Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

Maybe this will enlighten experienced traders as well but I think most experienced traders have probably figured out this indicator flaw...

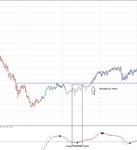

Indicators seem so magical when looking at them in confluence with the historical price action on a chart. They seem to predict or at least indicate in unison what the price is going to do or is doing. Isn't it amazing how the MACD crosses over almost exactly at the point price turns and goes in the same direction? The Stochastic seems to turn on a dime as the chart does the same thing.

Then why does it seem that every time you enter the trade on the cross or direction change, you're too late and ultimately stopped out? Notice this with other indicators as well?

It has been said many times that indicators lag price and this is true. But there is an often overlooked property of indicators that is actually pretty simple to understand once recognized: The angle of the lines of the indicator are influenced by the price action multiple periods FORWARD in time. This is why they work perfectly in a historical view but are difficult to gauge in real time.

Imagine a steep and sudden downtrend from a high point. Before that reversal happened, just about any traditional indicator would appear to be traveling upward with the price. The turnover doesn't only lag price, it takes time to paint the downward slope as the price declines. Depending on the underlying data, it may even appear to indicate a continuation of the upward price action while real time price is already descending.

But looking back on it, you would see how the indicator did it's job and you're left scratching your head, wondering how you missed that.

Indicators are not all bad. I use them to confirm the strength of my trade once I'm in it, to determine how much longer I want to allow price to run. But I still use discretion. I don't rely entirely on the indicator and plotting them across 3 time frames is also a good idea so you can view the behavior in short and longer term behavior.

Just a thought for the new trader... I had to figure this out on my own years ago and the lesson wasn't free.

All the best!

Indicators seem so magical when looking at them in confluence with the historical price action on a chart. They seem to predict or at least indicate in unison what the price is going to do or is doing. Isn't it amazing how the MACD crosses over almost exactly at the point price turns and goes in the same direction? The Stochastic seems to turn on a dime as the chart does the same thing.

Then why does it seem that every time you enter the trade on the cross or direction change, you're too late and ultimately stopped out? Notice this with other indicators as well?

It has been said many times that indicators lag price and this is true. But there is an often overlooked property of indicators that is actually pretty simple to understand once recognized: The angle of the lines of the indicator are influenced by the price action multiple periods FORWARD in time. This is why they work perfectly in a historical view but are difficult to gauge in real time.

Imagine a steep and sudden downtrend from a high point. Before that reversal happened, just about any traditional indicator would appear to be traveling upward with the price. The turnover doesn't only lag price, it takes time to paint the downward slope as the price declines. Depending on the underlying data, it may even appear to indicate a continuation of the upward price action while real time price is already descending.

But looking back on it, you would see how the indicator did it's job and you're left scratching your head, wondering how you missed that.

Indicators are not all bad. I use them to confirm the strength of my trade once I'm in it, to determine how much longer I want to allow price to run. But I still use discretion. I don't rely entirely on the indicator and plotting them across 3 time frames is also a good idea so you can view the behavior in short and longer term behavior.

Just a thought for the new trader... I had to figure this out on my own years ago and the lesson wasn't free.

All the best!