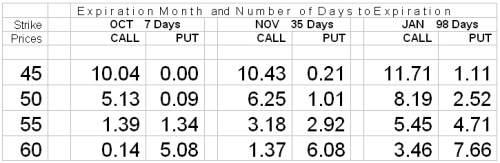

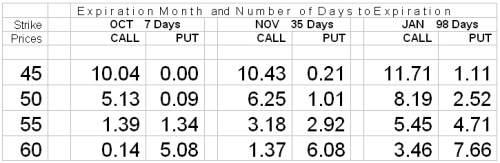

Today I'd like to talk about a strategy called the Vertical Spread. For those of you who are wondering how the terms Horizontal and Vertical came into common usage, ponder no more. In a typical options chain or montage, the options are typically displayed in the format shown here. Calendar months listed horizontally and strike prices listed vertically!

As I typically like to do, let's start out with a definition.

Definition: A Vertical Spread is an options strategy in which options are bought and an equal number of options of the same type (Puts or Calls) are sold with different strike prices, but with the same expiration date.

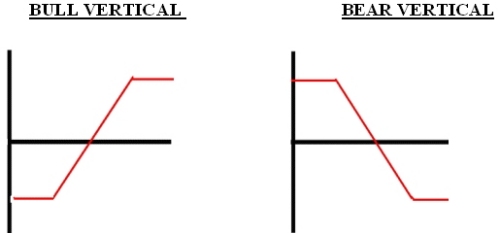

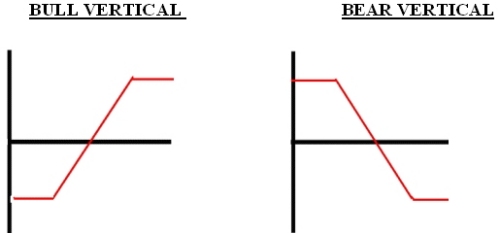

Vertical Spreads are directional strategies and are either bullish or bearish. This is what the generic expiration graphs look like.

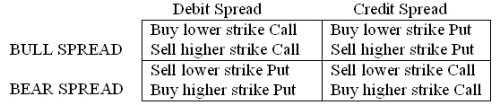

The Bull Vertical can be constructed with either Puts or Calls. When it's done with Calls, you buy a Call and simultaneously sell a Call at a higher strike. Since the Call with the lower strike price will always be worth more than the Call with the higher strike price, a Bull Vertical will always be established for a debit.

Similarly, a Bear Vertical can be constructed with Puts by buying a Put and selling a lower strike Put. This construction will also always be done for a debit, since the higher strike Put will always be more expensive than the lower strike Put.

What's interesting about these spreads is that you can also construct the Bull Vertical with Puts or the Bear Vertical with Calls. These spreads will be done for credits, since you are selling the more expensive option and buying the less expensive one.

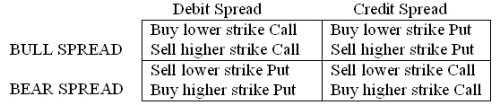

The following table should clear up any confusion:

Let's take an example using the above prices for options on XYZ stock which is currently trading at $55. Suppose you're bullish on the stock over the next 35 days. You could buy a 55Call option for $3.18. If XYZ increases by 10% to $60.50 at expiration, you will make $2.32 for each contract you bought. On the other hand, if you were wrong about the movement of XYZ, and it finishes constant at its current level, you'll lose the full amount of the purchase. In fact, just to break even, XYZ will have to increase to $58.18 at expiration.

Now a spread trader might have approached this situation differently. He could buy the 55Call for $3.18 and simultaneously sell the 60Call for $1.37, resulting in a net debit of $1.81. That's a reduction of 43% in the traders' net outlay. If the stock stays at $55, he still loses the entire debit, but it's still 43% less than what he would have lost on the Call. Also the breakeven point is now lowered to $56.81 versus $58.18 for the lonely Call.

So what's the problem, why would anyone just buy a Call? Like everything else regarding options trading, there's a trade-off. To get this reduced cost and lower breakeven point, you're giving up the unlimited potential of the Call purchase. No matter how high the stock goes, the value of the spread can never exceed $5. Consequently, since we paid $1.81 for the spread the maximum profit that can be made is $5 - $1.81 = $3.19. For example, with the stock at $63 the 55C = $8, the 60 C= $3, and the spread is worth $5. With the stock at $75 the 55C = $20, the 60C = $15, and the spread is still worth $5.

Suppose now that we were to construct this same Bull Spread using Puts. We could sell the 60Put for $6.08 and buy the 55Put for $2.92, yielding a net credit of $3.16. If XYZ is above $60 at expiration, both Puts will expire worthless, so the spread will also be worthless and we get to keep the credit of $3.16. If XYZ is below $55 at expiration, let's say $52, then the 60Put will be worth $8, and the 55Put $3, and therefore the spread will be worth $5. Since we sold it for $3.16 and now we have to buy it back for $5, we end up with a net loss of $5 - $3.16 = $1.84. This will be the amount of loss for any stock price less than or equal to $55 at expiration.

