Japan hits back at currency critics

By Jonathan Soble in Tokyo FT.com

The Japanese government has dismissed criticism that it is trying to revive the economy at the expense of the nation’s trading partners by intentionally weakening the yen, a policy that some foreign leaders warn could lead to a damaging spiral of global currency devaluations.

Akira Amari, economy minister, hit back against admonishments this week by Jens Weidmann, the president of Germany’s Bundesbank, and other German and UK officials who have raised concerns about the new Japanese government’s assertive efforts to loosen monetary policy.

In an interview with the Financial Times on Wednesday, Mr Amari rejected Mr Weidmann’s characterisation of Japanese moves as “alarming infringements” of central bank independence that could lead to “politicisation of the exchange rate”.

“Germany is the country whose exports have benefited most from the euro area’s fixed exchange rate system. He’s not in a position to criticise,” Mr Amari said.

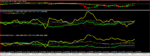

Shinzo Abe, Japan’s new prime minister, has piled pressure on the Bank of Japan to take more aggressive action to tackle the deflation that has plagued the economy for two decades. That effort is seen as a primary cause of the yen’s 10 per cent drop against the dollar and 14 per cent tumble against the euro since November, when the election that brought the new government to power was called.

On Tuesday, the Japanese central bank succumbed to the political pressure by extending indefinitely its programme of buying up government bonds and set a target of achieving 2 per cent inflation, strengthening what had been a flexible “goal” of 1 per cent.

Mr Amari denied that the recent Japanese moves were designed specifically to weaken the yen. He said they were aimed at boosting the domestic economy and reversing the mild consumer-price deflation that has dogged Japan since the bubble burst.

“The market is in the process of correcting on its own from an excessively strong yen,” he said. “We aren’t guiding it, we aren’t doing anything.”

Michael Meister, a senior member of Germany’s ruling Christian Democratic Union, responded to the Bank of Japan decision by saying Germany might seek support from fellow G20 nations to pressure Japan to reverse course. Sir Mervyn King, Bank of England governor, also warned of the risk of competitive currency devaluations – dubbed “currency wars” since the US adopted unorthodox measures to ease monetary policy in 2010.

when asked for comments NVP quipped "People in Glass houses"..........