There are literally hundreds of options strategies, many more if you include the vast array of complex strategy combinations. Why so many? Simple, it s because most options speculators can't figure out price direction. Instead, they rely on complex option strategies and a variety of standard pricing models that don t work and simply add illusion to a constant simple reality of all markets: supply (resistance) and demand (support).

When you filter out illusion and replace it with pure supply and demand analysis in options trading, you not only simplify the useless complexity of options, you discover endless low risk-high reward opportunity based on a set of objective rules. This opportunity is one in which the reality-based options speculator simply derives his or her profit from the illusion- or emotion-based options speculator.

An Observation

I have been trading and providing trading education for many years. One of the most important lessons I have learned is that most people can t follow simple rules. I can hand someone high- quality trading tools and a mechanical set of rules on a silver platter, but if the foundation of the trading belief system is faulty, he or she will not be able to follow or execute the simple rules. The problem is that the trader succumbs to illusion filters he or she doesn t even know are present. These illusions come in the form of lagging indicators and oscillators, market or economic news, so- called professional opinions, green and red candles on price charts, complex option strategies and so on. These types of market factors can trip up many novice traders in "the illusion trap."

Options traders who repeatedly fall for this trap make two consistent mistakes. First, they buy call options after a period of buying. Second, they buy calls at or near price levels where supply exceeds demand. Conversely, they sell put options after a period of selling and at or near price levels where demand exceeds supply. The simple laws of supply and demand ensure that the buyer and seller of anything who consistently takes this action will lose over time. To not only avoid this trap but also take advantage of it, a trader needs to make a simple shift in perception. Crossing this bridge of truth can lead to a monumental move in options trading performance.

The Proper Foundation

In my opinion, the two most important tenets for a proper foundation in trading anything are the following:

As long as these two tenets are the foundation of your trading belief system, you are likely headed down a path of objective information that offers consistent low risk-high reward opportunity. When the novice market speculator turns to conventional technical or fundamental analysis for price direction answers, he or she can get stuck in illusion traps that may add more layers of questions instead of providing answers.

Quantify Demand Objectively

When you focus on identifying objective supply and demand levels in the options market, you first have to analyze the underlying market. For example see Figure 1. Area A represents temporary price stability that gives the appearance of supply and demand equilibrium. Once the rally in price occurs (B), you know that area A was really a price level where supply and demand were out of balance. B can only happen because there is much more demand than supply at price level A. News and other market noise that accompanies price action does not offer the trader any additional insight beyond simple price. Therefore, if and when price revisits level A for the first time as seen in C, you can conclude that price is revisiting a level where demand greatly exceeds supply. In any market, when price reaches a level where demand greatly exceeds supply, prices rise.

[Image not available]

The Opportunity in Options at Demand

This is potent information for any options speculator. During the dramatic decline in price to demand C, three things are happening: 1) volatility is increasing; 2) calls are becoming cheap; and 3) puts are becoming expensive. The calls are cheapest and about to become expensive at the exact time rules tell you to buy calls, at the demand level C.

Quantify Supply Objectively

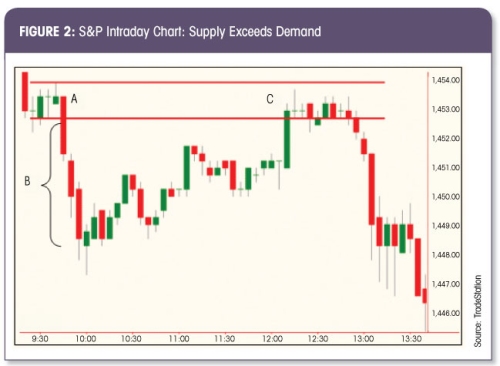

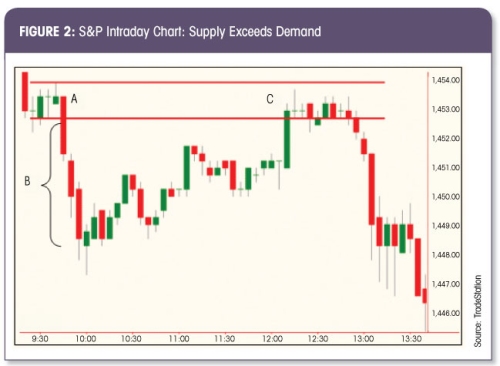

In Figure 2, area A again represents temporary price stability, which gives the appearance of supply and demand equilibrium. The price drop (B) tells you that area A was really a price level where supply greatly exceeded demand. B can only happen because of a supply and demand imbalance at price level A. Therefore, when price revisits level A for the first time at C, price is revisiting a level where supply greatly exceeds demand. In any market, when price is at a level where supply exceeds demand, prices decline. Notice in this example, the initial decline (B) is dramatic. This tells you that there is a great imbalance at A, which means you would expect a similar decline at C.

