I've recently written about the popular strategies of Straddles and Strangles. For the most part, they were discussed from the long side, in other words, buying the Straddle or buying the Strangle. Obviously, there is another side to this story, and that is the short side, selling the Straddle or Strangle.

There were 2 main reasons why I emphasized the long side. The first has to do with the fact that brokerage companies don't just let everyone trade short naked options. Each company has their own set of rules and requirements regarding what they require to allow a customer to trade short options. Factors taken into account can include the customers' length of options trading experience, their income and net worth, and the size of their trading account. Some brokers require as much as $100,000 in an account before giving approval to trade naked shorts.

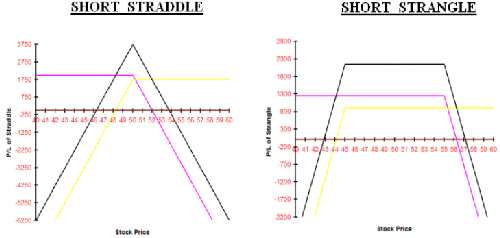

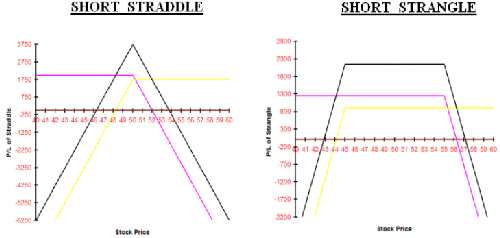

My second reason has to do with risk. Let's take a look at the graphs of the short Straddle and Strangle. What's the problem? Just look at the graphs and it's obvious. The problem is that if the stock moves too far, then we're faced with unlimited losses on the upside and huge losses on the downside. (The downside risk is somewhat mitigated by the fact that the stock cannot go below zero.)

So what do we do to reduce the amount of risk? There are at least 4 possibilities that we can examine.

What do we do for the short Strangle? No problem, we just buy a further out of the money Strangle. So, if the original position is short 10 XYZ July 45 Puts and 10 July 55 Calls, we can buy 10 each of the July 40 Puts and July 60 Calls. The resulting position is shown below and is called an "Iron Condor."

These are generic graphs. The horizontal red line represents the break even line. Above it indicates profits, and below it are losses.

There's a lot I want to tell you about these positions, but I'll put it all together in a comprehensive article that will cover the 3 different ways that Butterflies and Condors can be constructed, namely; Iron, Puts, and Calls.

There is one confusing aspect that I'll mention now. It should be obvious that both of these Iron positions are done for a credit, since the Strangle that's bought will be less expensive than either the Straddle or the Strangle that's sold. This might lead you to think of these as short positions since money is coming into your account. I've discussed this with many professionals, and the overall consensus is that these positions should be referred to as long positions, a long Iron Butterfly, and a long Iron Condor. In fact, after a recent discussion, the well known author of a new options book who referred to these as short positions has decided to change his terminology in the next edition. In truth, it really doesn't matter if you think of them as being long or short, but having a precise and consistent language will help eliminate mistakes and confusion when discussing these positions with brokers and other traders.

There were 2 main reasons why I emphasized the long side. The first has to do with the fact that brokerage companies don't just let everyone trade short naked options. Each company has their own set of rules and requirements regarding what they require to allow a customer to trade short options. Factors taken into account can include the customers' length of options trading experience, their income and net worth, and the size of their trading account. Some brokers require as much as $100,000 in an account before giving approval to trade naked shorts.

My second reason has to do with risk. Let's take a look at the graphs of the short Straddle and Strangle. What's the problem? Just look at the graphs and it's obvious. The problem is that if the stock moves too far, then we're faced with unlimited losses on the upside and huge losses on the downside. (The downside risk is somewhat mitigated by the fact that the stock cannot go below zero.)

So what do we do to reduce the amount of risk? There are at least 4 possibilities that we can examine.

- Don't trade them, no short Straddles or Strangles. That seems to me to be too drastic an approach. There are times when options are trading with very large premiums and it makes sense to capture them by selling. Of course there is risk, but we take risks all the time. Every time we cross the street or take a drive in the car we're taking a risk. The key is to make sure the risk is small in relationship to the size of the possible gain.

- The second way to mitigate our exposure to risk is to do smaller size. If your money management system allows you to risk $5,000 on a trade, then get out an options calculator and determine what you think the worst case scenario is. You might want to pad it a little bit to be more conservative, but then put on the trade. Be aware, that this is not the type of trade that you put on and walk away from, you should be watching the price movement of the stock and you should have your stops in place. Unless you're dealing with an extremely liquid option, I usually recommend mental stops based on the price of the stock, not the options.

- The next method is what most floor traders and professional traders do and that is keeping the position delta neutral. The truth is that trading a delta neutral position from the short side is tricky and very counter-intuitive. Since both the Puts and Calls are being sold the position has negative gamma (look at the bright side, positive theta.). That means that as the stock price is going up the position is losing deltas and becoming short, requiring you to buy deltas. On the other hand, as the stock price is going down, the short gamma puts you into a positive delta position and requires you to sell stock. Think about what's going on here, you're selling stock at the lows and buying stock at the highs. That's just the opposite of "buy low, sell high." Don't get me wrong, you can still make money delta neutral trading a short gamma position. Hopefully, the positive theta of the position will more than cover the cost of the adjustments, but it's not for the faint of heart. Believe me, been there, done that, still doing that!

For most public retail traders, the way to reduce the amount of risk is to buy insurance. How do we do this? In either case, the short Straddle or Strangle, we buy an out of the money Strangle. For example, if the Straddle we sold was the XYZ July 50 Puts and Calls, let's say 10 of each, then to protect the position against the stock moving against us, we can buy 10 each of the July 45 Puts and July 55 Calls, or depending on how much risk we are willing to absorb, the July 40 Puts and 60 Calls. Looking at the generic graph below you can see that there is now a maximum amount that can be lost and most traders will sleep better at night knowing that a large move in the stock may hurt, but it won't be catastrophic. Options traders, being such creative people, call this type of position an "Iron Butterfly." (Please, no need for the In-A-Gadda-Da-Vida jokes, I've heard them all.)

What do we do for the short Strangle? No problem, we just buy a further out of the money Strangle. So, if the original position is short 10 XYZ July 45 Puts and 10 July 55 Calls, we can buy 10 each of the July 40 Puts and July 60 Calls. The resulting position is shown below and is called an "Iron Condor."

These are generic graphs. The horizontal red line represents the break even line. Above it indicates profits, and below it are losses.

There's a lot I want to tell you about these positions, but I'll put it all together in a comprehensive article that will cover the 3 different ways that Butterflies and Condors can be constructed, namely; Iron, Puts, and Calls.

There is one confusing aspect that I'll mention now. It should be obvious that both of these Iron positions are done for a credit, since the Strangle that's bought will be less expensive than either the Straddle or the Strangle that's sold. This might lead you to think of these as short positions since money is coming into your account. I've discussed this with many professionals, and the overall consensus is that these positions should be referred to as long positions, a long Iron Butterfly, and a long Iron Condor. In fact, after a recent discussion, the well known author of a new options book who referred to these as short positions has decided to change his terminology in the next edition. In truth, it really doesn't matter if you think of them as being long or short, but having a precise and consistent language will help eliminate mistakes and confusion when discussing these positions with brokers and other traders.

Last edited by a moderator: