I have already posted some ideas, meant to assist struggling traders

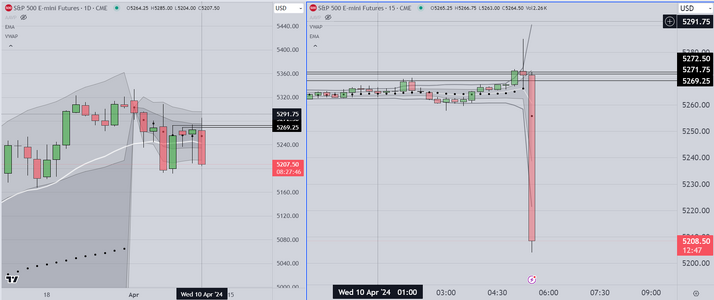

One of those concepts is called the "Run-Up" or "Run-Up Trade" An associate of mine

also calls this "Stealing the Trade"

Basically, institutions and funds take advantage of a usually quiet overnight market

to move price in advance (news organizations often use the language "in the run-up to")

a specific high impact economic report. As I have mentioned in the thread "Long Road to

Success", this allows them to accumulate inventory, wait for the open of the RTH session

then sell the marked up inventory, thus realizing significant profit, with very little risk.

I have many examples (I use them for training purposes) and what you can see in the

current example is the "measured move" up just prior to the release of economic news

today.

I will post a few more charts and miscellaneous examples, and then I intend to continue

on with my own blog of the same name ("Beyond Price Action").

Wish you all the best of luck

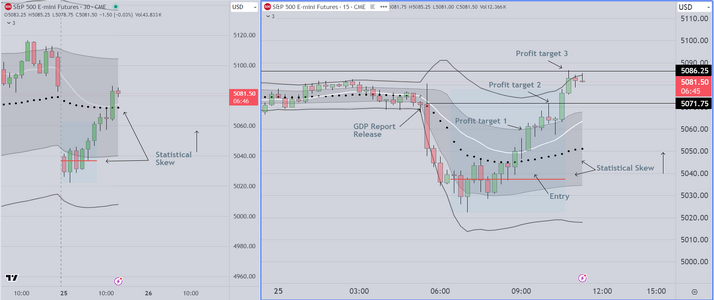

One of those concepts is called the "Run-Up" or "Run-Up Trade" An associate of mine

also calls this "Stealing the Trade"

Basically, institutions and funds take advantage of a usually quiet overnight market

to move price in advance (news organizations often use the language "in the run-up to")

a specific high impact economic report. As I have mentioned in the thread "Long Road to

Success", this allows them to accumulate inventory, wait for the open of the RTH session

then sell the marked up inventory, thus realizing significant profit, with very little risk.

I have many examples (I use them for training purposes) and what you can see in the

current example is the "measured move" up just prior to the release of economic news

today.

I will post a few more charts and miscellaneous examples, and then I intend to continue

on with my own blog of the same name ("Beyond Price Action").

Wish you all the best of luck