tr1ps_master

Active member

- Messages

- 117

- Likes

- 50

Update time.

So since my last post, I was feeling good - deservedly so! (I call myself out when I am not doing well, so equally I will praise myself when I do).

I was completely disciplined.

Knew my stats.

Knew my slight adjustments for certain setups.

Folks, the whole idea here is to MAKE SOME REAL MONEY.

I explored the idea of Online Prop Firms - which is a great way to really increase returns on the amount of capital you have - provided you are a profitable trader in the first place. Let's see how profitable and consistent I really I am, was my thinking.

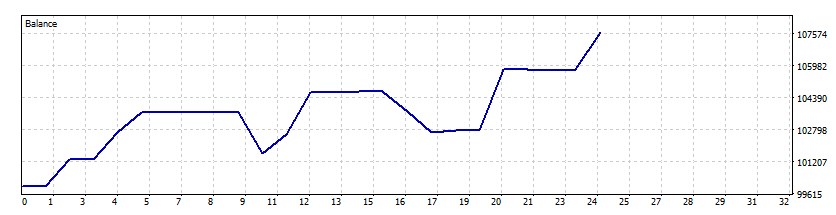

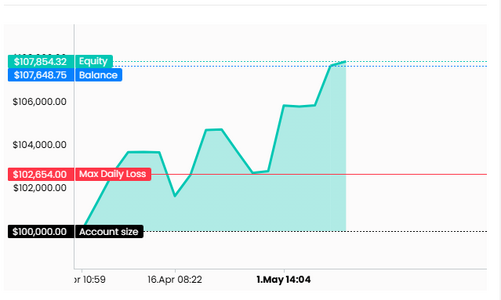

So naturally I took a $100k challenge.

Out of absolutely nowhere I was messing about with the process, it was purely mental.

- started varying risk (I am not at the stage where I can definitively say which setup deserves more/less risk).

- managing my trades like a tit, an absolute tit I might add.

I did this for a good 3 weeks. Nevertheless I managed to pass a phase 1 but lost on phase 2 - which I am glad about because it would have solidified tit-making decisions as the right thing to do.

I was absolutely in the Gutter, mentally speaking.

Trading is about strategy and process, the numbers are immaterial. Why on earth was I doing these crazy things?

I reviewed my trades. As always I screenshot before and after each trade, excel journal it and then analyse.

Found the errors I was making (already listed above), and what really hit home is that I would've passed the phases within 2 weeks if I simply followed what I was already doing before.

The mind is just a really funny machine - either you control it or it controls you.

So since my last post, I was feeling good - deservedly so! (I call myself out when I am not doing well, so equally I will praise myself when I do).

I was completely disciplined.

Knew my stats.

Knew my slight adjustments for certain setups.

Folks, the whole idea here is to MAKE SOME REAL MONEY.

I explored the idea of Online Prop Firms - which is a great way to really increase returns on the amount of capital you have - provided you are a profitable trader in the first place. Let's see how profitable and consistent I really I am, was my thinking.

So naturally I took a $100k challenge.

Out of absolutely nowhere I was messing about with the process, it was purely mental.

- started varying risk (I am not at the stage where I can definitively say which setup deserves more/less risk).

- managing my trades like a tit, an absolute tit I might add.

I did this for a good 3 weeks. Nevertheless I managed to pass a phase 1 but lost on phase 2 - which I am glad about because it would have solidified tit-making decisions as the right thing to do.

I was absolutely in the Gutter, mentally speaking.

Trading is about strategy and process, the numbers are immaterial. Why on earth was I doing these crazy things?

I reviewed my trades. As always I screenshot before and after each trade, excel journal it and then analyse.

Found the errors I was making (already listed above), and what really hit home is that I would've passed the phases within 2 weeks if I simply followed what I was already doing before.

The mind is just a really funny machine - either you control it or it controls you.

Last edited: