You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

a_gnome

Well-known member

- Messages

- 434

- Likes

- 15

forex101 said:I'm not sure you have a good grip on what it is all about...

You trade the Eur/USD vs the USD/CHF they are almost exact mirrors of each other. Big moves don't theoretically effect you because when the Eur/USD goes one way almost immediately the USD/CHF goes the other way. they have deviated by something like .96% or .04% over the last few years. So the money is made through the interest you are earning when you own the paris. The 400:1 leverage makes that interest quite significant. Of course if the pairs deviate in your favor you can capture the gains and start again compounding the new amount at that same high interest rate. It is a steady way to earn good money. The system sets limit orders so that you are buying and selling small amounts to balance out your position. It has worked for me so far.

You can try it for as long as you want in a demo account to test it out for yourself http://freedomrocks.com/23223

Why don't you just trade the very liquid EURCHF cross rate? If you are long (I think) this pair then you gain the difference between the EUR and the CHF interest rates on the leveraged amount. Why bother with the two major rates? Or am I missing something?

A Dashing Blade

Experienced member

- Messages

- 1,373

- Likes

- 171

So this is a positive carry trade "system" yes?

zupcon

Experienced member

- Messages

- 1,162

- Likes

- 322

A Dashing Blade said:So this is a positive carry trade "system" yes?

yes, its a positive carry trade system.

They also operate as a multi level marketing program

regards

mick

a_gnome said:Why don't you just trade the very liquid EURCHF cross rate? If you are long (I think) this pair then you gain the difference between the EUR and the CHF interest rates on the leveraged amount. Why bother with the two major rates? Or am I missing something?

A_Gnome.

It's great if you hold the EUR/CHF long and earn the interest but the fact is, you cannot predict when it is going up or down. As you cannot benefit from a Long position in a down market and the interest earned wouldn't be very valueable if your account keeps dropping.

So Freedomrocks uses the EUR/USD to Hedge against the USD/CHF. With a very close correlation it's the closest thing to hedging a single currency pair.

It's a Correlation trading method that Freedom Rocks uses. Probably on a Larger Scale the big financial institutions use similar types of Correlation techniques for hedging.

The FreedomRocks system simply allows the average person to get into the markets with a hedging strategy that doesn't require them to spend hours upon hours at their computers reading charts and signals looking for the next big break.

There is more to it then that and unless you have all the facts about any type of trading system, it's really difficult to make a blanket statement about it. It's like me saying "Candlestick formations are crap and don't tell you anything". I wouldn't say that of course because I have only had the luxury of using them only a few times throughout my trading.

Anyway, that's my 2 cents.

Cheers!

Rick M.

a_gnome

Well-known member

- Messages

- 434

- Likes

- 15

smarties said:A_Gnome.

It's great if you hold the EUR/CHF long and earn the interest but the fact is, you cannot predict when it is going up or down. As you cannot benefit from a Long position in a down market and the interest earned wouldn't be very valueable if your account keeps dropping.

So Freedomrocks uses the EUR/USD to Hedge against the USD/CHF. With a very close correlation it's the closest thing to hedging a single currency pair.

It's a Correlation trading method that Freedom Rocks uses. Probably on a Larger Scale the big financial institutions use similar types of Correlation techniques for hedging.

The FreedomRocks system simply allows the average person to get into the markets with a hedging strategy that doesn't require them to spend hours upon hours at their computers reading charts and signals looking for the next big break.

There is more to it then that and unless you have all the facts about any type of trading system, it's really difficult to make a blanket statement about it. It's like me saying "Candlestick formations are crap and don't tell you anything". I wouldn't say that of course because I have only had the luxury of using them only a few times throughout my trading.

Anyway, that's my 2 cents.

Cheers!

Rick M.

Thanks for the reply Rick.

Firstly let me say that all I am wanting to do is to understand properly what is going on. Please don't take any of this personally.

I'm afraid that what you are saying about hedging doesn't make sense. Let me illustrate using the example in the Freedom Rocks promotional video (which I have now watched). It says go long 50 lots EURUSD and long 50 lots USDCHF. You then aim to take 1 lot profit 100 pips above yoru entry price if it moves in your favour or to buy another lot if it moves 100 pips against you (with a view to selling it out again once it moves back to your entry price).

