forexbillions

Junior member

- Messages

- 26

- Likes

- 0

Hi

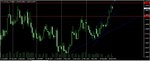

this is my position on EUR/USD

Currency: EUR/USD (2017.04.21)

Type: Buy

Entry: 1.0717

TP: 1.0777

SL: 1.0623

http://forexbillions.com/wp-content...in-EURUSD-EURNZD_body_Picture_1.png.full_.png

this is my position on EUR/USD

Currency: EUR/USD (2017.04.21)

Type: Buy

Entry: 1.0717

TP: 1.0777

SL: 1.0623

http://forexbillions.com/wp-content...in-EURUSD-EURNZD_body_Picture_1.png.full_.png