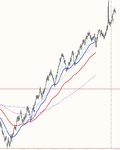

I shorted the ES at 1538.75. Would you have done the same? and if not then why not? and when would you have sho it if at all?

over the years you tend to look for the easy trades, the ability to see when money is on the ground waiting to be picked up, comes with time.

the small scalping trades become a headache. If I truely scalped, I can hit a W:L ratio of 80-90% in any market. But its extremely taxing on the system and wears you out.

its possible to obtain the same results with swing trading, its just a matter of adjusting amount of target and stop loss, which generally become wider.

as for the trade, no I would not have placed it, its working off a spring from 1520, upper end of channel is 1550, lower end 1490, but actually higher when you look at the daily chart since there is a inverse head n shoulders, that spring is dangerous since the market can gap up and break highs and never look back.

I look at:

1) 60 minute trend

2) overall direction of MA's

3) MA's crosses and violations

4) whether price is above or below open

5) whether price is above or below yesterdays high or low

6) whether price is above weekly high or low

its all a matter of increasing probability for you in terms of the trade, high probability trades, are usully contagion heuristic based. Contagion heuristic is a fear/greed trade as it enfolds. Most are too shocked at what the market is doing to take advantage of it, if they are not in the market at the moment.