Now long 50 EURUSD and long 50 USDCHF is equivalent to long 50 EURCHF. (EDIT: this is actually only true if the sizes traded are for the same USD amounts but it is pretty close otherwise). The reason why you are "hedged" is because the EURCHF rate doesn't move very much (have a look at a chart) compared to the USD major rates and you are completely hedged against the USD (for example you will find that at major news releases for example your position won't change since the EURCHF rate doesn't budge). You do have an outright EURCHF position though and the associated risk if it should move against you.

There see to be two components to the strategy:

1. the carry interest - you earn the same amount by holding the EURCHF position as you do if you leg in with the USD components.

2. the grid trading - this basically assumes that the market does not trend very much (which is true for EURCHF) so you are probably selling and buying at 1 standard deviation intervals from your entry price. You could put the initial position on in EURCHF and trade the 1 lot grid trades in the USD legs just as easily or you could do the grid trading part just in the EURCHF instead.

I can see how this strategy would work and for the EURCHF pair you are probably not going to get into any serious trouble unless it starts moving in a straight line in one direction. In such an instance you will end up on the wrong side of the move and losing. What is the strategy in the grid trading component if the market keeps going against you? The usual policy is to keep buying or selling at the next grid line (sometimes doubling up) until it moves back in your favour or until you go broke. If you are using high gearing then the going broke part will happen for a smaller straight-line move than with smaller gearing.

In conclusion I can see the underlying basis of the method now though I wonder how many of the FreedomRocks users actually understand the risks that they are taking on and how and when it can go wrong.

Last edited:

a_gnome said:Thanks for the reply Rick.

Firstly let me say that all I am wanting to do is to understand properly what is going on. Please don't take any of this personally.

No worries. 🙂 I'm enjoying this conversation. It challenges me to better understand the markets. I appreciate your point of view.

a_gnome said:I'm afraid that what you are saying about hedging doesn't make sense. Let me illustrate using the example in the Freedom Rocks promotional video (which I have now watched). It says go long 50 lots EURUSD and long 50 lots USDCHF. You then aim to take 1 lot profit 100 pips above yoru entry price if it moves in your favour or to buy another lot if it moves 100 pips against you (with a view to selling it out again once it moves back to your entry price).

Now long 50 EURUSD and long 50 USDCHF is equivalent to long 50 EURCHF. (EDIT: this is actually only true if the sizes traded are for the same USD amounts but it is pretty close otherwise). The reason why you are "hedged" is because the EURCHF rate doesn't move very much (have a look at a chart) compared to the USD major rates and you are completely hedged against the USD (for example you will find that at major news releases for example your position won't change since the EURCHF rate doesn't budge). You do have an outright EURCHF position though and the associated risk if it should move against you.

I understand what you are saying in the paragraph above. I looked at a chart. (Included below). It seems to me that the EUR/CHF trends similar to the EUR/USD. The USD/CHF has an opposite trend. The range since 1997 on the EUR/CHF is around 2000 pips which is considerably less of a range compared to the appx 5,000 pips of the EUR/USD and the 8,000 appx of the USD/CHF. So I can understand what you mean by the fact that the EUR/CHF rate doesn't move much. Although the trend still goes in a similar fasion as the EUR/USD.

Your last point is the point that makes the Freedom Rocks trading system work better with 2 currency pairs. In your scenario, if I am Long EUR/CHF and the market continues to drop, then I will continue to drain my account.

In FreedomRocks. if I am long EUR/USD and Long USD/CHF, they are closely correlated in opposite directions. So if the market is going down for EUR/USD then on average the USD/CHF is going up. And if the EUR/USD keeps going down in a straight line, you are buying EUR/USD lets say 1 lot at a time for easy numbers. Well because of the close correlation, the USD/CHF is going up in a straight line on average and you are Selling 1 lot at a time capturing profits on the USD/CHF.

That's where the hedge comes in and why there is an advantage of holding both currency pairs.

a_gnome said:There see to be two components to the strategy:

1. the carry interest - you earn the same amount by holding the EURCHF position as you do if you leg in with the USD components.

2. the grid trading - this basically assumes that the market does not trend very much (which is true for EURCHF) so you are probably selling and buying at 1 standard deviation intervals from your entry price. You could put the initial position on in EURCHF and trade the 1 lot grid trades in the USD legs just as easily or you could do the grid trading part just in the EURCHF instead.

1. You're right. The carry interest is the same. However I feel the risk is higher if you're holding this pair long alone instead of hedging like I explained above.

2. For the same reason above, with your scenario only, if the market moves in the down direction you could get caught in the cross hairs. :cheesy:

a_gnome said:I can see how this strategy would work and for the EURCHF pair you are probably not going to get into any serious trouble unless it starts moving in a straight line in one direction. In such an instance you will end up on the wrong side of the move and losing. What is the strategy in the grid trading component if the market keeps going against you? The usual policy is to keep buying or selling at the next grid line (sometimes doubling up) until it moves back in your favour or until you go broke. If you are using high gearing then the going broke part will happen for a smaller straight-line move than with smaller gearing.

As indicated above the pseudo hedge of the 2 opposite currency pairs is what gives you a cushion for this type of situation. Unless there is some pretty drastic news out of switzerland that doesn't affect the EUR or vice versa these two currency pairs have generally been closely correlated and work in opposite directions.

a_gnome said:In conclusion I can see the underlying basis of the method now though I wonder how many of the FreedomRocks users actually understand the risks that they are taking on and how and when it can go wrong.

Every Forex trading system comes with risk, the FreedomRocks system doesn't guarantee risk free trading either. But based on your scenario with just trading the Cross Curreny there is great risk if the market moves against you but it is clear that the FreedomRocks does not work the same as if you were trading only the EUR/CHF. because of the pseudo hedging of the 2 currency pairs.

I encourage more people to get involved in this discussion an put your points forward.

Cheers!

Rick M

Attachments

Last edited:

a_gnome

Well-known member

- Messages

- 434

- Likes

- 15

smarties said:No worries. 🙂 I'm enjoying this conversation. It challenges me to better understand the markets. I appreciate your point of view.

Glad to hear it. Likewise I am enjoying the discussion.

smarties said:I understand what you are saying in the paragraph above. I looked at a chart. (Included below). It seems to me that the EUR/CHF trends similar to the EUR/USD. The USD/CHF has an opposite trend. The range since 1997 on the EUR/CHF is around 2000 pips which is considerably less of a range compared to the appx 5,000 pips of the EUR/USD and the 8,000 appx of the USD/CHF. So I can understand what you mean by the fact that the EUR/CHF rate doesn't move much. Although the trend still goes in a similar fasion as the EUR/USD.

I'm afraid that you are still not fully understanding the nature of what a cross rate is. When you talk about EURUSD and USDCHF being closely correlated you are correct. However the extend to which they are correlated is dicated by the EURCHF pair. That is in fact what the EURCHF pair is. If you are long equal USD sizes of EURUSD and USDCHF then BY DEFINITION you are long the EURCHF pair. For example when a bank needs to do a large trade in an illiquid cross rate they do the appropriate sizes in the USD rates for each side of the cross rate pair since those two trades are identically equivalent to the cross rate.

smarties said:In FreedomRocks. if I am long EUR/USD and Long USD/CHF, they are closely correlated in opposite directions. So if the market is going down for EUR/USD then on average the USD/CHF is going up. And if the EUR/USD keeps going down in a straight line, you are buying EUR/USD lets say 1 lot at a time for easy numbers. Well because of the close correlation, the USD/CHF is going up in a straight line on average and you are Selling 1 lot at a time capturing profits on the USD/CHF.

That's where the hedge comes in and why there is an advantage of holding both currency pairs.

You say that if the EURUSD is going down then on average the USDCHF is going up. The degree to which the USDCHF is going in the opposite direction is dictated by the EURCHF rate - this is in fact what the EURCHF rate means. If the EURCHF rate doesn't change at all then you will be perfectly 100% hedged and what you say about making on one what you lose on the other is correct. If on the other hand the EURCHF rate shifts then you will only be partially hedged - the more that the EURCHF rate shifts the less perfect your hedge is.

Let me illustrate with some actual figures. Currently as I write EURUSD = 1.2945 USDCHF = 1.2535 and EURCHF = 1.6227. Note how 1.2945 x 1.2535 = 1.6227 exactly as this is the definition of the cross rate.

Let's go long EURUSD and short USDCHF in equal USD amounts (which may not be exactly what you do in Freedom Rocks but serves for the purpose of this discussion).

Scenario 1.

EURCHF rate is unchanged. EURUSD goes up by 2% to 1.3204. We can work out the corresponding change in the USDCHF from the EURCHF rate. Since the EURCHF rate is unchanged the USDCHF rate = 1.6227 / 1.3204 = 1.2289. Note that this is a 2% drop from the starting level of the USDCHF. We are therefore perfectly hedged since the 2% rise in EURUSD is counteracted by the 2% drop in USDCHF. If the EURCHF rate doesn't change then you are completely hedged.

Scenario 2.

EURCHF rate drops 2% to 1.5902. EURUSD goes up by 2% to 1.3204. How much does the USDCHF go down in response to this move? The answer is USDCHF = 1.5902 / 1.3204 = 1.2043 a drop of 4%. So in this scenario our hedge is not so good with a 2% loss. Note how the 2% loss is exactly equal to the move in the EURCHF pair (since that is effectively the position that you have).

In conclusion you are only hedged to the extent that the EURCHF rate doesn't change.

smarties said:In your scenario, if I am Long EUR/CHF and the market continues to drop, then I will continue to drain my account.

Exactly! The truth is that you DO have a long EURCHF position together with all the associated risk. Of course if the EURCHF rate goes up then you will actually gain money from your "hedge" but there is no escaping the fact that you have a EURCHF rate position whether you do it in one trade or as two seperate USD trades as Freedom Rocks suggests.

I hope that this clarifies things.

I think something that may be getting overlooked here is that when you are trading the two pairs rather than just the EUR/CHF you can adjust you position and exposure to either side. The FR video shows a balanced pairing but notes that is a situation that almost never occurs. The fact is that no position I have ever seen FR take can be duplicated using the EUR/CHF. The reason for this that you can't trade the single pair without being locked into the "carry trade". By breaking it up, you can take advantage of the differences in each currency.

Another reason for trading the two pairs rather than just the single is that the individual currencies don't track perfectly and you can sell off one that is overheating and/or buy one that is getting oversold. This changes the entire balance of your portfolio and moves you further away from the EUR/CHF trend.

Overall, trading the single pair locks you into trading that trend. Breaking them up allows you to limit loss and profit from gains in a way that wold otherwise be impossible. That's why FR works much, much better than you would think by just looking at the EUR/CHF.

Another reason for trading the two pairs rather than just the single is that the individual currencies don't track perfectly and you can sell off one that is overheating and/or buy one that is getting oversold. This changes the entire balance of your portfolio and moves you further away from the EUR/CHF trend.

Overall, trading the single pair locks you into trading that trend. Breaking them up allows you to limit loss and profit from gains in a way that wold otherwise be impossible. That's why FR works much, much better than you would think by just looking at the EUR/CHF.

A quick warning. I know a large number of posters here also post on the TalkGold Forum. That forum has been hacked. Posts are disappearing and false posts are being inserted under other peoples names. I had a third party post a note warning that there was a problem and these same people pounded the Warning Bot until the account was eliminated. If you have any personal data in the UserCP I would remove it right now. Email addresses, anything with personal ID.

The Administrator has been informed but it may be a while until order is restored. Until then I would be very careful.

The Administrator has been informed but it may be a while until order is restored. Until then I would be very careful.

I think that there is something vaguely ironic that I'm looking at this thread on a day the EURCHF is up 90 pips in a 110 pip range!!

Actually ,look at a longer term chart and I expect that FR's 98 % correlation may be a bit ambitious for the last 14 months.