The Opportunity in Options at Supply

During the dramatic rally in price to supply C, three things are happening: 1) volatility is increasing; 2) calls are becoming expensive; and 3) puts are becoming cheap. The puts are cheapest and about to become expensive at the exact time rules tell you to buy puts at the supply level C.

If you were interested in selling (writing) options and taking advantage of inflated premium, you would be selling overpriced calls at supply level C. As the price advances to that supply level, the call premium just above and at the supply level is highly expensive and volatility is sky high but that is all about to change. Why? Objective supply and demand analysis tells traders that price is reaching an area where supply exceeds demand. While most are scurrying to buy calls after an advance in price and at a level where supply exceeds demand, the low risk-high reward anticipatory analysis would have you selling calls to them, at or near the supply level C.

The Illusion Trap

Let s take a look at a market example. On March 26, 2007, Walgreen's announced earnings before the open of trading and, as you can see in Figure 3, its earnings were better than expected. Price gapped higher on the earnings report seen at C. Just prior to this, price had been in a steady uptrend with upward sloping moving averages, seen at B. Volume during this period of rising prices was strong, suggesting that a sustainable uptrend was underway. All these factors are positive and invite the masses to buy Walgreen s stock and also buy the call options on the stock.

Is this the correct action to take? Well, this depends on whether your point of view is objective or clouded by illusion. The bullish factors just mentioned that invited people to buy the large gap up (C), fell for the illusion trap and ignored a reality that had been staring them in the face all along. C was a gap up in price into an objective supply level at A. At C, Walgreen s call premium is extremely high and about to become cheap. Put premium at C is cheap and about to become expensive. It is at C that the illusion-based options speculator buys calls and sells puts. The reality- based options speculator sells calls at C and buys puts. The key is to keep everything simple and objective. When price reaches an objective supply level, it must decline. Knowing this in advance for the options speculator offers a tremendous edge. The goal is not only to avoid the illusion trap for which so many options speculators fall. But just as important, you can take advantage of it and get paid considerably from those who do.

Time Decay

The issue of time decay tends to be a never- ending battle for the options buyer. Objective supply and demand analysis should be the options trader s first and most important decision-making tool, not subjective and flawed conventional options pricing models, especially when it comes to time decay. The way you quantify potential profit margin in market speculation is no different than how a corporation quantifies profit margins. The distance from a demand level to a supply level is the objective profit margin. Measuring potential profit margin objectively allows one to truly take advantage of option premium and to properly assess time decay.

Let the Trap Pay You

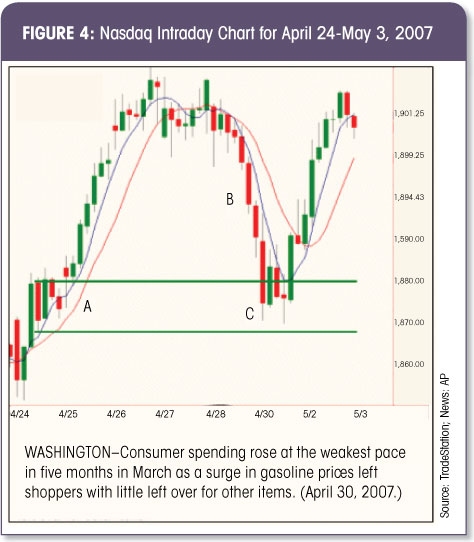

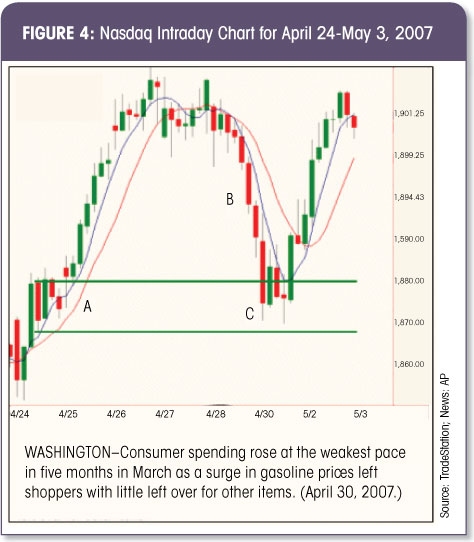

In Figure 4, you can see a weak premarket consumer spending index (CPI) number, ugly red candles and down-sloping moving averages that invite the illusion-based crowd to sell the Nasdaq futures. Nasdaq put options are being accumulated fast and furiously during the decline (B), and calls are being sold at nearly the same pace. At C, the astute trader knows that no matter what the news and lagging indicators suggest, price has reached a level where demand greatly exceeds supply (A). This novice action allows the astute options speculator to buy calls cheap and buy them just before they become expensive at or near C.

