Atilla

I don't see trillions of dollars all over the globe coming into the food stamps or unemployed benefits. The numbers simply do not add up.

I've been trying to figure out where the trillions have gone and what the transmission mechanism is and food stamps and unemployed benefits may just about account for 1% with some fat rounding.

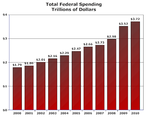

First off, observe the growth of government debt: from circa $9.0 Trillion to circa $14 Trillion.

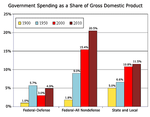

Now you say that Welfare accounts for maybe 1% with generous rounding. Let's look at some breakdowns. In a $16 Trillion economy: government spending now accounts for 36.9% of all spending [see attached chart]

Medicare/Medicaid [12%], Social Security [19%], Other [Unemployment benefits lumped together] + Government salaries etc [38%] [see attached chart]

This has taken Federal spending to $3.72 Trillion/annum from $1.79 Trillion in 2000. That's a significant increase. [see attached chart]

Inflation is not by default but by design imo. What period of time are we looking at until inflation erodes trillions of debt? Not sure what you mean by unlikely - governments will have to balance books. Can't keep selling TBills. Market appetite will turn into puke soon enough.

I disagree. Inflation is exactly that. Expropriation via default. It has been government policy since 1913 and the creation of the Federal Reserve System.

Let's look at US inflation rates:

1774-1890 = +0.10%

1800-1890 = [-0.36%]

1913-2010 = +3.27%

*Note that the 1800-1890 period coincides with the gold coin standard. The true gold standard. Real wealth increased massively in this period.

US

1800 to 1890

Consumer Price Index -0.36%

Unskilled Wage 0.93%

Real GDP 4.27%

Contrasted with:

US

1913 to 2009

Consumer Price Index 3.29%

Unskilled Wage 4.87%

Real GDP 3.25%

US

1980 to 2009

Consumer Price Index 3.36%

Unskilled Wage 3.32%

Real GDP 2.77%

As government grows, the metrics deteriorate.

The government aren't selling T-bills. They are simply creating new money via the Federal Reserve. Look at the growth in debt [see attached charts] and money supply and the Federal Reserve Balance Sheet.

All tangibal asset values will have to be adjusted as negative interest rates will be with us for some time. We can see this already happening and ratios will change. eg: Technology products falling in value and food and energy rising. Ratios from 20 years ago likely to show considerable variance to today.

Tangible Assets are not products: they are the means of production, either capital goods or consumer goods. In an inflation, the legal title to assets rises, which is why the stockmarket is currently a buy. If the government continue to inflate, which they must, the nominal value of the market goes higher.

Not sure I agree with these lines. Gold is the ultimate currency - which is why we have seen it rise in value and will do so in the future as fiat currencies become devalued. Gold always rises in uncertainty - we are in the cusp of a new era and not out of the unknown by far.

Gold is currently an asset class: it is not legal money, though it is real money. There is likely a speculative premium in gold, although knowing what that is, is not really calculable, being that money itself is an ordinal value.

I agree that gold will continue to rise for the basic reason: should fiat currencies fail, specifically the US dollar, then pricing the conversion to gold will necessitate an anchor to the current nominal numbers of dollars.

I'm a little confused here my self with US deflation. Japan has been in deflation for some time. I do believe inflation will prevail but have been surprised my self with its slow creep in US. Perhaps stagflation is in the making...

US inflation is increasing rapidly now. Once it takes hold, it becomes very, very difficult to reverse, as the policies required are always unpalatable.

jog on

duc