see if i get a "gut feel" - based on that then i make the bet - otherwise i throw it away and keep it in a history pile to see what would have happened if i took the trade.

Hope this gives you an overview.

Thanks

I identify a set of patterns which usually (about 85%) lead to a new swing occuring and then I calculate the fib levels to set the prices - the second can takes the results and calculates the risk/reward ratio - and then runs against a set of criteria for me e.g I dont want stock which is above a certian price or not in certtain sectors.

I've cut down my time in stupid tasks like setting fib levels etc and alerts which allow me to look at a chart and see if i get a "gut feel" - based on that then i make the bet - otherwise i throw it away and keep it in a history pile to see what would have happened if i took the trade.

Hope this gives you an overview.

Thanks

Hi Pervaz

Sorry, but can you run that by me again?

I saw your post on another thread and thought I understood what you were doing but now I'm not so sure.

The real reason for this question is that on the weekend I usually go through FTSE100 stocks looking for likely candidates for swing trading over the next week (2 to 5+ days) and have come up with a short list of 13 stocks. The interesting thing is that none are on your list!

Basically I discard some for reasons of low volatility or low ATR (no movement in other words) and then scan the rest by eye (Metastock charts) looking for stocks close to Support/resistance and particularly those that are "in the channel" plus trendline breakouts.

Can you run through one of the candidates on your list - say ABF - so i can see what you are doing.

Sorry, but can you run that by me again?

I saw your post on another thread and thought I understood what you were doing but now I'm not so sure.

The real reason for this question is that on the weekend I usually go through FTSE100 stocks looking for likely candidates for swing trading over the next week (2 to 5+ days) and have come up with a short list of 13 stocks. The interesting thing is that none are on your list!

Basically I discard some for reasons of low volatility or low ATR (no movement in other words) and then scan the rest by eye (Metastock charts) looking for stocks close to Support/resistance and particularly those that are "in the channel" plus trendline breakouts.

Can you run through one of the candidates on your list - say ABF - so i can see what you are doing.

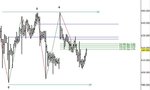

abf

Peter,

Maybe its a good thing that we didnt agree on your and mine scans 🙂

I dont know what exact criteria you use to run your scans so I cant say - here is our differences. I dont run atr or volalitity (as I have just developed my scanner/chart tool - that will be included in the next week or 2)

Please find attached a "clean" fib chart on abf - the fibzones have a support line at 618 (this is based on my criteria as aggressive trading - if i was to change to passive I would wait until the price reached 620-621)

It will be interesting to see what you think of this or any other trades that i have put on

thanks

Peter,

Maybe its a good thing that we didnt agree on your and mine scans 🙂

I dont know what exact criteria you use to run your scans so I cant say - here is our differences. I dont run atr or volalitity (as I have just developed my scanner/chart tool - that will be included in the next week or 2)

Please find attached a "clean" fib chart on abf - the fibzones have a support line at 618 (this is based on my criteria as aggressive trading - if i was to change to passive I would wait until the price reached 620-621)

It will be interesting to see what you think of this or any other trades that i have put on

thanks

Attachments

Hi Pervaz

You are right of course, if all agreed we would not have a market!

I suspect that we are both scanning but looking for something completely different.

Looking at your chart it might be the time frame we use. I am looking to hold trades for 2 to 5 days (perhaps more) and the reason I want a decent move is that I am not trying to squeeze out every last penny but only hoping to catch most of a big move.

So when i put on a Fib retracement onto a chart , in this instance ABF, my top and bottom are 648 and 603 (Thumbnail 1) whereas your chart shows top and bottom of 627 and 616.55 to get these levels. (Thumbnail2)

ABF in fact is in a channel 648 top 595 bottom both been tested a couple of times. If I had traded ABF (I did not) I would have been watching last weekend and I would liked to have got in on 25/08 after the Doji on good volume with a stop around 603. I love bollinger bands and once it had left the bottom band there is a good chance it was going to the top one . So the target would have been 625 which is also the 50% fib and also a resistance from the previous week. This would mean around 15 points gain. Depends on your stake (if Spreadbetting) as to whether this is worth while. From there it would be decision time again; stay in, reduce stake or close.

