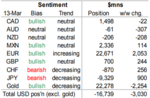

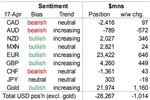

As follows from the latest CFTC data, in this week the main changes in speculative positioning occurred in euros and yen, while the situation in other currencies remained more or less the same. The euro remains the only clearly bought currency, the yen is the only one clearly sold, and positioning in the loonie, cable, aussie, kiwi and franc is close to neutral. The volume of the net short position on the dollar increased by $ 3 billion, and it was sold mainly against the euro and the yen.

Net long euros increased by $2.1 billion to $22.7 billion, closely approaching the historical high of $23.1 billion recorded in late January. This happened against the background of the closing of short and the opening of fresh long positions.

Positioning in the cable has almost not changed and remains close to neutral.

Bears in the yen close the shorts at an increasingly fast pace, but the bulls open longs while not in a hurry. The volume of the net short position in the Japanese currency fell by $0.9 billion to $9.3 billion (the minimum level since early October, which will be lower than the multi-year high of $15.0 billion achieved in mid-November).

The volume of net long loonie almost did not change, however, traditionally there was an opening of interests, as speculators opened new long and short positions. This reporting period ended on March 13, so this data does not take into account the changes in speculative positioning, which probably occurred during the dollar / luny growth above C$1.30.

Pure positioning on the Aussie again became bearish. Since the beginning of February, there has been a steady trend towards active interest.

Net long euros increased by $2.1 billion to $22.7 billion, closely approaching the historical high of $23.1 billion recorded in late January. This happened against the background of the closing of short and the opening of fresh long positions.

Positioning in the cable has almost not changed and remains close to neutral.

Bears in the yen close the shorts at an increasingly fast pace, but the bulls open longs while not in a hurry. The volume of the net short position in the Japanese currency fell by $0.9 billion to $9.3 billion (the minimum level since early October, which will be lower than the multi-year high of $15.0 billion achieved in mid-November).

The volume of net long loonie almost did not change, however, traditionally there was an opening of interests, as speculators opened new long and short positions. This reporting period ended on March 13, so this data does not take into account the changes in speculative positioning, which probably occurred during the dollar / luny growth above C$1.30.

Pure positioning on the Aussie again became bearish. Since the beginning of February, there has been a steady trend towards active interest.