The Keys: Discipline and Rules

Objective rules are important. However, discipline to follow through and implement the rules is a necessary ingredient for trading success. To recap the key element's:

The Rules

Create a Path for Others to Follow

Instead of using conventional trend analysis to identify that a trend is well underway, use objective supply and demand analysis to anticipate the next trend. Rather than noticing high volatility after it is already high, use simple supply and demand analysis to anticipate when volatility is likely to increase. The key to any type of trading, especially options, is to take action just before everyone else does. Never forget, the only way you can derive a profit trading anything is if others are willing to pay more than you paid. Therefore, the key to low risk- high reward trading is to be first in line, at the right time.

It's Not Easy

The greatest flaw of the human mind is that it poses the ability to deceive itself through two filters: one is illusion and the other is emotion. In the options markets, identifying traders who take action based on illusion and emotion is simple if your analysis is reality based. Knowing where demand (support) and supply (resistance) levels are is the key to predicting future price movement. Predicting future price movement in underlying markets offers the options trader a tremendous edge.

When you filter out illusion and replace it with pure supply and demand analysis in options trading, you not only simplify the useless complexity of options, you discover endless low risk-high reward opportunity based on a set of objective rules. This opportunity is one in which the reality-based options speculator simply derives his or her profit from the illusion- or emotion-based options speculator.

An Observation

I have been trading and providing trading education for many years. One of the most important lessons I have learned is that most people can t follow simple rules. I can hand someone high- quality trading tools and a mechanical set of rules on a silver platter, but if the foundation of the trading belief system is faulty, he or she will not be able to follow or execute the simple rules. The problem is that the trader succumbs to illusion filters he or she doesn t even know are present. These illusions come in the form of lagging indicators and oscillators, market or economic news, so- called professional opinions, green and red candles on price charts, complex option strategies and so on. These types of market factors can trip up many novice traders in "the illusion trap."

Options traders who repeatedly fall for this trap make two consistent mistakes. First, they buy call options after a period of buying. Second, they buy calls at or near price levels where supply exceeds demand. Conversely, they sell put options after a period of selling and at or near price levels where demand exceeds supply. The simple laws of supply and demand ensure that the buyer and seller of anything who consistently takes this action will lose over time. To not only avoid this trap but also take advantage of it, a trader needs to make a simple shift in perception. Crossing this bridge of truth can lead to a monumental move in options trading performance.

The Proper Foundation

In my opinion, the two most important tenets for a proper foundation in trading anything are the following:

- The movement of price in any and all free markets is a function of an ongoing supply and demand equation. Opportunity exists when this simple and straightforward relationship is out of balance. In other words, you want to enter a position in a market when price is at a level where supply and demand are out of balance and exit that market when price has moved back to a level where supply and demand are in equilibrium.

- Any and all influences on price are reflected in price. In other words, price charts alone give all the information you need.

As long as these two tenets are the foundation of your trading belief system, you are likely headed down a path of objective information that offers consistent low risk-high reward opportunity. When the novice market speculator turns to conventional technical or fundamental analysis for price direction answers, he or she can get stuck in illusion traps that may add more layers of questions instead of providing answers.

Quantify Demand Objectively

When you focus on identifying objective supply and demand levels in the options market, you first have to analyze the underlying market. For example see Figure 1. Area A represents temporary price stability that gives the appearance of supply and demand equilibrium. Once the rally in price occurs (B), you know that area A was really a price level where supply and demand were out of balance. B can only happen because there is much more demand than supply at price level A. News and other market noise that accompanies price action does not offer the trader any additional insight beyond simple price. Therefore, if and when price revisits level A for the first time as seen in C, you can conclude that price is revisiting a level where demand greatly exceeds supply. In any market, when price reaches a level where demand greatly exceeds supply, prices rise.

[Image not available]

The Opportunity in Options at Demand

This is potent information for any options speculator. During the dramatic decline in price to demand C, three things are happening: 1) volatility is increasing; 2) calls are becoming cheap; and 3) puts are becoming expensive. The calls are cheapest and about to become expensive at the exact time rules tell you to buy calls, at the demand level C.

Quantify Supply Objectively

In Figure 2, area A again represents temporary price stability, which gives the appearance of supply and demand equilibrium. The price drop (B) tells you that area A was really a price level where supply greatly exceeded demand. B can only happen because of a supply and demand imbalance at price level A. Therefore, when price revisits level A for the first time at C, price is revisiting a level where supply greatly exceeds demand. In any market, when price is at a level where supply exceeds demand, prices decline. Notice in this example, the initial decline (B) is dramatic. This tells you that there is a great imbalance at A, which means you would expect a similar decline at C.

The Opportunity in Options at Supply

During the dramatic rally in price to supply C, three things are happening: 1) volatility is increasing; 2) calls are becoming expensive; and 3) puts are becoming cheap. The puts are cheapest and about to become expensive at the exact time rules tell you to buy puts at the supply level C.