G-Man

Actually ,look at a longer term chart and I expect that FR's 98 % correlation may be a bit ambitious for the last 14 months.

G-Man

a_gnome

Well-known member

- Messages

- 434

- Likes

- 15

qclown said:I think something that may be getting overlooked here is that when you are trading the two pairs rather than just the EUR/CHF you can adjust you position and exposure to either side. The FR video shows a balanced pairing but notes that is a situation that almost never occurs. The fact is that no position I have ever seen FR take can be duplicated using the EUR/CHF. The reason for this that you can't trade the single pair without being locked into the "carry trade". By breaking it up, you can take advantage of the differences in each currency..

I'm afraid that the carry trade part isn't actually true unless you start trading your USD hedge components in the wrong direction! The truth is that the carry credit/debit that you get on EURCHF is the same if you do it with the USD components on each side (again assuming equal USD sizes) with the USD credit/debit part cancelling out on each side. Otherwise there would be a risk-free arbitrage opportunity.

qclown said:Another reason for trading the two pairs rather than just the single is that the individual currencies don't track perfectly and you can sell off one that is overheating and/or buy one that is getting oversold. This changes the entire balance of your portfolio and moves you further away from the EUR/CHF trend.

Overall, trading the single pair locks you into trading that trend. Breaking them up allows you to limit loss and profit from gains in a way that wold otherwise be impossible. That's why FR works much, much better than you would think by just looking at the

EUR/CHF.

It is true that you get added flexibility if you don't trade equal sizes in the two components and IF you are able to time each leg profitably then this is going to be better than trading the fixed cross rate.

I would be fascinated to follow someone's actual trades going forward on a daily basis in order to get a better understanding of what is going on. In particular, in the light of the recent moves in EURCHF as well as the other FX rates I would be interested to hear how FR traders have been faring recently.

On a more general level, part of the reasons for my posting on this thread is I am concerned about rather naive traders signing up for the FR program on the basis of a very one-sided promo video without fully understanding what risks they are actually taking on. I'm not suggesting that the method is necessarily a bad one to trade and I can quite believe that it can be made to work but this thread seems to be full of FR MML people trying to get others to sign up without fully explaining the risks (which the FR video doesn't do either).

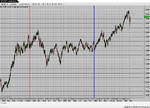

EURCHF Correlation

Waiting for the NFP I thought I would see what the current correlation for EURCHF is and compare that to what is touted in the promo video.

From 25/11/03 it is -0.91162, or appx 91.2%, and from 2/1/06 it comes out at -0.90835, or 90.8%. Seems high but EURGBP from 25/11/03 is 89.5%, so I don't think that it is appreciably more.

I have also attached a chart of EURCHF, which as mentioned earlier is effectively the position, and it shows a general appreciation of the EUR during that period. N.B. The red line is 25/11/03 and the blue 2/1/06.

On that basis it is not surprising that FR esponents like it, as they have been on the right side of the market. I wonder how many of them would be so pleased if the trend reversed. It would take a lot of swap to cover a 650 pip move.

G-Man

Waiting for the NFP I thought I would see what the current correlation for EURCHF is and compare that to what is touted in the promo video.

From 25/11/03 it is -0.91162, or appx 91.2%, and from 2/1/06 it comes out at -0.90835, or 90.8%. Seems high but EURGBP from 25/11/03 is 89.5%, so I don't think that it is appreciably more.

I have also attached a chart of EURCHF, which as mentioned earlier is effectively the position, and it shows a general appreciation of the EUR during that period. N.B. The red line is 25/11/03 and the blue 2/1/06.

On that basis it is not surprising that FR esponents like it, as they have been on the right side of the market. I wonder how many of them would be so pleased if the trend reversed. It would take a lot of swap to cover a 650 pip move.

G-Man

Attachments

I haven't spent much looking into this freedomrocks thing, but from what I've heard so far, it doesn't sound right. Even euro and chf are correlated to a certain degree, this pair does go one way or the other and could never come back, just like any other pairs. The pair could wipe out your account before u accumulate enough swap to cover the loss if you're in the wrong direction. Unless, both governments guarantees that there's a set range for this pair, I don't think it works.

DallasSteve

Member

- Messages

- 63

- Likes

- 3

Interest Carry

I'm sorry that I got into this thread late. I've just recently been approached about Freedom Rocks and I want to learn more.

Do forex brokers pay and charge interest based on the leveraged amount of currency held rather than the equity? I was unaware of that and I wonder if all brokers do that? In particular, I have my money with Interactive Brokers. Are they paying and charging 50:1 interest on the positions I hold? Can I really exploit cross currency interest rate differences like that at IB? Would it be better for me to use a broker that gives 100:1 or more even if their spreads are larger?

I'm reading that EUR/CHF tends to be more stable than other pairs. Can you really still benefit from the interest rate difference if you are only holding one pair? Is the leveraged interest difference enough to cover a EUR/CHF trend that goes against the trader rather than the current trend that goes for the trader? Do I really lose much of the safety in Freedom Rocks system if I just trade EUR/CHF? It seems like trading 2 pairs means you have double spread and commissions which isn't a good thing.

Thanks. I hope someone still reads this thread. a_gnome seems to really understands the finances involved.

Steve

I'm sorry that I got into this thread late. I've just recently been approached about Freedom Rocks and I want to learn more.

Do forex brokers pay and charge interest based on the leveraged amount of currency held rather than the equity? I was unaware of that and I wonder if all brokers do that? In particular, I have my money with Interactive Brokers. Are they paying and charging 50:1 interest on the positions I hold? Can I really exploit cross currency interest rate differences like that at IB? Would it be better for me to use a broker that gives 100:1 or more even if their spreads are larger?

I'm reading that EUR/CHF tends to be more stable than other pairs. Can you really still benefit from the interest rate difference if you are only holding one pair? Is the leveraged interest difference enough to cover a EUR/CHF trend that goes against the trader rather than the current trend that goes for the trader? Do I really lose much of the safety in Freedom Rocks system if I just trade EUR/CHF? It seems like trading 2 pairs means you have double spread and commissions which isn't a good thing.

Thanks. I hope someone still reads this thread. a_gnome seems to really understands the finances involved.

Steve

a_gnome

Well-known member

- Messages

- 434

- Likes

- 15

DallasSteve said:I'm sorry that I got into this thread late. I've just recently been approached about Freedom Rocks and I want to learn more.

Do forex brokers pay and charge interest based on the leveraged amount of currency held rather than the equity? I was unaware of that and I wonder if all brokers do that? In particular, I have my money with Interactive Brokers. Are they paying and charging 50:1 interest on the positions I hold? Can I really exploit cross currency interest rate differences like that at IB? Would it be better for me to use a broker that gives 100:1 or more even if their spreads are larger?

I'm reading that EUR/CHF tends to be more stable than other pairs. Can you really still benefit from the interest rate difference if you are only holding one pair? Is the leveraged interest difference enough to cover a EUR/CHF trend that goes against the trader rather than the current trend that goes for the trader? Do I really lose much of the safety in Freedom Rocks system if I just trade EUR/CHF? It seems like trading 2 pairs means you have double spread and commissions which isn't a good thing.

Thanks. I hope someone still reads this thread. a_gnome seems to really understands the finances involved.

Steve

Hi DS,

In answer to your question, generally yes, a broker will credit or debit you interest on your leveraged position. Basically you are borrowing at the prevailing rate the currency you are short and so paying the interest out and being paid interest on the currency that you are long. Thus you get a net credit or debit on the difference between the two interest rates and entering a trade in order to benefit from this is know as a carry trade. Many people have been doing these against the yen (e.g. long USDJPY) since it has such a low interest rate. Recently there was a lot of turmoil as everyone unwound these positions at the same time leading to great gains in the JPY.

The risk with this is that you are earning a few percent PER YEAR on your leveraged position whereas you can get fluctuations in your underlying position of the same order of magnitude PER DAY. You mustn't lose sight of the fact that if you put on a 100:1 leveraged position then a 1% fluctuation against you wipes you out! One reasonable approach is to do trades (of a sensible size) only in the favourable direction of the carry but making sure that you have decent positional entries and exits as well. That way you are getting an extra benefit from the carry whilst still trading sensibly.

