malaspina

Active member

- Messages

- 115

- Likes

- 1

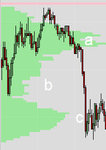

It´s all about VOLUME and his friend named “PRICE”.

Yes, that is a clear statement. The market move, yes it does, but it needs gas to move, where do you think that gas come from ?. Well, I can assure you is not coming from retail orders. When the market moves is because the BIG BOYS (Banks, Investment Houses and Big Broker Houses) are buying or selling in huge quantities. All that action creates big volume and you can see that volume very clear in your computer screen. Well, you need a trained eye to detect it, but once you have the practice, you can read the market volume as if you were reading the newspaper. Now, it is your skill as a trader that will help you to make money following the trend that is pushed by big institutional volume.

Please, I BEG YOU, do not be fooled by those GURUS who talk about using magical technical indicators, I have seen novice traders using like 10 indicators at the same time, IT IS CRAZY!!. Please follow my advice, do not do that. You have to keep your trading strategy as simple as possible. Price, Volume, and trend lines is all you need to trade any market.

If you want to learn how to trade and to make money, please follow the advice above, in time you will know that I am writing the truth here.

Until next time.

Yes, that is a clear statement. The market move, yes it does, but it needs gas to move, where do you think that gas come from ?. Well, I can assure you is not coming from retail orders. When the market moves is because the BIG BOYS (Banks, Investment Houses and Big Broker Houses) are buying or selling in huge quantities. All that action creates big volume and you can see that volume very clear in your computer screen. Well, you need a trained eye to detect it, but once you have the practice, you can read the market volume as if you were reading the newspaper. Now, it is your skill as a trader that will help you to make money following the trend that is pushed by big institutional volume.

Please, I BEG YOU, do not be fooled by those GURUS who talk about using magical technical indicators, I have seen novice traders using like 10 indicators at the same time, IT IS CRAZY!!. Please follow my advice, do not do that. You have to keep your trading strategy as simple as possible. Price, Volume, and trend lines is all you need to trade any market.

If you want to learn how to trade and to make money, please follow the advice above, in time you will know that I am writing the truth here.

Until next time.