FetteredChinos

Veteren member

- Messages

- 3,897

- Likes

- 40

ok, the patient is dead....

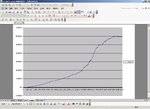

attached is an equity curve of a home-grown trading strat tested on data as far back as 1990.

the inputs (all two of them) are dynamic, and so should therefore respond to current prevailing market conditions..

it is counter-trend..

performance has been rather stellar (50pts per trade, 80% win rate), until we hit 2004, whereupon it has basically flatlined.

this...

is...

annoying....

looks like 60,000 points is providing overhead resistance.. 🙄

anyway, the point of my posting was..

has anyone come up with a decent mechanical strat that has performed well on the Dow during 2004? all my trend-following ones have got a similar pattern, as have my counter trend ones.

it cant be due to current market volatility can it, as the inputs are based on recent volatility levels......?

attached is an equity curve of a home-grown trading strat tested on data as far back as 1990.

the inputs (all two of them) are dynamic, and so should therefore respond to current prevailing market conditions..

it is counter-trend..

performance has been rather stellar (50pts per trade, 80% win rate), until we hit 2004, whereupon it has basically flatlined.

this...

is...

annoying....

looks like 60,000 points is providing overhead resistance.. 🙄

anyway, the point of my posting was..

has anyone come up with a decent mechanical strat that has performed well on the Dow during 2004? all my trend-following ones have got a similar pattern, as have my counter trend ones.

it cant be due to current market volatility can it, as the inputs are based on recent volatility levels......?