Oops, bit late...my mind's not on the job, in more way's than one.Looked promising from the pre-market rise....so what happened? Given that the RS SWitch breakout has not continued as all then others did, I guess I can only mean one thing and that's down. Plenty of room on CCI for that.There is just a glimmer of hope on the time line. It has to pullback tomorrow if it's to stay on form .i feel that horizontal line across 640 will be key.From where I'm sitting, that looks like one of those chimineys that Santa has to squeeze down- the D top at 740.! :cheesy:

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Not hard to get in on the short, so long as you didn't get pre-conditiioned into thinking we were off to the moon- actually quite hard to ignore the signs from the pre market action! But having got in on the short, it was a nice simple ride down with that typical 20 point pullback in the middle to give T2- which failed to deliver.Not by much- you need to allow some lee way, but the clue was by way of confirmation with CCI well O/S at 375 ish followed by higher lows adn highs as the price crept up towards the 100MA.Not an easy out, as there was no sign of any PD's.....

Attachments

TraderTony

Active member

- Messages

- 180

- Likes

- 1

No data feed on MyTrack for most of first hour - great.

Still unhappy trading from this data so reverting to DJIA feed but probably best to keep out here until the two charts look the same.

11:01 1) S 10712. Couldn't resist signal off the DJIA for a move down to 700 level.

11:03 EXIT: +11

11:48 2) S 10698. For a breakdown. Moves well. Then bounces up from just above LOD. Doesn't close above 7ema so hold. Looking for +15 on move to pivot.

11:57 EXIT: +10. Got nervous and took 10 the second time it was offered.

Then missed the clearer re-entry for the bigger move down to close the gap from Friday.

12:52 3) L 10688. But congestion and no follow through. Eventually goes up. Stalls at +9 - I would have taken 10. The sharp pull back.

13:10 EXIT: +5. Bit disappointing after holding for so long. And still just short of the +25 net limit for changing approach.

Missed the breakdown at 13:53 despite a good entry signal at the end of the previous bar.

Well, with the kids off school I'm going to be finishing early this week if I can so I will take the points now and go and do my duties.

+26 from 3

+23 for the day after costs

+189 for December so far after commissions (13 days of trading)

Still unhappy trading from this data so reverting to DJIA feed but probably best to keep out here until the two charts look the same.

11:01 1) S 10712. Couldn't resist signal off the DJIA for a move down to 700 level.

11:03 EXIT: +11

11:48 2) S 10698. For a breakdown. Moves well. Then bounces up from just above LOD. Doesn't close above 7ema so hold. Looking for +15 on move to pivot.

11:57 EXIT: +10. Got nervous and took 10 the second time it was offered.

Then missed the clearer re-entry for the bigger move down to close the gap from Friday.

12:52 3) L 10688. But congestion and no follow through. Eventually goes up. Stalls at +9 - I would have taken 10. The sharp pull back.

13:10 EXIT: +5. Bit disappointing after holding for so long. And still just short of the +25 net limit for changing approach.

Missed the breakdown at 13:53 despite a good entry signal at the end of the previous bar.

Well, with the kids off school I'm going to be finishing early this week if I can so I will take the points now and go and do my duties.

+26 from 3

+23 for the day after costs

+189 for December so far after commissions (13 days of trading)

Attachments

TraderTony

Active member

- Messages

- 180

- Likes

- 1

action either side of the pivot.for ...first hour...second hour....

11:37 1) L 10707 for break to upside. Nope coming back on me. I shouldn't so this, but I am holding with both 100 ema and 700 level within my max 10 point stop. Stupid. 700 must hold. Could be. And up. Go on. Now let it run.

11:57 EXIT: +16. What a fool. Why did I get out? No resistance. No ugly bar. No pressure on 7ema. Plonker. I should have at least gone for 20 or preferably my 25 threshold before I start looking for a big move. R1 at 33 would also have been a good target if I wanted one.

12:34 2) S 10733. On right shoulder after big ND at top. Moves well. Looking for 11. Then stalls. Proabably just a flag. But not going anywhere now.

12:48 EXIT: +6. Next push down failed and do not want to give it back when trading counter trend. Good decision this time as it pushed back up after exit.

Well, it's past 6pm and I've been lucky and made 20 points net so I'll cash in there and see if we can get one more good day tomorrow before the Christmas shutdown (it looks like Thursday is just a half day for many futures - albeit not the indices - and then everything is shut on Friday - see attachment).

+22 from 2

+20 for the day after commissions

+209 for December so far after commissions (14 days of trading)

Charts to follow after close.

11:37 1) L 10707 for break to upside. Nope coming back on me. I shouldn't so this, but I am holding with both 100 ema and 700 level within my max 10 point stop. Stupid. 700 must hold. Could be. And up. Go on. Now let it run.

11:57 EXIT: +16. What a fool. Why did I get out? No resistance. No ugly bar. No pressure on 7ema. Plonker. I should have at least gone for 20 or preferably my 25 threshold before I start looking for a big move. R1 at 33 would also have been a good target if I wanted one.

12:34 2) S 10733. On right shoulder after big ND at top. Moves well. Looking for 11. Then stalls. Proabably just a flag. But not going anywhere now.

12:48 EXIT: +6. Next push down failed and do not want to give it back when trading counter trend. Good decision this time as it pushed back up after exit.

Well, it's past 6pm and I've been lucky and made 20 points net so I'll cash in there and see if we can get one more good day tomorrow before the Christmas shutdown (it looks like Thursday is just a half day for many futures - albeit not the indices - and then everything is shut on Friday - see attachment).

+22 from 2

+20 for the day after commissions

+209 for December so far after commissions (14 days of trading)

Charts to follow after close.

Attachments

Last edited:

tradesmart

Experienced member

- Messages

- 1,286

- Likes

- 22

Good points TTony....!

Bullish times as the Dow repeatedly tests resistance at around 10740…..

Very likely an advanced test prior to a breakout that will take the index up to 10775/10800 and maybe above…….

The Dow has somewhat lagged behind the Naz/S&P recently, and there is now (reportedly..) some evidence of rotation into Dow stocks in the hope of relative outperformance; and some likelihood that this will continue until the year end as many major fund managers have had the majority of their years ‘performance’ since mid-October, and will not want to see this evaporate with a successful outcome just ten days away…

Indeed, they may wish to enhance that performance, if they can, by further buying…

There has previously been a syndrome at year-end noted as “low-volume levitation” and this is what we may witness…….

(pure speculation until proved of course…… 😉 )

Bullish times as the Dow repeatedly tests resistance at around 10740…..

Very likely an advanced test prior to a breakout that will take the index up to 10775/10800 and maybe above…….

The Dow has somewhat lagged behind the Naz/S&P recently, and there is now (reportedly..) some evidence of rotation into Dow stocks in the hope of relative outperformance; and some likelihood that this will continue until the year end as many major fund managers have had the majority of their years ‘performance’ since mid-October, and will not want to see this evaporate with a successful outcome just ten days away…

Indeed, they may wish to enhance that performance, if they can, by further buying…

There has previously been a syndrome at year-end noted as “low-volume levitation” and this is what we may witness…….

(pure speculation until proved of course…… 😉 )

Attachments

GruntnoWay

Active member

- Messages

- 159

- Likes

- 2

Well that resistance went today. 10765 is the new level. There is not much to stop it now.

I guess it had to go...If you think about it, this is following what is happening in the stocks, not the other way round.... If the MM's see a big move coming, they have to harvest some spare stock from somewhere to fuel/supply the demand. It doesn't come out of thin air.... I said yesterday that 640 would have to go to effect a drop and there was a last chance time wise to get back on course.How sweet. Having said that, there's not a lot of room up there and is unlikely to make my EOD near target of 850 just yet.

I've just seen we can now upload 5 images ....

I've just seen we can now upload 5 images ....

Attachments

GruntnoWay

Active member

- Messages

- 159

- Likes

- 2

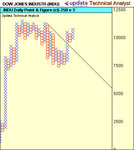

I have a PnF target of 12150

GruntnoWay

Active member

- Messages

- 159

- Likes

- 2

Just looking through my charts again. The very long term 250 x 3 PnF which i never look at has just given the first double top buy signal for 3 years.

It looked like an r/s swith on my 10 min chart if you ignore yesterday's false breakout and up we went. 10 min RSI looking high so if we are going to carry on up maybe a pullback is due?

After the gap up the first two and a half hours were spent in a 25 point range but the flag and triangle breakout were enough to prompt a long and exit at 32.

Another flag, this time unsure of target but 64 was the obvious place to exit this time with CCI so high.

Double top at 64, but the being late in the day and not being able see a clear 3 PK divergence I packed up for the day. Could have grabbed a few points on the pullback to 740 but then it went for a retest of 64 anyway.

Hope everyone had a good day!

Justyn.

After the gap up the first two and a half hours were spent in a 25 point range but the flag and triangle breakout were enough to prompt a long and exit at 32.

Another flag, this time unsure of target but 64 was the obvious place to exit this time with CCI so high.

Double top at 64, but the being late in the day and not being able see a clear 3 PK divergence I packed up for the day. Could have grabbed a few points on the pullback to 740 but then it went for a retest of 64 anyway.

Hope everyone had a good day!

Justyn.

Attachments

Gruntnoway

Please could you explain what 250 x PnF refers to?

Also what is a "double top buy signal"? Normally I would take a double top as a signal to sell?

Justyn.

Just looking through my charts again. The very long term 250 x 3 PnF which i never look at has just given the first double top buy signal for 3 years.

Please could you explain what 250 x PnF refers to?

Also what is a "double top buy signal"? Normally I would take a double top as a signal to sell?

Justyn.

GruntnoWay

Active member

- Messages

- 159

- Likes

- 2

justyn said:Gruntnoway

Please could you explain what 250 x PnF refers to?

Also what is a "double top buy signal"? Normally I would take a double top as a signal to sell?

Justyn.

250 points x 3 reversal point and figure chart. each X is 250 points. the double top buy occurs when a X breaks above a previous X. Also notice that the long term downtrend has broken.

I shall make an attempt at a chart 🙂

Attachments

Easy start..... Can't show the bull flag that lies within the open triangle- getting a few of those now. Target was 778.Getting in on that triangle/flag would have netted a swift 60 odd.... Then the tricky bit. Stop and reverse, or look for a pause and reversal? Tough call.A gamble short would have done the trick.Especially if you held through the pullbacks ( 15 points) to see the D top at 810 ish. And then the swiftest of drops to outrageously oversold at 780. Check out the ES vol on that dip. Here's the long re-entry point. No brainer, and hold to the close....

If I had taken the gamble short at the top, I think I would have bottled it on the second high of the D Top at 810, because of the RS Switch.The second low at 17:38 would have convinced me this was the bottom for the switch and take a long.That and the short time ND convinced me it was going to be an up only day. It turned out that way in the end, with a nasty sting in the middle.... :cheesy:

If I had taken the gamble short at the top, I think I would have bottled it on the second high of the D Top at 810, because of the RS Switch.The second low at 17:38 would have convinced me this was the bottom for the switch and take a long.That and the short time ND convinced me it was going to be an up only day. It turned out that way in the end, with a nasty sting in the middle.... :cheesy:

Attachments

TraderTony

Active member

- Messages

- 180

- Likes

- 1

Missed the run up off the announcement of oil inventories at 10:30.

10:53 1) S) 10828. On triple ND looking ideally for a move back to 800. Starts moving well.

11:00 EXIT: +1. Moved stop to b/e +1 as neighbours arrived unexpectedly with pressies for the kids. Ah well, I think I need to accept that trading is over now at least until after Christmas and stop trying to stretch it out for one more trade.

It actually turned out to be a decent entry and did hit 800 but I doubt I ever would have held it that long.

