You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Here is the chart, those who count on the gold should now also buy Asian currency.

Hi E

why should we do that ?...........and what asian currencies ?

couldnt we perhaps buy Gold and sell the asian indices to trade the potential convergence ?

you need to factor in the US dollar index risk as well though..........

and in truth this is not my bag but thanks for sharing !

N

no worries ..........

i'm not sure Hamish even would describe himself as "flying"......though his origins do hail from the North ? 😛

N

This is just a flying visit! I am looking at Basket-trading (14 pairs) and using the FX-Correlator (many thanks to NVP as always) to watch the relative strength/weakness of JPY and USD to improve my guesswork on going Long All or Short All.

IOW, always observe the mantra: "Trade what you see!" with an added dose of patience.

Anyone else here with the same strategy?

Trade canny,

Hamish.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

This is just a flying visit! I am looking at Basket-trading (14 pairs) and using the FX-Correlator (many thanks to NVP as always) to watch the relative strength/weakness of JPY and USD to improve my guesswork on going Long All or Short All.

IOW, always observe the mantra: "Trade what you see!" with an added dose of patience.

Anyone else here with the same strategy?

Trade canny,

Hamish.

now that sounds real interesting H 👍

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Everything was just written…

Hi E

please explain to us what you are doing regarding trading these patterns ..........you have to remember many many visitors are new to these ideas and strategies 😎

N

mark brown

Junior member

- Messages

- 13

- Likes

- 0

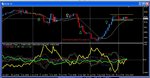

i have been studying the emini sp with the eurusd and created a spread between the two which is depicted in the lower graph. the green vertical bar would indicate a buy of the eurusd and a sell or the emini sp and vise versa. it pretty much performs the same way no matter the time based chart. mark

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

morning all

Well the Dow is like a roller coaster at the moment ...and with it on full tilt rise yesterday afternoon I hope you all went to the Yen sells (and even USD was below the Zero) ........lovely buys on the Aussie Twins 👍👍

I was unable to do much yesterday and was pretty angry that I missed the fun

Busy again today ......GRRRR

N

Well the Dow is like a roller coaster at the moment ...and with it on full tilt rise yesterday afternoon I hope you all went to the Yen sells (and even USD was below the Zero) ........lovely buys on the Aussie Twins 👍👍

I was unable to do much yesterday and was pretty angry that I missed the fun

Busy again today ......GRRRR

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hey all

get any questions in today / tomorrow as i'm then in Boston for a week and my chances of doing any trading or getting to my screens are Zero........

I'm catching up with my boss and a few other cronies along the way ........a few beers may be needed naturally and a lot cheaper than my usual stomping ground in switzerland I hope .......

Good hunting today all.....

N

get any questions in today / tomorrow as i'm then in Boston for a week and my chances of doing any trading or getting to my screens are Zero........

I'm catching up with my boss and a few other cronies along the way ........a few beers may be needed naturally and a lot cheaper than my usual stomping ground in switzerland I hope .......

Good hunting today all.....

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hey all

I noticed that we hit top spot in T2W forex rankings a while back now ..........thanks again for everyones support and belief in our approach here.....😛arty:

and to newbies ...........why not take a look at the free strategies below in the signature area ?....sure it takes a bit of thinking about and can be a bit of a learning curve .......but perhaps you might like them ? 😎

N

I noticed that we hit top spot in T2W forex rankings a while back now ..........thanks again for everyones support and belief in our approach here.....😛arty:

and to newbies ...........why not take a look at the free strategies below in the signature area ?....sure it takes a bit of thinking about and can be a bit of a learning curve .......but perhaps you might like them ? 😎

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Well I did kinda hint this earlier in the week ?......

http://www.trade2win.com/boards/for...-basic-ideas-strategies-1431.html#post2145416

N

http://www.trade2win.com/boards/for...-basic-ideas-strategies-1431.html#post2145416

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

mornin all

heres the week .....Yen took nearly 5% off of USD and CAD as it stayed predominently above the Zero

nice day yesterday as well if you followed the yellow one alongside Dows declines

the middle chart is a weekly 1 ma Xmen ........shows who did what this week

I use X-men charts a lot in my private trading .......it has more clarity than lines when the fur is flying ......:smart:

N

heres the week .....Yen took nearly 5% off of USD and CAD as it stayed predominently above the Zero

nice day yesterday as well if you followed the yellow one alongside Dows declines

the middle chart is a weekly 1 ma Xmen ........shows who did what this week

I use X-men charts a lot in my private trading .......it has more clarity than lines when the fur is flying ......:smart:

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hey all......

can I ask a favour to all contributers here please ?

as you know I am always very grateful for people adding comments and presenting their own correlation and Strengthmeter ideas here alongside any other market insights and gossip

but can I ask for presenters to add some depth and clarity to anything that is posted please ?

presenters need to remember we have a broad spectrum of viewers here and we do need explanations to help get their points across.......

still waiting on 2 posts I have mentioned recently so let us see where you are coming from guys ......

cheers

N

can I ask a favour to all contributers here please ?

as you know I am always very grateful for people adding comments and presenting their own correlation and Strengthmeter ideas here alongside any other market insights and gossip

but can I ask for presenters to add some depth and clarity to anything that is posted please ?

presenters need to remember we have a broad spectrum of viewers here and we do need explanations to help get their points across.......

still waiting on 2 posts I have mentioned recently so let us see where you are coming from guys ......

cheers

N

superstunner

Junior member

- Messages

- 45

- Likes

- 0

Hey NVP, I would guess the last support for USD/JPY is the wk low 93.75...

Then down it goes if it fail to hold. Would it break on Mon? I guess I might be cutting loss on Mon.

Then down it goes if it fail to hold. Would it break on Mon? I guess I might be cutting loss on Mon.

mark brown

Junior member

- Messages

- 13

- Likes

- 0

this strategy is nothing more than the close to close difference of two instruments used as price input for a typical channel breakout. the top market dominates the signals and you automatically do the opposite direction trade with the lower instrument your trading.

it is always in the market long or short and it catches all the big moves while maintaining small losses on trades that don't work so well. because it is in the market all time it is free to trade without any money managment what-so-ever as i have found that is the most profitable way to trade it.

typical of any trend following method it loses more trades than it wins however the winners are substantial and more than cover the cost of the losses.

thank you for looking

it is always in the market long or short and it catches all the big moves while maintaining small losses on trades that don't work so well. because it is in the market all time it is free to trade without any money managment what-so-ever as i have found that is the most profitable way to trade it.

typical of any trend following method it loses more trades than it wins however the winners are substantial and more than cover the cost of the losses.

thank you for looking

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hey NVP, I would guess the last support for USD/JPY is the wk low 93.75...

Then down it goes if it fail to hold. Would it break on Mon? I guess I might be cutting loss on Mon.

Hey S

I dont pay attention to pair prices that much........I follow the dynamics of Currency strengths ............to me price is pretty irrelevent as it will do what it does........jees ive done it now .......another rule broken :whistling

N

Similar threads

- Replies

- 0

- Views

- 3K