You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

complex day .............thats why we always need to keep it simple

I didnt and tried for a E/G play...........would have been b/e or small loss......

Shame that Dow didnt really come down ......and the GBP buy was a killer move and unexpected ....

N

If we were trading the strict 4Hr bias chart we would be hunting SELL's on the USD and Yen (off a rising Dow) on the middle chart 15m TF..so actually pretty much no trades to day so far ........as the Dow is falling and we just cannot get the Yen and USD below that Zero together !

I didnt and tried for a E/G play...........would have been b/e or small loss......

Shame that Dow didnt really come down ......and the GBP buy was a killer move and unexpected ....

N

If we were trading the strict 4Hr bias chart we would be hunting SELL's on the USD and Yen (off a rising Dow) on the middle chart 15m TF..so actually pretty much no trades to day so far ........as the Dow is falling and we just cannot get the Yen and USD below that Zero together !

Attachments

Last edited:

jusiur

Junior member

- Messages

- 13

- Likes

- 1

Hi J

ok use a 20ma delta . . .

ok thanks for your reply. I have another question

when you read fxcorrelator, do you "only" are concerned about the order of strength vs. weakness and/or also influences the angle of the lines or dot level?

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

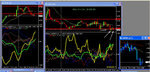

mornin all.......

If we follow the new mandate from me of using the (left chart) 4hr TF 20/3 setting as the rules for trading lower TF's then the Yen has become the No1 buy trade at the moment against everything and USD can only be bought against euro and CHF (until further changes occur)

you can see we have a change of guard following that extended YEN sellfest over last week or 2 !

and Dow is softening a little to help things ...........unless BOJ steps in with more QE selling we should have a decent result buying Yen this week (and of course the USD)

USD has been very strong recently...on the 15m chart see how it is more happy to go with Yen 0n the rises above the Zero line than the falls ..........interesting and great news !

anyway I would look for USD and YEN buy opportuities today on the lower TF's ...alongside a falling Dow naturally

on the right 15m TF chart you can see a very tight band formed on the Dow so hopefully start buying yen and USD (if/when) it breaks out further south today below 12850.....

good hunting

N

If we follow the new mandate from me of using the (left chart) 4hr TF 20/3 setting as the rules for trading lower TF's then the Yen has become the No1 buy trade at the moment against everything and USD can only be bought against euro and CHF (until further changes occur)

you can see we have a change of guard following that extended YEN sellfest over last week or 2 !

and Dow is softening a little to help things ...........unless BOJ steps in with more QE selling we should have a decent result buying Yen this week (and of course the USD)

USD has been very strong recently...on the 15m chart see how it is more happy to go with Yen 0n the rises above the Zero line than the falls ..........interesting and great news !

anyway I would look for USD and YEN buy opportuities today on the lower TF's ...alongside a falling Dow naturally

on the right 15m TF chart you can see a very tight band formed on the Dow so hopefully start buying yen and USD (if/when) it breaks out further south today below 12850.....

good hunting

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

👍

Hi J

Excellent question - one of the best I have received over the years 👍

I am concerned about Everything I see on my FXCorrelator Screens.........I just dont go into much detail here about them 😉

seriously though - My FXCorrelator systems and strategies I use personally encompass constant examination and determining patterns/signals from these factors :-

PATTERNS by observing :-

Power (strength of each currency)

Position (of each currency relative to others)

Partnerships (of Currencies - groups,pairs....or non partnerships)

Polarity (of currencies +/- ....who is above or below the MA Zero)

Period(s) (TF and MA , TF/MA combos & multiples relationships)

Perspective (G8 relationship to other markets - Equities/Gold/Bonds/Commodities)

Politics (Global Market news , Events)

one day I will get around to publishing my thoughts/observations on all of this or perhaps teach a little again ..but no time at the moment...................

strengthmeters are incredibly underated indicators in the Trading world .........Imagine what the Quants do with this kind of stuff day in day out .........mindblowing ! 😉

N

ok thanks for your reply. I have another question

when you read fxcorrelator, do you "only" are concerned about the order of strength vs. weakness and/or also influences the angle of the lines or dot level?

