Ultima markets

Active member

- Messages

- 132

- Likes

- 0

Middle East Conflict Intensifies: Israel and Iran Exchange Blows, Global Equities Cautiously Higher, Oil Surges – What's Next?

Global equities opened broadly higher on Monday , despite rising geopolitical risks in the Middle East where tensions between Israel and Iran escalated further over the weekend. The situation worsened on Sunday, with both sides engaging in retaliatory attacks.Market Overview: Middle East Tensions and Market Reaction

On Friday, global equity markets slipped while oil prices surged sharply, following Israel’s large-scale strikes on Iran’s nuclear and military facilities. These latest exchanges reportedly resulted in civilian casualties and heightened fears of a wider regional conflict, as both militaries issued warnings to civilians on the opposing side to take safety precautions.Investors are increasingly concerned about potential disruptions in the Strait of Hormuz—a strategic shipping route that handles roughly 20% of the world’s total oil consumption. Any extended military confrontation in the region could significantly disrupt oil flows and further elevate energy prices.

Geopolitical Uncertainty Remains High

U.S. President Donald Trump said on Sunday that he hoped Israel and Iran could reach a ceasefire, but added that “sometimes countries have to fight it out first.” He reaffirmed U.S. support for Israel but declined to comment on whether he had urged Israel to halt its strikes. The Middle East conflict is expected to be a key topic at this week’s Group of Seven (G7) summit in Canada. German Chancellor Merz expressed hope that G7 leaders could reach a consensus on how to help de-escalate the situation. However, Iran has firmly stated that it will not engage in ceasefire negotiations while under active attack by Israel—adding further uncertainty to the geopolitical outlook.Oil prices rallied sharply on Friday, with Brent crude settling at $74.80 per barrel and WTI closing at $73.20. In intraday trading, WTI crude spiked over 14%, hitting its highest level since January, while Brent rose nearly 12% for the week.

Global Equities: Cautious Optimism Amid Rising Risks

Global equity markets faced broad selling pressure last Friday, leading to declines across major indices. However, despite escalating geopolitical tensions over the weekend, Asian markets opened higher on Monday, and futures in Europe and the U.S. also edged up. Still, investor sentiment remains fragile. With several key central bank decisions on the horizon and ongoing geopolitical uncertainty, market nerves could resurface quickly. Any sudden shift in risk appetite or policy tone may trigger renewed volatility across global markets.- Technical Outlook: S&P 500 As highlighted earlier, the S&P 500’s bullish momentum has started to wane. A rising wedge pattern had formed near the critical 6000 level—often a bearish reversal signal.

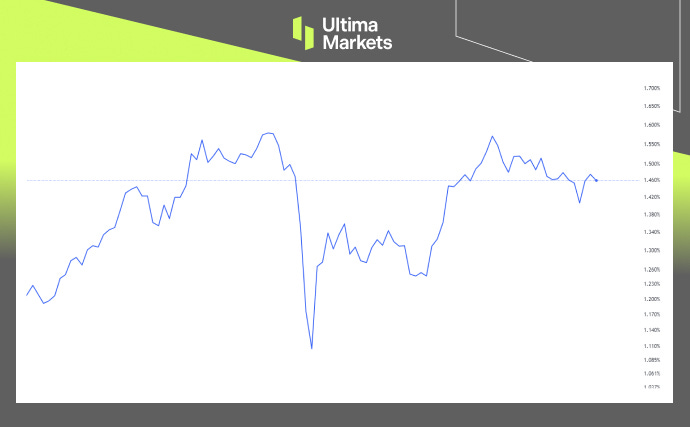

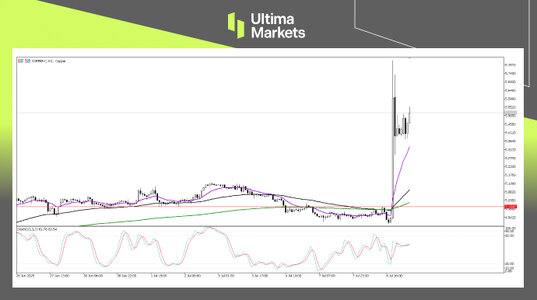

Image Source: SP500, Day-Chart Analysis | Source: Ultima Market MT5

The EU50 index has broken below a key ascending wedge structure, signaling a potential bearish reversal. The breakdown comes after multiple failed attempts to breach the upper resistance zone near 5430–5450, which aligns with the upper bound of the multi-month consolidation range.