If you were interested in selling (writing) options and taking advantage of inflated premium, you would be selling overpriced calls at supply level C. As the price advances to that supply level, the call premium just above and at the supply level is highly expensive and volatility is sky high but that is all about to change. Why? Objective supply and demand analysis tells traders that price is reaching an area where supply exceeds demand. While most are scurrying to buy calls after an advance in price and at a level where supply exceeds demand, the low risk-high reward anticipatory analysis would have you selling calls to them, at or near the supply level C.

The Illusion Trap

Let s take a look at a market example. On March 26, 2007, Walgreen's announced earnings before the open of trading and, as you can see in Figure 3, its earnings were better than expected. Price gapped higher on the earnings report seen at C. Just prior to this, price had been in a steady uptrend with upward sloping moving averages, seen at B. Volume during this period of rising prices was strong, suggesting that a sustainable uptrend was underway. All these factors are positive and invite the masses to buy Walgreen s stock and also buy the call options on the stock.

Is this the correct action to take? Well, this depends on whether your point of view is objective or clouded by illusion. The bullish factors just mentioned that invited people to buy the large gap up (C), fell for the illusion trap and ignored a reality that had been staring them in the face all along. C was a gap up in price into an objective supply level at A. At C, Walgreen s call premium is extremely high and about to become cheap. Put premium at C is cheap and about to become expensive. It is at C that the illusion-based options speculator buys calls and sells puts. The reality- based options speculator sells calls at C and buys puts. The key is to keep everything simple and objective. When price reaches an objective supply level, it must decline. Knowing this in advance for the options speculator offers a tremendous edge. The goal is not only to avoid the illusion trap for which so many options speculators fall. But just as important, you can take advantage of it and get paid considerably from those who do.

Time Decay

The issue of time decay tends to be a never- ending battle for the options buyer. Objective supply and demand analysis should be the options trader s first and most important decision-making tool, not subjective and flawed conventional options pricing models, especially when it comes to time decay. The way you quantify potential profit margin in market speculation is no different than how a corporation quantifies profit margins. The distance from a demand level to a supply level is the objective profit margin. Measuring potential profit margin objectively allows one to truly take advantage of option premium and to properly assess time decay.

Let the Trap Pay You

In Figure 4, you can see a weak premarket consumer spending index (CPI) number, ugly red candles and down-sloping moving averages that invite the illusion-based crowd to sell the Nasdaq futures. Nasdaq put options are being accumulated fast and furiously during the decline (B), and calls are being sold at nearly the same pace. At C, the astute trader knows that no matter what the news and lagging indicators suggest, price has reached a level where demand greatly exceeds supply (A). This novice action allows the astute options speculator to buy calls cheap and buy them just before they become expensive at or near C.

The Keys: Discipline and Rules

Objective rules are important. However, discipline to follow through and implement the rules is a necessary ingredient for trading success. To recap the key element's:

- As price nears demand (support): 1) Calls become cheap but are about to become pricey; and 2) puts become pricey but are about to become cheap.

- As price nears supply (resistance): 1) calls become pricey but are about to become cheap; and 2) puts become cheap but are about to become pricey.

The Rules

- Identify the nearest demand level below current price that has not seen price revisit the demand level even once.

- Identify the nearest supply level above current price that has not seen price revisit the supply level even once.

- Measure the distance between the demand and supply level and determine whether there is a desirable profit margin.

- If and when price revisits a demand level for the first time, the options buyer can look to buy at- or in-the-money calls. The options seller can look to sell (write) overpriced puts with a strike just below the demand level and take advantage of inflated put premium.

- If and when price revisits a supply level for the first time, the options buyer can look to buy at- or in-the-money puts. The options seller can look to sell (write)overpriced calls with a strike just above the supply level and take advantage of inflated call premium.

Create a Path for Others to Follow

Instead of using conventional trend analysis to identify that a trend is well underway, use objective supply and demand analysis to anticipate the next trend. Rather than noticing high volatility after it is already high, use simple supply and demand analysis to anticipate when volatility is likely to increase. The key to any type of trading, especially options, is to take action just before everyone else does. Never forget, the only way you can derive a profit trading anything is if others are willing to pay more than you paid. Therefore, the key to low risk- high reward trading is to be first in line, at the right time.

It's Not Easy

The greatest flaw of the human mind is that it poses the ability to deceive itself through two filters: one is illusion and the other is emotion. In the options markets, identifying traders who take action based on illusion and emotion is simple if your analysis is reality based. Knowing where demand (support) and supply (resistance) levels are is the key to predicting future price movement. Predicting future price movement in underlying markets offers the options trader a tremendous edge.

Last edited by a moderator: