BLS

Established member

- Messages

- 642

- Likes

- 229

View attachment 143258

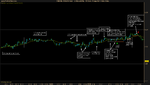

I've only seen one opportunity so far today and I skipped it. That first bearish push cut through the bottom of the range without running into any resistance, so I skipped the SB setup at 7:54 on the chart. This was a terrible breakout because there was mysteriously no tension at all behind it, and it died out. There was a DD right in the average that I knew to skip because it had also not yet pulled back 40%.

I watched that BB setup but didn't take it. I wish I had, but I've had trouble with the smaller BBs. I think in this case it would be an ARB? This one shows excellent tension and was clearly bullish. Even had a retest of the breakout range, providing a 2nd chance to get in.

The 2nd box that I drew was a possible BB developing, however I didn't see the level of tension that I wanted so I skipped it. Seeing that price would need to clear 2 tops, I wanted to see a little more bullish tension before the break.

For that first BB, I would not trade it as a BB since the market wasn't really trending at the point. I would hesitate to trade it as a clustering ARB since there was a solid upper barrier line for the range that it broke out of (the clustering occurs because there is some uncertainty as to where the break actually occurred).