Hi J

Excellent question - one of the best I have received over the years 👍

I am concerned about Everything I see on my FXCorrelator Screens.........I just dont go into much detail here about them 😉

seriously though - My FXCorrelator systems and strategies I use personally encompass constant examination and determining patterns/signals from these factors :-

PATTERNS by observing :-

Power (strength of each currency)

Position (of each currency relative to others)

Partnerships (of Currencies - groups,pairs....or non partnerships)

Polarity (of currencies +/- ....who is above or below the MA Zero)

Period(s) (TF and MA , TF/MA combos & multiples relationships)

Perspective (G8 relationship to other markets - Equities/Gold/Bonds/Commodities)

Politics (Global Market news , Events)

one day I will get around to publishing my thoughts/observations on all of this or perhaps teach a little again ..but no time at the moment...................

strengthmeters are incredibly underated indicators in the Trading world .........Imagine what the Quants do with this kind of stuff day in day out .........mindblowing ! 😉

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

so for example my simple 20ma system I use here encompasses a pattern from the following 4 elements.......the rest are not in fact relevent to my core signal...........

Partnerships (Yen and USD together)

Polarity ( both +ve or -ve to Zero)

Period (1 TF and 20MA/Delta 1)

Perspective (must be inverse position to Dows position vs its 20ma)

I have hundreds more in use and under test and (unfortunately) more complex than this simple pattern......this is probably one of the simplest I have discovered over the years and why it was a great intro to show people on this Thread ...........

N

Partnerships (Yen and USD together)

Polarity ( both +ve or -ve to Zero)

Period (1 TF and 20MA/Delta 1)

Perspective (must be inverse position to Dows position vs its 20ma)

I have hundreds more in use and under test and (unfortunately) more complex than this simple pattern......this is probably one of the simplest I have discovered over the years and why it was a great intro to show people on this Thread ...........

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

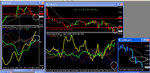

well we are at the 12850's on dow futures .........

Not convinced we have more in the tank for GBP and Euro sells at the moment and USD and Yen look a little overcooked on that middle 15m TF dont they ?

perhaps a retrace and then the big move will come ?

or will the Dow bounce ?

hmmmmmmmmm

N

Not convinced we have more in the tank for GBP and Euro sells at the moment and USD and Yen look a little overcooked on that middle 15m TF dont they ?

perhaps a retrace and then the big move will come ?

or will the Dow bounce ?

hmmmmmmmmm

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Nope - looks like we are full steam ahead here .......👍

expect a retrace at some point though on the 15m TF.....those are releatively big divergences now on the 15m TF for GBP and EUR (south) and indeed Yen and USD (north)........

also notice on the left chart (4hr TF 20ma/delta3) the USD is now 2nd strongest so we really have a big move on......and this signal allows us the confidence to sell any other currency against them on the lower TF's .......thats a long time since 9th november when we had this confidence signal last before !

N

expect a retrace at some point though on the 15m TF.....those are releatively big divergences now on the 15m TF for GBP and EUR (south) and indeed Yen and USD (north)........

also notice on the left chart (4hr TF 20ma/delta3) the USD is now 2nd strongest so we really have a big move on......and this signal allows us the confidence to sell any other currency against them on the lower TF's .......thats a long time since 9th november when we had this confidence signal last before !

