You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

Jedster2001

Active member

- Messages

- 120

- Likes

- 3

sell AUD or BUY GBP into the USD ?

both are fine with me 🙂

N

Sell AUD 🙂

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

ok gotta scoot

here the 1 minute 20ma FXCorrelator available for free below in the links

NOTE - I dont use this anymore in my scalping ..........(jedster and I have evolved some pretty awesome derivatives these days)

BUT you can see whats happening ................USD is flat and we have the otehr currencies all diverging

hence I could have traded both the AUDUSD down and the GBPUSD up .....and made a few pips scalping 👍

it just takes practice practice practice gang...........and a lot of experience reading the currencies and dynamics of the G8 market !

later

N

here the 1 minute 20ma FXCorrelator available for free below in the links

NOTE - I dont use this anymore in my scalping ..........(jedster and I have evolved some pretty awesome derivatives these days)

BUT you can see whats happening ................USD is flat and we have the otehr currencies all diverging

hence I could have traded both the AUDUSD down and the GBPUSD up .....and made a few pips scalping 👍

it just takes practice practice practice gang...........and a lot of experience reading the currencies and dynamics of the G8 market !

later

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Sell AUD 🙂

hahahahahahahahahahahaha 😆

nice call dude 👍

jees he cracks me up sometimes 🙂

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

buy G/U 6450

turn and burn baby .............turn and burn 😎

signing off .....gotta scoot .........

and be careful out there you topgun scalpers !!!!

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

well ...............if you step back to the 1 hour TF on a 20ma setting

you see the USD has been North of the Zero line for nearly 2 days .........plenty of time to salvage a few pips here and there buying it ...........surely ?

have a good weekend

N

you see the USD has been North of the Zero line for nearly 2 days .........plenty of time to salvage a few pips here and there buying it ...........surely ?

have a good weekend

N

Attachments

Last edited:

James Austin

Member

- Messages

- 59

- Likes

- 3

thanks for the detailed info Jedster 👍

Guys,

NVP asked me to post a message just to summarise what is going on with the MT4 update.

Hope that helps...

J

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Februarys here ..............howd you guys do in January ?

using a 500 ma setting on a 4hr TF re the FXCorrelator (Available free below in the links)..........lets take a look at the January G8 action

using a 500ma is almost like viewing real time price moves up and down (like any pairchart).....the MA skew is minimised and you can theoretically use standard price action techniques to trade currencies

but thats another story .................lets start with the Dow

N

using a 500 ma setting on a 4hr TF re the FXCorrelator (Available free below in the links)..........lets take a look at the January G8 action

using a 500ma is almost like viewing real time price moves up and down (like any pairchart).....the MA skew is minimised and you can theoretically use standard price action techniques to trade currencies

but thats another story .................lets start with the Dow

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

OK

the Dow took a big hit in january alongside most global Equities..........why ?..........Risk off dudes risk off ...............as the Fed turn off the tap everyone gets thirsty real quick and cut their Equity positions .........bond yields took the brunt and the vix got real scared

action like this naturally affect the currency markets ......Global markets are interconnected like never before and a sneeze in New york gets its nose blown across the globe in milliseconds

so who won and who lost in this scenario ?........shucks do you really need me to tell you ?

N

the Dow took a big hit in january alongside most global Equities..........why ?..........Risk off dudes risk off ...............as the Fed turn off the tap everyone gets thirsty real quick and cut their Equity positions .........bond yields took the brunt and the vix got real scared

action like this naturally affect the currency markets ......Global markets are interconnected like never before and a sneeze in New york gets its nose blown across the globe in milliseconds

so who won and who lost in this scenario ?........shucks do you really need me to tell you ?

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

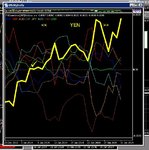

ok the winner was ............

monster performance from the Yellow Yen that surged on the classic risk reversal play ...........😎

it took an average of just over 4% off the average G7 and over 7% off the brown CAD ........also highlighted here as the big Loser of the month

thats gotta hurt :whistling

N

monster performance from the Yellow Yen that surged on the classic risk reversal play ...........😎

it took an average of just over 4% off the average G7 and over 7% off the brown CAD ........also highlighted here as the big Loser of the month

thats gotta hurt :whistling

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

ok lets run the 20ma standard FXCorrelator against the daily TF to see what we had as signals in Jan ............here it is

what do you see ?...........

remember we like DIVERGING currencies away from the ZERO......if we can get a decent level of divergence from the Zero......... and or at least 5 bars running on the same side we are seriously quids in if we select a similar currency acting the same on the opposite side 👍

N

what do you see ?...........

remember we like DIVERGING currencies away from the ZERO......if we can get a decent level of divergence from the Zero......... and or at least 5 bars running on the same side we are seriously quids in if we select a similar currency acting the same on the opposite side 👍

N

Attachments

Last edited:

Similar threads

- Replies

- 0

- Views

- 3K