Davydenko33

Newbie

- Messages

- 2

- Likes

- 0

Hi,

Apologies in advance for asking novicey questions but seeking some advice please.

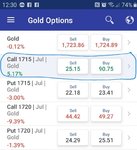

This morning on Plus 500, I set a buy on the Call of Gold. I had a starting position of 53.31 with the pricing staying in and around that area for most of the trade. Suddenly out of nowhere the spread between "Sell" and "Buy" was in excess of 65 - (a sell of 25.15 and a buy of 90.75) - see image below. A margin call was immediately actioned and my account balance was taken. I imagine this would have happened to many buyers and sellers given the huge spread suddenly given.

Sure enough, almost instantly the market immediately came back to the same level of around 51 and the same tight spread/ However, a margin call was made without any notification and all funds were taken. Is there anything I can do to challenge this with Plus500 as it appears totally unjust to swallow all funds and close a trade by suddenly implementing of spread of 65 between buy and sell. I am even wondering if it was just a mistake, the margin typically on that market is less than 1.

Any advice or explanation much appreciated.

Thanks

Jon

Apologies in advance for asking novicey questions but seeking some advice please.

This morning on Plus 500, I set a buy on the Call of Gold. I had a starting position of 53.31 with the pricing staying in and around that area for most of the trade. Suddenly out of nowhere the spread between "Sell" and "Buy" was in excess of 65 - (a sell of 25.15 and a buy of 90.75) - see image below. A margin call was immediately actioned and my account balance was taken. I imagine this would have happened to many buyers and sellers given the huge spread suddenly given.

Sure enough, almost instantly the market immediately came back to the same level of around 51 and the same tight spread/ However, a margin call was made without any notification and all funds were taken. Is there anything I can do to challenge this with Plus500 as it appears totally unjust to swallow all funds and close a trade by suddenly implementing of spread of 65 between buy and sell. I am even wondering if it was just a mistake, the margin typically on that market is less than 1.

Any advice or explanation much appreciated.

Thanks

Jon