In this article, I will go over three possible outcomes for a Bear Call spread at the expiry. Those scenarios involve the price of the underlying closing within the spread, above the sold call, and below the sold call.

Last week's article, "Iron Condor Revisited", had addressed the issue of two vertical credit spreads. Since then, a student whom I shall leave unnamed, has emailed me pleading with me to explain to him a trade in which the student has gotten into without knowing much about spread trading. From the email, it could be inferred that the student has taken a bigger position from what is normal. Again, without disclosing anything more about the student, I will go over the facts of the trade. (I do have the student's consent to share this freely.)

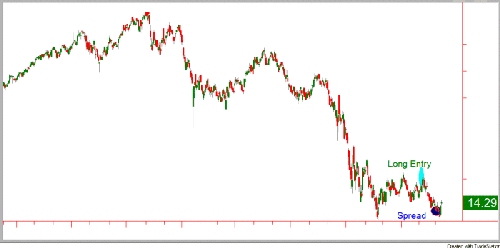

I have included the chart here, as I usually do for my real trades, but I choose to white out the exact ticker. Thus, when referencing the underlying, I will use that worn out cliché of XYZ.

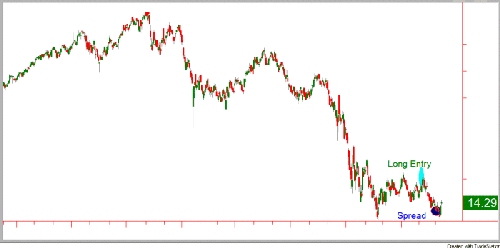

The daily chart of XYZ below shows (with a blue oval) the point of the initial entry. I have also marked on the chart in green letters the words, "Long Entry." It is at this point that the student went long. In hindsight, we could observe that from the technical analysis view point, the XYZ at the time of the entry was coming to a resistance, yet that was the exact place where the student went long.

I was told in the email that the initial trade on XYZ involved going long on a March 14 call, while XYZ was hitting resistance, as I pointed out above. At that time, the premium for the calls was high, but as soon as XYZ started to head South (way South), the call premium got cheaper. The next point, marked on the chart with a dark blue oval and the word "Spread," is where the student has added more contracts to the existing position and then turned it into a spread trade. This action of Averaging Down is something that we, the instructors, strongly discourage, for even if it works out occasionally, the strategy of Averaging Down creates a bad habit which is difficult to break later on.

[For those readers who need the refresher how a Bear Call works and what is involved, I suggest that you read my article, "Bear (Call) at Work."]

The final outcome of turning it into a Bear Call has produced the following trade:

BTO + 100 Mar 14c @ -0.505 (OTM)

STO - 100 Mar 13c @ +0.70 (ATM)

Max P (is the difference) + 0.195

Max L (width Spread 14c-13c) 1.00 ?Max P

Max L -0.805

ROI = Max P/Max L = .195/.805 = 24.2 %

BEP = sold strike + Max P = 13.00 + 0.195

BEP = 13.195

Oddly enough, the moment the student had turned his initially Bullish trade into a Bearish trade, the market had reversed and started rallying up. Now the trader is sitting in a trade that he completely does not understand. Moreover, due to the huge contract size, the broker has placed the maintenance on his existing position, in this case ten thousand dollars. This is a huge chunk of change to be sitting unused.

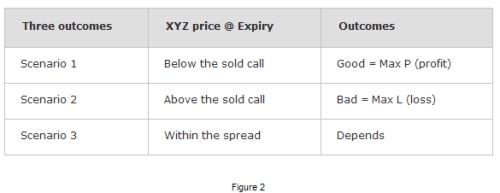

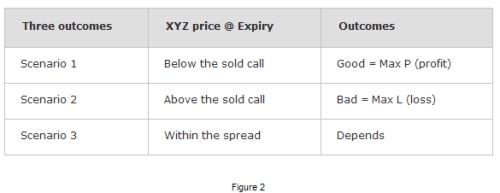

Having presented all the facts, let us go over three possible outcomes which could take place at the expiry. They are in fact simple and Figure 2 provides the visual presentation of them.

Once again, I hate oversimplifications but often when explaining something it is useful to use them as a starting point. Now let us turn our attention to each of those three scenarios and dig a bit deeper into them.

