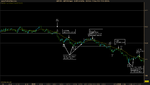

If I'm measuring this trend right and C to D is the next major leg, then we should definitely skip that DD in between D and E. A week ago I would've taken it because I would have considered that questionable DD right before it the start of a new leg. But that pullback wasn't very significant, so I left C up there after the larger countertrend. I am not sure if I should've put D lower where I did, or if I should've put it at this questionable DD. The next setup will clarify why I am confused about this:

E makes a pretty good bear flag. The later DD is much better, but here's where again, I get confused. If I marked C to D correctly, then D to E isn't a long enough pullback. But if we measure from that 2nd DD trade, it's a 50% retracement and looks like a very good trade. But then that makes the false DD in the middle of the countertrend look like a sufficient pullback.