Mark Twain's intuition of facts lies and statistics :

Facts are stubborn things, but statistics are more pliable.

Get your facts first, and then you can distort them as much as you please

A lie can travel halfway around the world while the truth is putting on its shoes.

There are 3 kinds of lies : Lies, Damned lies and statistics.

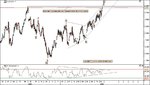

Do not wholeheartedly trust charts, patterns and statistics without due deliberation.

Know the Italian accountant N Elliott lost his entire life savings in the NY stockmarket after he retired and migrated to the US ? He then spent the rest of his life to mull this so-called wave principle thinggy before his death. It managed to join all the knots and dots in the market past and made them fit in one go on his drawing board.

Then came the greater fool, in the name of Robert Precther, a self-proclaimed diciple of N Elliott : Remember this young guy predicted a supernova of bull rages on the eve of that infamous Oct 1987 crash ? But that was not his mworst. After the crash, he was again conned by this same Principle to predict an imminent period of Dark Ages in the American financial landscape : Dow would plunge below, way below, 3 digits. What actually happened ? Albeit some corrections along the path, Dow moved right up from there almost unstoppably and pierced the 10,000 level for the first time in history on Mar 29 1999.

Your homeworks and your own intuition are utmost important. Trust your feel, Follow your nose.