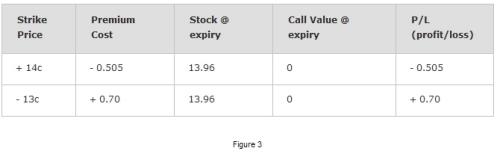

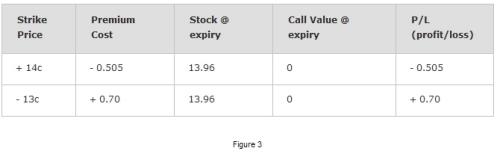

Scenario # 1 (Good outcome) XYZ $13.96

Bottom line = + 0.195

The best possible outcome, keeping the maximum profit (Max P) or 0.195 and the maintenance on our account is lifted after the expiry.

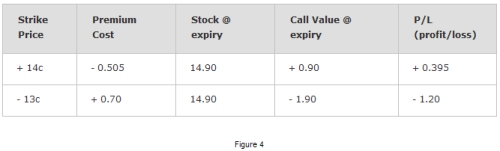

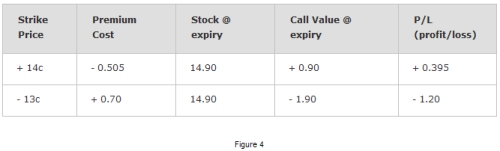

Scenario # 2 (Bad outcome) XYZ $14.9

Bottom line = - 0.805

With the price being at $14.9, the sold 13c is now worth 1.90 and it needs to be repurchased for a much higher price than what was sold. Observe that it was sold for 0.70 cents and now needs to be bought back for 1.90. In this case, the loss is 1.20 per contract. However, the trade has gone sour, yet the max loss isn't 1.20 because of the fact that the 14 call which was bought for 0.505 and is now trading for 0.90; so once the 14 call is sold the profit of 0.395 is received and needs to be subtracted from the 1.20 loss (caused by the sale of the strike price of the 13 call). Therefore, the loss is actually - 0.805.

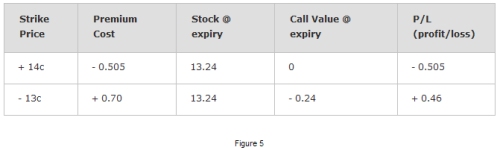

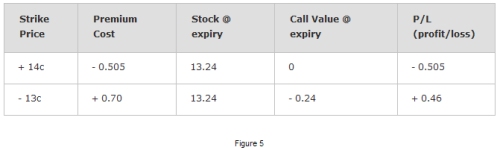

Scenario # 3 (Within the spread) XYZ $13.24

Bottom line = - 0.045

When all the calculations are done, the loss is basically less than a nickel per contract. The reason why that would be the case is the following. The breakeven point (BEP) was 13.195 and the price has closed at 13.24, when the bigger number is subtracted from the smaller one (the closing price minus the BEP) or 13.24 - 13.195, we get the loss of only 0.045; which is small. Now keep in mind that 1 contract controls 100 shares and the student has 100 contracts which is basically 10,000 shares. This means that the loss which seems small is in fact $450 plus the commissions. Once again be aware of the position sizing when trading options. Leverage is a two way street, it can work either for you or against you.

In conclusion, this trade is still open and it is in play until the expiry (Friday, 03/20/2009). Which way it's going to unfold remains to be seen, yet as of now we could learn from the student's pain. The saying goes: "Wise trader learns from his or her mistakes, but the wiser one also learns from the mistakes of the other traders." Please do not look down on other fellow traders; learn from their mistakes. Even if you lose money on the trade, do not lose the valuable lesson that the trade had. Go over your bad trades and learn from them. It is painful but it is worth it.

Good trading and again watch your position sizing.

Last week's article, "Iron Condor Revisited", had addressed the issue of two vertical credit spreads. Since then, a student whom I shall leave unnamed, has emailed me pleading with me to explain to him a trade in which the student has gotten into without knowing much about spread trading. From the email, it could be inferred that the student has taken a bigger position from what is normal. Again, without disclosing anything more about the student, I will go over the facts of the trade. (I do have the student's consent to share this freely.)