So what will your target and stops be this week? How do you trade? SB?

Volume with ABF has not often been much help but I do look for volume spikes or trends.

BTW - i think you may have some data glitches on your chart - notably 02/07 and 28/05 but also 21/07. They don't make much difference to the current trade.

You are right of course, if all agreed we would not have a market!

I suspect that we are both scanning but looking for something completely different.

Looking at your chart it might be the time frame we use. I am looking to hold trades for 2 to 5 days (perhaps more) and the reason I want a decent move is that I am not trying to squeeze out every last penny but only hoping to catch most of a big move.

So when i put on a Fib retracement onto a chart , in this instance ABF, my top and bottom are 648 and 603 (Thumbnail 1) whereas your chart shows top and bottom of 627 and 616.55 to get these levels. (Thumbnail2)

ABF in fact is in a channel 648 top 595 bottom both been tested a couple of times. If I had traded ABF (I did not) I would have been watching last weekend and I would liked to have got in on 25/08 after the Doji on good volume with a stop around 603. I love bollinger bands and once it had left the bottom band there is a good chance it was going to the top one . So the target would have been 625 which is also the 50% fib and also a resistance from the previous week. This would mean around 15 points gain. Depends on your stake (if Spreadbetting) as to whether this is worth while. From there it would be decision time again; stay in, reduce stake or close.

So what will your target and stops be this week? How do you trade? SB?

Volume with ABF has not often been much help but I do look for volume spikes or trends.

BTW - i think you may have some data glitches on your chart - notably 02/07 and 28/05 but also 21/07. They don't make much difference to the current trade.

Attachments

.

Peter,

thanks for that..

I think its the time frame we use - rather than look at the time I look at where the "macro" swings - if there are two swings closely I take the higher (or lower one). I havent looked at BB for ages (simply becuase I havent sat down and studied what they really do).

In the grand scheme of things we werent that far apart me from 618-21 you from 625 🙂

I'm using capital spreads for my account - they seem ok and havent had many probs with them.

I'm using paritech for my datasource - what do u use ? - I had a look at sharescope but £12 per month and £70 req fee just for uk but with them i got UK and US for the same price almost.

As a matter of interest what were your results for this week ?

P

Peter,

thanks for that..

I think its the time frame we use - rather than look at the time I look at where the "macro" swings - if there are two swings closely I take the higher (or lower one). I havent looked at BB for ages (simply becuase I havent sat down and studied what they really do).

In the grand scheme of things we werent that far apart me from 618-21 you from 625 🙂

I'm using capital spreads for my account - they seem ok and havent had many probs with them.

I'm using paritech for my datasource - what do u use ? - I had a look at sharescope but £12 per month and £70 req fee just for uk but with them i got UK and US for the same price almost.

As a matter of interest what were your results for this week ?

P

hi Pervaz

I use Finspread for one Futures system I trade - completely mechanical. Then I use D4F for spreadbetting stocks - I like their interface and narrow spreads.

I was on holiday until last weekend so didn't do my scanning as normal. I did make money with a long on Aviva but I got out Friday with a long weekend on the way. So it wasn't great.

My data comes from Investorease but I'm very surprised it's different to Paritech who have a good reputation. I'll have to check tomorrow. I only trade UK stocks and so don't require US data. I am looking at trying the US markets but I'm using Yahoo for EOD data who are a bit flaky! If i decide to trade US stocks then I'll need something a bit more robust.

(My mechanical system is long on DOW at present and has been since 18th August but that's a different story)

I use Finspread for one Futures system I trade - completely mechanical. Then I use D4F for spreadbetting stocks - I like their interface and narrow spreads.

I was on holiday until last weekend so didn't do my scanning as normal. I did make money with a long on Aviva but I got out Friday with a long weekend on the way. So it wasn't great.

My data comes from Investorease but I'm very surprised it's different to Paritech who have a good reputation. I'll have to check tomorrow. I only trade UK stocks and so don't require US data. I am looking at trying the US markets but I'm using Yahoo for EOD data who are a bit flaky! If i decide to trade US stocks then I'll need something a bit more robust.

(My mechanical system is long on DOW at present and has been since 18th August but that's a different story)

P,

Havent looked at d4f - cs has recieved some rave reviews so i went in .. it doesnt really have a big (material) difference in the final price especially if i have a long (3+ wks) hold for me.

Whats the idea with the mechanical trade ? Thats something i would be interested in doing - I thought SB companies didnt take automated trades.

I think there is a bit of mileage with aviva - and my position is still open (i worked for them 😉 for a little while as well).

If you need some sample US data give me a shout

thanks

Havent looked at d4f - cs has recieved some rave reviews so i went in .. it doesnt really have a big (material) difference in the final price especially if i have a long (3+ wks) hold for me.

Whats the idea with the mechanical trade ? Thats something i would be interested in doing - I thought SB companies didnt take automated trades.

I think there is a bit of mileage with aviva - and my position is still open (i worked for them 😉 for a little while as well).

If you need some sample US data give me a shout

thanks

Punts for this week:

Chart, ,High/Buy Ref.,Low/Sell Ref.

ALLIANCE UNICHEM D,680.000,

BRITISH AIRWAYS ,224.000

CADBURY SCHWEPPE D,463.750,

EMAP D,760.00,

LEGAL & GENERAL D,104.820,

LLOYDS TSB GROUP D,441.50,

Monitor

AMERSHAM D,"","",""

BOC GROUP D,"","",""

MAB D,"","",""

PFG D,"","",""

SAFEWAY D,"","",""

SMITH & NEPHEW D,"","",""

Chart, ,High/Buy Ref.,Low/Sell Ref.

ALLIANCE UNICHEM D,680.000,

BRITISH AIRWAYS ,224.000

CADBURY SCHWEPPE D,463.750,

EMAP D,760.00,

LEGAL & GENERAL D,104.820,

LLOYDS TSB GROUP D,441.50,

Monitor

AMERSHAM D,"","",""

BOC GROUP D,"","",""

MAB D,"","",""

PFG D,"","",""

SAFEWAY D,"","",""

SMITH & NEPHEW D,"","",""

PitBull

Established member

- Messages

- 620

- Likes

- 59

Pervaz

I too am interested in trading FTSE stocks and would like to know how you scan for these set ups. Do you have a core list? do you scan the whole FTSE by eye looking for certain set ups or do you use a datamining facility?

On my watchlist are:

Tate & Lyle

ICAP

BPB

AMEC

i had a good run on AZN last week. i feel this will come to an abrupt end on monday morning!

Cheers

Pitbull

I too am interested in trading FTSE stocks and would like to know how you scan for these set ups. Do you have a core list? do you scan the whole FTSE by eye looking for certain set ups or do you use a datamining facility?

On my watchlist are:

Tate & Lyle

ICAP

BPB

AMEC

i had a good run on AZN last week. i feel this will come to an abrupt end on monday morning!

Cheers

Pitbull

Mark Barton

Junior member

- Messages

- 12

- Likes

- 0

ftse stocks,or top 200 liquid stocks.only pick the high priced stocks,ie azn.gsk,emg,imt,ccl,rbs.otherwise there is very little movement,perhaps only 2-3p a day.best spreadbet per point with stocks that can easily move 20-30 in one day.uneless you get a good news story smaller priced stocks have very little daily movement in the uk

Pitbull,

I scan the FTSE100 + 250 based on breakout levels and Fibs.

I do this weekly for stocks and nightly for all indices. I agree with Mark and the liquidity of the 250 I usually buy outright (my current portfolio contains 12 stocks mostly from FT250 which I usually for 1+month).

I scan the FTSE100 + 250 based on breakout levels and Fibs.

I do this weekly for stocks and nightly for all indices. I agree with Mark and the liquidity of the 250 I usually buy outright (my current portfolio contains 12 stocks mostly from FT250 which I usually for 1+month).

Similar threads

- Replies

- 12

- Views

- 3K

- Replies

- 2

- Views

- 4K

M