jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N and whoever else,

The snow has at last started to clear but its left a soggy mess behind it - something the current UK government will do come the general election! Interesting day today after last Friday's blow out and subsequent retrace, onto what I saw:-

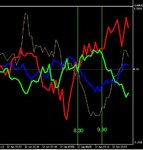

GU; Entered long on 08:20 bar at 61294 and I got the usual retrace for a smallish MAE before price chugged away upwards. Held on during the very thin period around 09:00 then price took my adjusted SL out during 09:35 bar for a 17 pip loss - ouch! Second trade had my 61304 buy stop order filled during that big 10:00 bar thrust and I was able to let this trade ride off into the northern regions before it took out my TS during 11:45 bar for a nice and revengeful 33 pip profit.

EU; Wierdly similar to GU today. Had 45174 buy stop filled during 08:30 bar but price retreated away from this as the bar closed. Next bar hauled me out of trouble and I was off on the subsequent up/down ride before being dumped out during 09:55 bar at adjusted SL for a 11 pip loss. Curses there as the very next bar proceded to pop up again and really I should have kept my initial SL intact to stay in the market, but all that meandering had the trigger finger twitching like mad! Second trade again enterd long with buy stop at 45308 which was filed during 10:55 bar that initially looked to be a failrly decent sized bar, but the SoB had retreated by its close and then went deathly quiet for a further bar before popping up again. Price lazily went up (just where has the momentum gone today?) and down then up again and by the time the 11:45 bar had finished its trace down to a tad above my initial entry point, I'd had enough of this lacklustre performance and bailed out for a thoroughly ridiculous 1 pip profit!

EG; This looked to be completely out of sync from what I normally see on most days and with both G and E sort of following each other around hand-in-hand (just like bad news and the UK's prime minister!) and neither one willing to "break" away, so I left this pair well alone and marked it off to be watched during the afternoon session.

Will upload chart pics when I eventually find where I dropped these on my pc - ahh, the wonders of this technology thing! Anyway, not a very good morning by any means but hopefully a bit of energy will emerge later on.

Trade well and regards,

Simon.

The snow has at last started to clear but its left a soggy mess behind it - something the current UK government will do come the general election! Interesting day today after last Friday's blow out and subsequent retrace, onto what I saw:-

GU; Entered long on 08:20 bar at 61294 and I got the usual retrace for a smallish MAE before price chugged away upwards. Held on during the very thin period around 09:00 then price took my adjusted SL out during 09:35 bar for a 17 pip loss - ouch! Second trade had my 61304 buy stop order filled during that big 10:00 bar thrust and I was able to let this trade ride off into the northern regions before it took out my TS during 11:45 bar for a nice and revengeful 33 pip profit.

EU; Wierdly similar to GU today. Had 45174 buy stop filled during 08:30 bar but price retreated away from this as the bar closed. Next bar hauled me out of trouble and I was off on the subsequent up/down ride before being dumped out during 09:55 bar at adjusted SL for a 11 pip loss. Curses there as the very next bar proceded to pop up again and really I should have kept my initial SL intact to stay in the market, but all that meandering had the trigger finger twitching like mad! Second trade again enterd long with buy stop at 45308 which was filed during 10:55 bar that initially looked to be a failrly decent sized bar, but the SoB had retreated by its close and then went deathly quiet for a further bar before popping up again. Price lazily went up (just where has the momentum gone today?) and down then up again and by the time the 11:45 bar had finished its trace down to a tad above my initial entry point, I'd had enough of this lacklustre performance and bailed out for a thoroughly ridiculous 1 pip profit!

EG; This looked to be completely out of sync from what I normally see on most days and with both G and E sort of following each other around hand-in-hand (just like bad news and the UK's prime minister!) and neither one willing to "break" away, so I left this pair well alone and marked it off to be watched during the afternoon session.

Will upload chart pics when I eventually find where I dropped these on my pc - ahh, the wonders of this technology thing! Anyway, not a very good morning by any means but hopefully a bit of energy will emerge later on.

Trade well and regards,

Simon.