DallasSteve

Member

- Messages

- 63

- Likes

- 3

Interest Carry

Thanks a_gnome.

I'm glad that you are still responding to this thread. It sounded too good too be true and I think you have analyzed this well. If this were truly a risk-free arbitrage, or almost risk-free, the pros would already have systems running that drain off all the juice before we get there. If someone wants to execute carry trades I don't think they need to pay Freedom Rocks to tell them what to buy. It seems that they could just watch the published interest rates themselves and do the math. And if they want to balance the portfolio on two currency pairs they can do that with an Excel spreadsheet in 5 minutes for free.

It is amusing that some people seem to think that holding two pairs is different than holding the cross currency pair. If there were a difference it would be arbitraged away in milliseconds.

Steve

a_gnome said:Hi DS,

In answer to your question, generally yes, a broker will credit or debit you interest on your leveraged position. Basically you are borrowing at the prevailing rate the currency you are short and so paying the interest out and being paid interest on the currency that you are long. Thus you get a net credit or debit on the difference between the two interest rates and entering a trade in order to benefit from this is know as a carry trade. Many people have been doing these against the yen (e.g. long USDJPY) since it has such a low interest rate. Recently there was a lot of turmoil as everyone unwound these positions at the same time leading to great gains in the JPY.

The risk with this is that you are earning a few percent PER YEAR on your leveraged position whereas you can get fluctuations in your underlying position of the same order of magnitude PER DAY. You mustn't lose sight of the fact that if you put on a 100:1 leveraged position then a 1% fluctuation against you wipes you out! One reasonable approach is to do trades (of a sensible size) only in the favourable direction of the carry but making sure that you have decent positional entries and exits as well. That way you are getting an extra benefit from the carry whilst still trading sensibly.

Thanks a_gnome.

I'm glad that you are still responding to this thread. It sounded too good too be true and I think you have analyzed this well. If this were truly a risk-free arbitrage, or almost risk-free, the pros would already have systems running that drain off all the juice before we get there. If someone wants to execute carry trades I don't think they need to pay Freedom Rocks to tell them what to buy. It seems that they could just watch the published interest rates themselves and do the math. And if they want to balance the portfolio on two currency pairs they can do that with an Excel spreadsheet in 5 minutes for free.

It is amusing that some people seem to think that holding two pairs is different than holding the cross currency pair. If there were a difference it would be arbitraged away in milliseconds.

Steve

a_gnome

Well-known member

- Messages

- 434

- Likes

- 15

DallasSteve said:Thanks a_gnome.

I'm glad that you are still responding to this thread. It sounded too good too be true and I think you have analyzed this well. If this were truly a risk-free arbitrage, or almost risk-free, the pros would already have systems running that drain off all the juice before we get there. If someone wants to execute carry trades I don't think they need to pay Freedom Rocks to tell them what to buy. It seems that they could just watch the published interest rates themselves and do the math. And if they want to balance the portfolio on two currency pairs they can do that with an Excel spreadsheet in 5 minutes for free.

It is amusing that some people seem to think that holding two pairs is different than holding the cross currency pair. If there were a difference it would be arbitraged away in milliseconds.

Steve

I think that in fairness to FR, they are doing a bit more than simply putting on the carry trade. They claim that they can trade around the basic position so as to reduce the outright positional risk and that as they don't trade equal sizes in each leg then it's not exactly the same as the straight cross-rate position. Whether they can actually add value through doing this or not is another matter.

As G-Man points out, they've been lucky in being on the right side of the EURCHF move so far which is why they are all happy bunnies.

I am also always wary of people who are on a MLM scheme telling me how great something is - they a strong incentive to do so of course!

DallasSteve

Member

- Messages

- 63

- Likes

- 3

That's definitely the feeling I get. They've got MLM fever like the neighbor who used to sell my wife cosmetics.a_gnome said:I am also always wary of people who are on a MLM scheme telling me how great something is - they a strong incentive to do so of course!

Steve

Similar threads

- Replies

- 2

- Views

- 2K

- Replies

- 3

- Views

- 1K