Ultima markets

Active member

- Messages

- 132

- Likes

- 0

Optimism about rate cuts boosted global stocks, with the market focused on US inflation data.

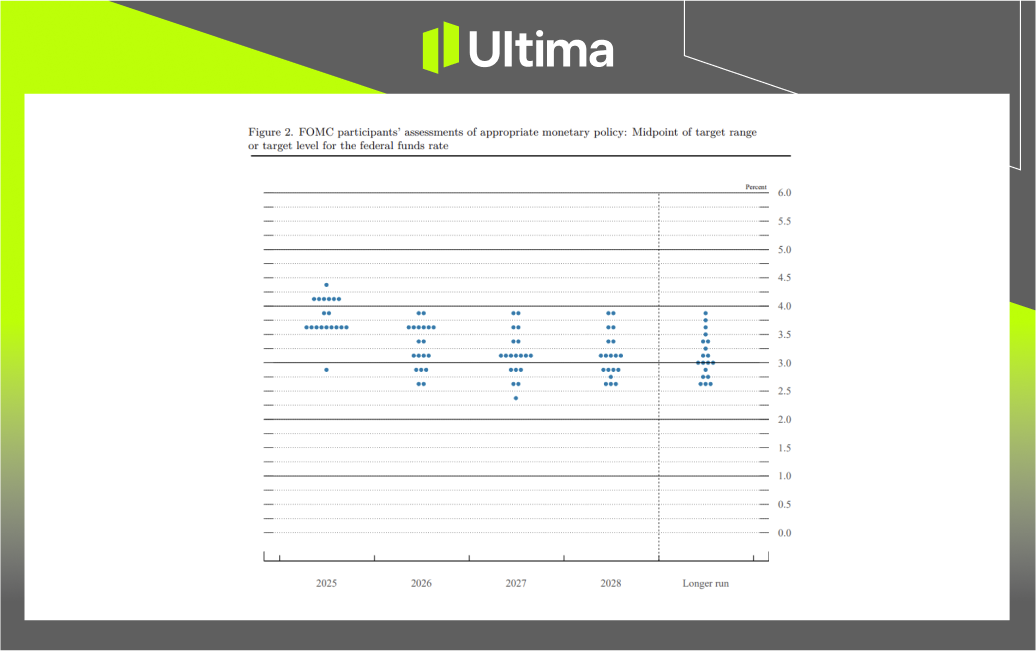

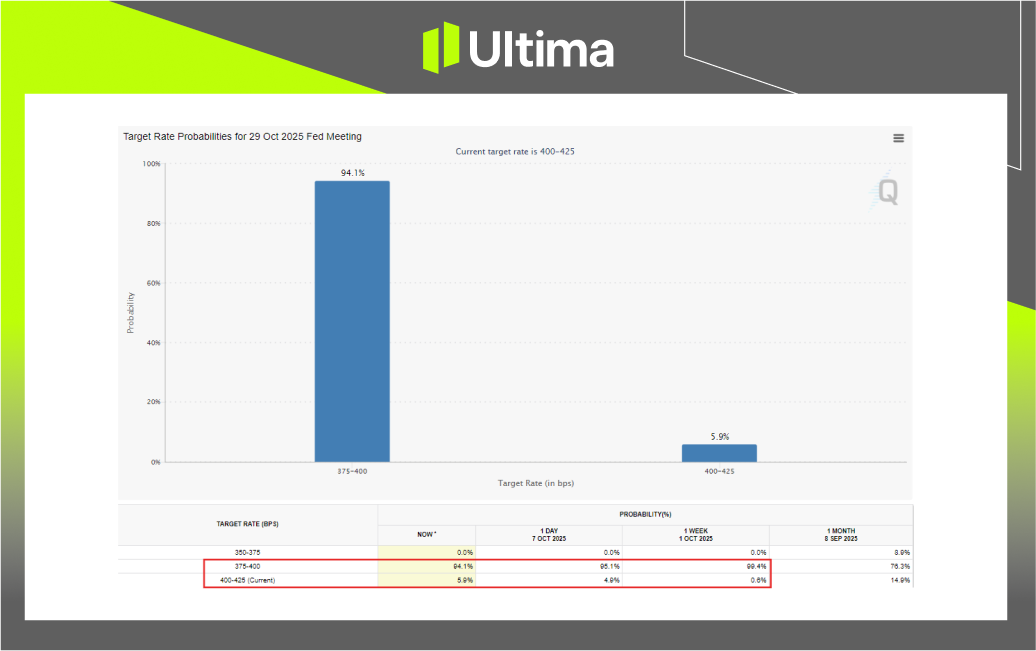

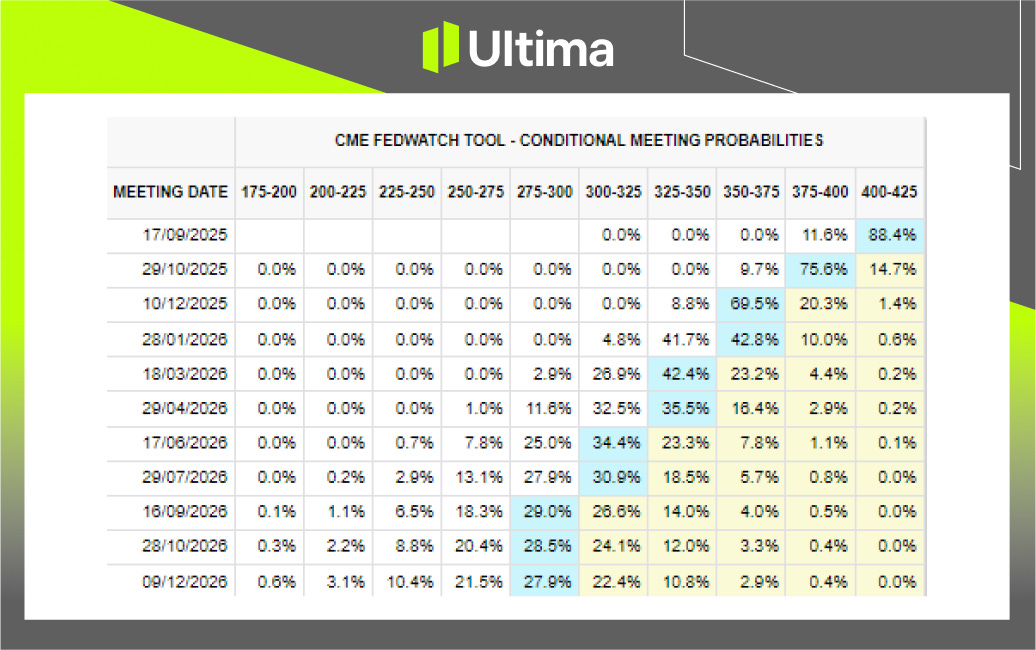

Global stock markets rallied on Monday, fueled by widespread expectations that the Federal Reserve (Fed) will restart its easing cycle in September. Japan's Nikkei 225 and the US Nasdaq both hit new highs. Further fueling the gains, the market is pricing in three interest rate cuts by 2025, according to the CME FedWatch tool. However, analysts at Ultima Markets caution that the market could quickly reprice after the first rate cut, shifting focus to the pace and depth of the easing cycle.

Chart: CME FedWatch Rate Cut Probability | Source: CME Group

Bond Markets, the US Dollar, and the Challenge of Inflation

Despite the Fed's easing policy outlook, the bond market continues to show concerns about fiscal issues. The divergence of U.S. Treasury yields from other major markets has provided some support to the U.S. dollar. Currently, 98.50 and 97.50 , and its recent movement suggests a possible downside breakout.Market attention now turns to this week's US inflation report, which will be the last major test before the Federal Open Market Committee (FOMC) meeting on September 16-17. A lower-than-expected Consumer Price Index (CPI) figure would reinforce market expectations for a deeper easing cycle. Conversely, if inflation remains stubbornly subdued, the Fed may need to act more cautiously.

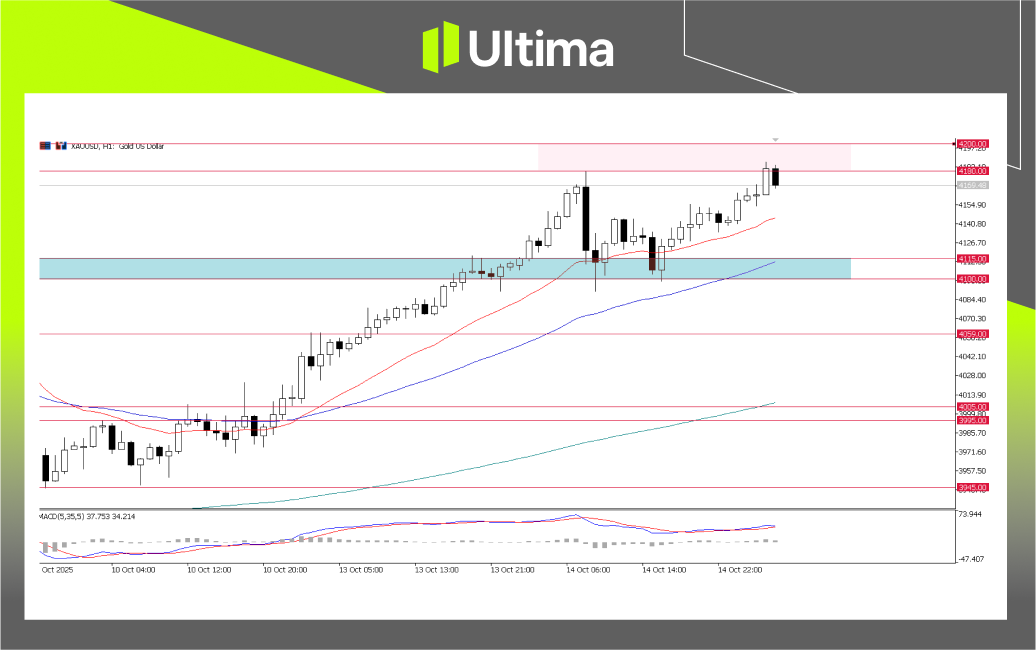

Chart: S&P 500 daily chart | Source: Ultima Markets MT5

S&P 500 Technical Analysis

The S&P 500's uptrend remains intact, but a rising wedge pattern has formed, which typically indicates that upward momentum is waning. This suggests that market sentiment may turn more cautious ahead of the inflation data release.Risk Warning : Trading leveraged derivatives involves a high level of risk and may result in capital loss.

Disclaimer : All commentary, news, research, analysis, prices, and other information contained herein is for general informational purposes only and is intended to assist readers in understanding market conditions. It does not constitute investment advice. Ultima Markets has taken reasonable steps to ensure the accuracy of this information, but cannot guarantee its absolute accuracy. Content is subject to change without notice. Ultima Markets assumes no liability for any loss or damage (including, without limitation, loss of profit) arising directly or indirectly from the use of or reliance on such information.