barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

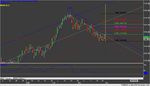

Into April and the bears footprints have begun to appear on monthly and weekly as well as being out in force on the daily. Little relief in sight as yet (particularly after DOW close) but the two dojis on the weekly do point to indecision.

Maybe those dojis also reflect the prevailing mood seems which seems to be a desire to rise continually thwarted by Wall Street weakness - Thursday and Friday action shows it well. Maybe buyers holding off rather than significantly increasing selling pressure?

Anyway it'll go where it goes. I'm still favouring shorts.

Good trading

jon

Maybe those dojis also reflect the prevailing mood seems which seems to be a desire to rise continually thwarted by Wall Street weakness - Thursday and Friday action shows it well. Maybe buyers holding off rather than significantly increasing selling pressure?

Anyway it'll go where it goes. I'm still favouring shorts.

Good trading

jon