+1 from 1

B/e for the day after commissions

+209 for December so far after commissions (15 days of trading)

A slightly lower month in terms of overall points and daily average, but still positive. I believe over caution due to increasing contract size, especially early in the month, had an impact. However, just wait 'til I finally hit them with some Big Kahuna trades in the New Year!

Merry Christmas to all, many thanks for all your suggestions and support, and a special word of appreciation to Chartman for his immense contribution - this thread really has helped me improve my trading to the point where making a living from trading has become a realistic (albeit still highly ambitious) goal for 2005.

10:53 1) S) 10828. On triple ND looking ideally for a move back to 800. Starts moving well.

11:00 EXIT: +1. Moved stop to b/e +1 as neighbours arrived unexpectedly with pressies for the kids. Ah well, I think I need to accept that trading is over now at least until after Christmas and stop trying to stretch it out for one more trade.

It actually turned out to be a decent entry and did hit 800 but I doubt I ever would have held it that long.

+1 from 1

B/e for the day after commissions

+209 for December so far after commissions (15 days of trading)

A slightly lower month in terms of overall points and daily average, but still positive. I believe over caution due to increasing contract size, especially early in the month, had an impact. However, just wait 'til I finally hit them with some Big Kahuna trades in the New Year!

Merry Christmas to all, many thanks for all your suggestions and support, and a special word of appreciation to Chartman for his immense contribution - this thread really has helped me improve my trading to the point where making a living from trading has become a realistic (albeit still highly ambitious) goal for 2005.

Attachments

TraderTony said:Merry Christmas to all, many thanks for all your suggestions and support, and a special word of appreciation to Chartman for his immense contribution - this thread really has helped me improve my trading to the point where making a living from trading has become a realistic (albeit still highly ambitious) goal for 2005.

Thank-you very much for those kind words. It means a great deal to me to hear from others that have genuinely benefitted from my efforts. I wish you, and all others that hang in here, both visible and invisible, a seriously profitable new year.

Happy Xmas to you all.

Martin

Merry Xmas

I would also like to thank both Chartman and Trader Tony for their daily posts and commentary. Chartman's feedback and encouragement have been invaluable for me. And Tonys' regular posts have given me the inspiration I need to continue following my dream.

Thanks also to all the regular posters....Tradesmart, Bill, Justyn etc.....I enjoy reading your comments and I am grateful to you for sharing your thoughts etc on this forum. I hope 2005 is a very prosperous one for all of you.

Happy Xmas and Best Wishes for 2005 ......Debs

I would also like to thank both Chartman and Trader Tony for their daily posts and commentary. Chartman's feedback and encouragement have been invaluable for me. And Tonys' regular posts have given me the inspiration I need to continue following my dream.

Thanks also to all the regular posters....Tradesmart, Bill, Justyn etc.....I enjoy reading your comments and I am grateful to you for sharing your thoughts etc on this forum. I hope 2005 is a very prosperous one for all of you.

Happy Xmas and Best Wishes for 2005 ......Debs

tradesmart

Experienced member

- Messages

- 1,286

- Likes

- 22

Interesting looking back a while, to see that predictions/comments based on T/A have proved to be remarkably accurate – the ‘magic breakout’ proved to be just that. And the Dow target of 10850 based on the prior 600 channel has happened today……!

Nice to know that the T/A works and here’s thanks to CM for his daily tuition – I certainly didn’t know much about it before I started following Dow Intraday Charts, and the great thing is that you can apply the basic principles to Stocks/Commodities/Forex as well if you wish…..

Merry Christmas to one and all……...!.......... :cheesy:

(Christmas Card attached…..... 😉 )

Nice to know that the T/A works and here’s thanks to CM for his daily tuition – I certainly didn’t know much about it before I started following Dow Intraday Charts, and the great thing is that you can apply the basic principles to Stocks/Commodities/Forex as well if you wish…..

Merry Christmas to one and all……...!.......... :cheesy:

(Christmas Card attached…..... 😉 )