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

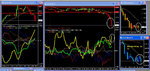

hmmmmm

I hate it when a plan doesnt come together.........

look at the falling Dow.......but the USD is not responding like the Yen is

So as I am continuing to mention this week the Yen buys are the better peaches to eat on these falling Dow plays......but beware the timezones when the BoJ are active and can QE/sell their precious currency

N

I hate it when a plan doesnt come together.........

look at the falling Dow.......but the USD is not responding like the Yen is

So as I am continuing to mention this week the Yen buys are the better peaches to eat on these falling Dow plays......but beware the timezones when the BoJ are active and can QE/sell their precious currency

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

morning all..........

well the 15m TF on a standard 20/1 setting has given some superb signals overnight and this morning

(right chart)

look at the dow pull back up above its 20 sma , and send the Yen and USD into the Negative......euro was the more frequent buy currency on the reduced selection I show here (I have removed CAD and NZD and CHF to simplify the chart).....

HOWEVER !!!

if you follow a 2 TF system and adopt the bias of a higher TF.....like the 20/3 setting on the 4hr on the left chart you would not be trading this as the Yen and USD were still strong and indicating Buys until more recent notice

this is the conundrum of following 2 tier systems ..........the trend is your friend.......but sometimes its not and you sit on your hands missing moves on the retraces

but then again that system is not losing you money on actual trades .....just missing opportunities to trade .........:smart:

hmmmmmmm...nothings perfect 😉

N

well the 15m TF on a standard 20/1 setting has given some superb signals overnight and this morning

(right chart)

look at the dow pull back up above its 20 sma , and send the Yen and USD into the Negative......euro was the more frequent buy currency on the reduced selection I show here (I have removed CAD and NZD and CHF to simplify the chart).....

HOWEVER !!!

if you follow a 2 TF system and adopt the bias of a higher TF.....like the 20/3 setting on the 4hr on the left chart you would not be trading this as the Yen and USD were still strong and indicating Buys until more recent notice

this is the conundrum of following 2 tier systems ..........the trend is your friend.......but sometimes its not and you sit on your hands missing moves on the retraces

but then again that system is not losing you money on actual trades .....just missing opportunities to trade .........:smart:

hmmmmmmm...nothings perfect 😉

N

Attachments

Good day, NPV.

I have been lurking here for some time - working through the thread from No 1 onwards...I think I'll still be at during Christmas. It is excellent and many thanks for providing the rest of us with your valuable knowledge. It is a fantastic 'edge'.

As a contibution to recognise your prodigious efforts, I thought you might like to read this:

Is the Bear Yen Position Becoming Too Popular? > CashBackForex

The massive short spec in Yen implies that your stance on a rising yen price idc is absolutely correct.

I also want to send you some specific global FX research from a famous 'House' - but please provide me with your PA address?

Yours sincerely,

Hamish

I have been lurking here for some time - working through the thread from No 1 onwards...I think I'll still be at during Christmas. It is excellent and many thanks for providing the rest of us with your valuable knowledge. It is a fantastic 'edge'.

As a contibution to recognise your prodigious efforts, I thought you might like to read this:

Is the Bear Yen Position Becoming Too Popular? > CashBackForex

The massive short spec in Yen implies that your stance on a rising yen price idc is absolutely correct.

I also want to send you some specific global FX research from a famous 'House' - but please provide me with your PA address?

Yours sincerely,

Hamish

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hey hamish

thanks for the comments .........just doing what I do day in day out

[email protected] is fine to contact me

if your a brave man my site at FXcorrelator.com has more general information on what i do but I have some Techy problems with my Web Service provider (and my IT/Business partner has been very ill)

so we are getting some malware problems

it will be up again and virus free soon - when I get time to kick them about a bit ......

N

thanks for the comments .........just doing what I do day in day out

[email protected] is fine to contact me

if your a brave man my site at FXcorrelator.com has more general information on what i do but I have some Techy problems with my Web Service provider (and my IT/Business partner has been very ill)

so we are getting some malware problems

it will be up again and virus free soon - when I get time to kick them about a bit ......

N

RussianHunter

Junior member

- Messages

- 19

- Likes

- 0

Hello every one, nice EURO ride on Asian session (EJ - was completely correlated), well I think objects of interest will be Jen and EURO today on Euro session

Similar threads

- Replies

- 0

- Views

- 3K