I have included the chart here, as I usually do for my real trades, but I choose to white out the exact ticker. Thus, when referencing the underlying, I will use that worn out cliché of XYZ.

The daily chart of XYZ below shows (with a blue oval) the point of the initial entry. I have also marked on the chart in green letters the words, "Long Entry." It is at this point that the student went long. In hindsight, we could observe that from the technical analysis view point, the XYZ at the time of the entry was coming to a resistance, yet that was the exact place where the student went long.

I was told in the email that the initial trade on XYZ involved going long on a March 14 call, while XYZ was hitting resistance, as I pointed out above. At that time, the premium for the calls was high, but as soon as XYZ started to head South (way South), the call premium got cheaper. The next point, marked on the chart with a dark blue oval and the word "Spread," is where the student has added more contracts to the existing position and then turned it into a spread trade. This action of Averaging Down is something that we, the instructors, strongly discourage, for even if it works out occasionally, the strategy of Averaging Down creates a bad habit which is difficult to break later on.

[For those readers who need the refresher how a Bear Call works and what is involved, I suggest that you read my article, "Bear (Call) at Work."]

The final outcome of turning it into a Bear Call has produced the following trade:

BTO + 100 Mar 14c @ -0.505 (OTM)

STO - 100 Mar 13c @ +0.70 (ATM)

Max P (is the difference) + 0.195

Max L (width Spread 14c-13c) 1.00 ?Max P

Max L -0.805

ROI = Max P/Max L = .195/.805 = 24.2 %

BEP = sold strike + Max P = 13.00 + 0.195

BEP = 13.195

Oddly enough, the moment the student had turned his initially Bullish trade into a Bearish trade, the market had reversed and started rallying up. Now the trader is sitting in a trade that he completely does not understand. Moreover, due to the huge contract size, the broker has placed the maintenance on his existing position, in this case ten thousand dollars. This is a huge chunk of change to be sitting unused.

Having presented all the facts, let us go over three possible outcomes which could take place at the expiry. They are in fact simple and Figure 2 provides the visual presentation of them.

Once again, I hate oversimplifications but often when explaining something it is useful to use them as a starting point. Now let us turn our attention to each of those three scenarios and dig a bit deeper into them.

Scenario # 1 (Good outcome) XYZ $13.96

Bottom line = + 0.195

The best possible outcome, keeping the maximum profit (Max P) or 0.195 and the maintenance on our account is lifted after the expiry.

Scenario # 2 (Bad outcome) XYZ $14.9

Bottom line = - 0.805

With the price being at $14.9, the sold 13c is now worth 1.90 and it needs to be repurchased for a much higher price than what was sold. Observe that it was sold for 0.70 cents and now needs to be bought back for 1.90. In this case, the loss is 1.20 per contract. However, the trade has gone sour, yet the max loss isn't 1.20 because of the fact that the 14 call which was bought for 0.505 and is now trading for 0.90; so once the 14 call is sold the profit of 0.395 is received and needs to be subtracted from the 1.20 loss (caused by the sale of the strike price of the 13 call). Therefore, the loss is actually - 0.805.

Scenario # 3 (Within the spread) XYZ $13.24

Bottom line = - 0.045

When all the calculations are done, the loss is basically less than a nickel per contract. The reason why that would be the case is the following. The breakeven point (BEP) was 13.195 and the price has closed at 13.24, when the bigger number is subtracted from the smaller one (the closing price minus the BEP) or 13.24 - 13.195, we get the loss of only 0.045; which is small. Now keep in mind that 1 contract controls 100 shares and the student has 100 contracts which is basically 10,000 shares. This means that the loss which seems small is in fact $450 plus the commissions. Once again be aware of the position sizing when trading options. Leverage is a two way street, it can work either for you or against you.

In conclusion, this trade is still open and it is in play until the expiry (Friday, 03/20/2009). Which way it's going to unfold remains to be seen, yet as of now we could learn from the student's pain. The saying goes: "Wise trader learns from his or her mistakes, but the wiser one also learns from the mistakes of the other traders." Please do not look down on other fellow traders; learn from their mistakes. Even if you lose money on the trade, do not lose the valuable lesson that the trade had. Go over your bad trades and learn from them. It is painful but it is worth it.

Good trading and again watch your position sizing.

Last edited by a moderator: