Hi,

Here is a description of the underlying strategy of PUL.

Sorry for the delay, unfortunately my schedule is very busy.

I may add more detail later.

But feel free to ask questions, I would be happy to answer them, but maybe with a little delay.

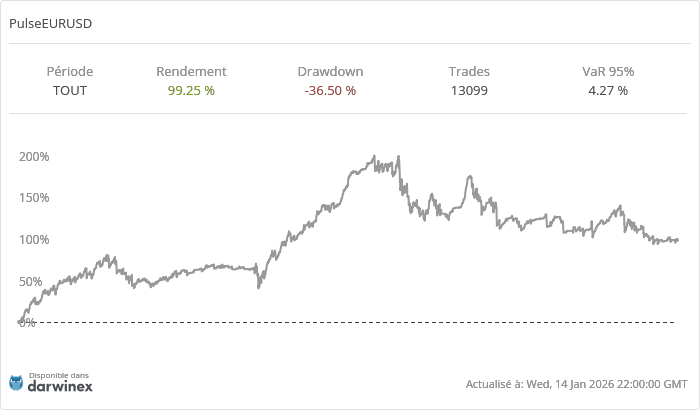

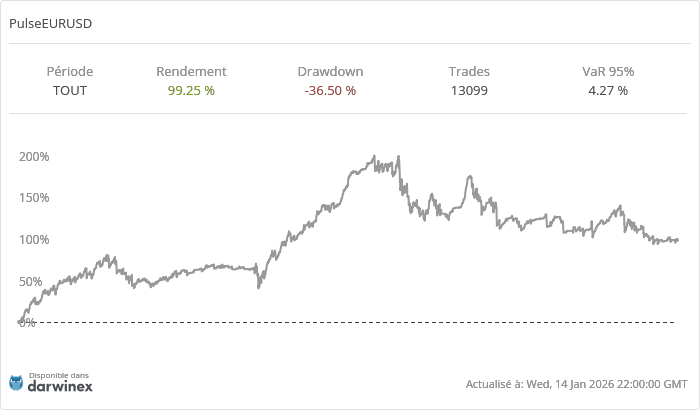

DARWIN NAME: PUL

UNDERLYING STRATEGY NAME : PulseEURUSD

Myfxbook

UNDERLYING STRATEGY NAME : PulseEURUSD

Myfxbook

Results of the underlying strategy are a little better in reality because Darwinex offers me 40% rebate on commissions.

As I generate a lot of commissions, this represents about 2 or 3% of additional return per year.

This is a big part of why the Darwin Equity Curve is a little different from that of the underlying strategy.

Since a 60% commission rebate is applied on Darwins.

STRATEGY :

Automated contrarian intraday strategy appllied on EURUSD.

BACKTESTS

FIXED SPREAD (DUKASCOPY TICK DATA) :

VARIABLE SPREAD + COMMISSIONS (DARWINEX TICK DATA) :

Backtest done with tick data suite (0.01 lots per trades).

I rely on the last 5 years to update this strategy, but I still check that their behavior is correct over a longer period.

This backtest corresponds to the stategy as it is now but the settings are adjusted at least once a year.

Usually I adjust the settings of all my strategies at the start of each year and also following an unusual drawdown.

For example, I adapted this strategy following the drawdown related to COVID-19.

MONEY AND RISK MANAGEMENT :

The indications below relate to the underlying strategy and not to Darwin.

I have no control over Darwin's risk management.

Most of the time, it is rather lower than that of the underlying strategy.

But as this strategy has an activity proportional to the volatility, it can happen that the risk of Darwin increases strongly in period of low volatility.

0.01 lots every 600 euros of equity.

Limited leverage : 6 trades maximum at the same time.

Stop-loss for each trade.

Maximum excursion per position : 10%.

The strategy no longer opens trade if the stop loss of the existing trades and the one to open could exceed this limit.

Maximum loss by sliding 24h : 10%

The expert advisor stops opening trades when this limit can be reached, so that even if all the trades in progress ended on stop-loss this limit can not be reached.

This does not mean that this strategy will steadily risk 10% in a day.

On the contrary, this protection is supposed to never be used, it serves as a fuse in case things turn worse than expected.

All trades are closed before week-end.

Beeks VPS and Personnal Server ready to take relay in case of VPS failure.

EXPECTATIONS (for the underlying strategy) :

- Average yearly profit aimed : 15%.

This is a rather pessimistic estimate which takes into account the backtests and also the difficulties that the strategy has encountered so far which have led to adaptation.

It is not a promise, just an indicative value.

- Maximum lifetime drawdown aimed : 30%

The lots size is defined according to the results of the backtest and forward test so that the drawdown never exceeded 15% until today.

But I rely on 30% to leave a margin of safety.

If the stategy exceeds the 15% drawdown, the size of the lots is gradually reduced in order to keep the target drawdown of 15%.

At this point, if I haven't already, I'm focusing my work on this strategy to try to figure out what's wrong.

But I didn't make any changes in a rush.

As the risk decreases as the drawdown increases, I can take my time to study the situation quietly.

If I could no longer adapt the strategy, and the expected return becomes too low compared to the drawdown, the strategy would be paused or replaced by another.

Before that, I'll let the investors know here as well as on the Darwin page so they can decide what to do.

ABOUT MY OTHER DARWINS

All my strategies are managed in a manner similar to PUL.

The target risk is still 30% drawdown, but other parameters vary.

Note that this was not always the case, some darwins which were then in development did not have serious money / risk management at certain times (this is the case for PUH for example).

It was a mistake to do this because it might give the impression that I could do the same on my other darwins.

But that won't happen again, even for my darwins in development.

For darwins containing more than one strategy, the management remains the same except that a fair share of the equity is attributed to each of them.

But in this case, the risk can then be increased depending on the diversification.

Have a nice day.