ALEXGOLD

Junior member

- Messages

- 21

- Likes

- 0

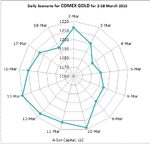

Be patient - wait for the 4th of March, see if the price is at its low, probably best consider second additional point to open long position in GOLD on the 5th of March, at the end of the day...

Major uptrend is on the 10th of March and you may wish to close the trade on the 13th of March or use appropriate stop.

The pattern for March, 16.

Could open higher and slide considerably with price low on the next day. The 18th will resemble the pattern of the 16th day.

Made with best possible precision, so use at you own risk or just as additional view on gold.

Major uptrend is on the 10th of March and you may wish to close the trade on the 13th of March or use appropriate stop.

The pattern for March, 16.

Could open higher and slide considerably with price low on the next day. The 18th will resemble the pattern of the 16th day.

Made with best possible precision, so use at you own risk or just as additional view on gold.