You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

woo woo nice earnings, too bad everyone is talking up the recession talk. Even our good friend Paulson trying to hauck his paper to the world, talking up the recession, so bonds get better receivership abroad.

way to **** of the chinese by hosting, Dalai Lama, a big buyer, of US securities.

way to **** of the chinese by hosting, Dalai Lama, a big buyer, of US securities.

there exists a opportunity of a severe mind job, when even with good earnings the market fails to propel higher. As the good earnings buyers buy in on the open, huge volume will be sold into them, since the people in the know already positioned to offload their inventory to these late artists.

the towel will be thrown in, when stocks fail to move higer even with positive earnings.

😛

the towel will be thrown in, when stocks fail to move higer even with positive earnings.

😛

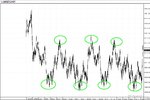

information about earnings was available to a lot of players...notice the chart pattern. Basically they chop beyond tic noise levels, to break positions.

Its called buying without fear, knowing full well your position was covered with the earnings coming out. Those buyers will sell into retail orders.

Its called buying without fear, knowing full well your position was covered with the earnings coming out. Those buyers will sell into retail orders.

Attachments

Last edited:

spooz should be down -17.50 by 1:30 pm Est USA tomm. That doesn't include the premium of +6 currently.

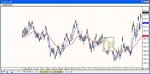

a higher probability scenario is 1565 trendie..before a turn. Long @ 55 .......... 🙂

Attachments

<<<<<both your ES and NQ trades will be golden, I was hoping for more of a downdraft to position, but it looks like the strong earnings will swing it around within points of their highs around FOMC meeting.

the FOMC meeting volatility will spill it over, I expect to see 1620 and higher, as the months tic away.

If you've watched Bernies and Paulsons speeches as of late, they are indicating expect another rate cut.

Options expiration will add some volatility for positioning too.

its...19.30 pm est USA time, here is the turn...for new highs....(notice my time stamp)...>>>

I posted this on another board.

the FOMC meeting volatility will spill it over, I expect to see 1620 and higher, as the months tic away.

If you've watched Bernies and Paulsons speeches as of late, they are indicating expect another rate cut.

Options expiration will add some volatility for positioning too.

its...19.30 pm est USA time, here is the turn...for new highs....(notice my time stamp)...>>>

I posted this on another board.

information about earnings was available to a lot of players...notice the chart pattern. Basically they chop beyond tic noise levels, to break positions.

Its called buying without fear, knowing full well your position was covered with the earnings coming out. Those buyers will sell into retail orders.

Chart looks funny. Doesn't match mine. Looks like circled bottoms 3 & 4 are repeats of 1 & 2. Top 3 looks to be a repeat of top 1. Confusion aside, I really enjoy your thread Xymox. You do a good job of conveying big money sentiment, which I always find fascinating. Thanks.

Chart looks funny. Doesn't match mine. Looks like circled bottoms 3 & 4 are repeats of 1 & 2. Top 3 looks to be a repeat of top 1. Confusion aside, I really enjoy your thread Xymox. You do a good job of conveying big money sentiment, which I always find fascinating. Thanks.

its a 'echo' in the data. But basically a floor was put in by the peope in the 'know'...

thanx for your kind words.

its much harder for the bigboys to hide what they do in the large price ranges., the little guys get caught in 1-2 point decisive moments. The large money pools are looking at 50 point ranges..because thats all they can work with in terms of order entry and exit.

thus the little guys get chopped in the minutae..

thus the little guys get chopped in the minutae..

notice the tic action AH, trying to run stops a little below,...usually they slowly run stops down, and then bam ramp it up before US open....classic AH trading.

🙂

the last few sessions had some to deal with the cold weather and diminished light levels, as diminished light levels filter to the pineal glamd, physiological changes occur, that fosters hibernation. Depressive tendencies, the maket has to shake this off.

Similar threads

- Replies

- 16

- Views

- 6K