Notice that when we constructed the Bull Vertical with Calls (for a debit), the maximum gain was $3.19 and the maximum loss was $1.81. When constructed with Puts (for a credit), the maximum gain was $3.16 and the maximum loss was $1.84. So assuming that you could do the Bull Vertical with either Puts or Calls for the amounts shown, which would be a more profitable spread? Think about it. Okay, drum roll please, the answer is that they would have exactly the same profit or loss, regardless of where the stock ended up at expiration. While it may appear that the debit spread is better since you can gain more and lose less, the difference (3 cents in this case) is actually an interest adjustment reflecting the fact that in one case (the debit) money is leaving the account, and in the other (credit), money is coming into the account and would be earning interest. That difference is calculated by multiplying the maximum value of the spread ($5), by the risk free rate of return (assumed to be 5%) in this example, for the number of days until expiration, or: 5 x .05 x 35/365 = .03

The real key to understanding the difference between the 2 spreads discussed above is to realize that they are synthetically equivalent. Also, you must know how to compare them to each other. For example, if I could buy the Bull Call Vertical for less than $1.81 that would be a good buy relative to receiving a credit of $3.16 for the Bull Put Vertical. Likewise, if I could sell the Bull Put Vertical for more than $3.16 that would be a good sale relative to buying the Bull Call Vertical for $1.81.

While the examples I've shown generally relate to Bull Vertical Spreads, the concept is exactly the same for Bear Vertical Spreads. It would probably help your understanding, if you ran some Bear Vertical scenarios using the theoretical values in the above table.

As I typically like to do, let's start out with a definition.

Definition: A Vertical Spread is an options strategy in which options are bought and an equal number of options of the same type (Puts or Calls) are sold with different strike prices, but with the same expiration date.

Vertical Spreads are directional strategies and are either bullish or bearish. This is what the generic expiration graphs look like.

The Bull Vertical can be constructed with either Puts or Calls. When it's done with Calls, you buy a Call and simultaneously sell a Call at a higher strike. Since the Call with the lower strike price will always be worth more than the Call with the higher strike price, a Bull Vertical will always be established for a debit.

Similarly, a Bear Vertical can be constructed with Puts by buying a Put and selling a lower strike Put. This construction will also always be done for a debit, since the higher strike Put will always be more expensive than the lower strike Put.

What's interesting about these spreads is that you can also construct the Bull Vertical with Puts or the Bear Vertical with Calls. These spreads will be done for credits, since you are selling the more expensive option and buying the less expensive one.

The following table should clear up any confusion:

Let's take an example using the above prices for options on XYZ stock which is currently trading at $55. Suppose you're bullish on the stock over the next 35 days. You could buy a 55Call option for $3.18. If XYZ increases by 10% to $60.50 at expiration, you will make $2.32 for each contract you bought. On the other hand, if you were wrong about the movement of XYZ, and it finishes constant at its current level, you'll lose the full amount of the purchase. In fact, just to break even, XYZ will have to increase to $58.18 at expiration.

Now a spread trader might have approached this situation differently. He could buy the 55Call for $3.18 and simultaneously sell the 60Call for $1.37, resulting in a net debit of $1.81. That's a reduction of 43% in the traders' net outlay. If the stock stays at $55, he still loses the entire debit, but it's still 43% less than what he would have lost on the Call. Also the breakeven point is now lowered to $56.81 versus $58.18 for the lonely Call.

So what's the problem, why would anyone just buy a Call? Like everything else regarding options trading, there's a trade-off. To get this reduced cost and lower breakeven point, you're giving up the unlimited potential of the Call purchase. No matter how high the stock goes, the value of the spread can never exceed $5. Consequently, since we paid $1.81 for the spread the maximum profit that can be made is $5 - $1.81 = $3.19. For example, with the stock at $63 the 55C = $8, the 60 C= $3, and the spread is worth $5. With the stock at $75 the 55C = $20, the 60C = $15, and the spread is still worth $5.

Suppose now that we were to construct this same Bull Spread using Puts. We could sell the 60Put for $6.08 and buy the 55Put for $2.92, yielding a net credit of $3.16. If XYZ is above $60 at expiration, both Puts will expire worthless, so the spread will also be worthless and we get to keep the credit of $3.16. If XYZ is below $55 at expiration, let's say $52, then the 60Put will be worth $8, and the 55Put $3, and therefore the spread will be worth $5. Since we sold it for $3.16 and now we have to buy it back for $5, we end up with a net loss of $5 - $3.16 = $1.84. This will be the amount of loss for any stock price less than or equal to $55 at expiration.

Notice that when we constructed the Bull Vertical with Calls (for a debit), the maximum gain was $3.19 and the maximum loss was $1.81. When constructed with Puts (for a credit), the maximum gain was $3.16 and the maximum loss was $1.84. So assuming that you could do the Bull Vertical with either Puts or Calls for the amounts shown, which would be a more profitable spread? Think about it. Okay, drum roll please, the answer is that they would have exactly the same profit or loss, regardless of where the stock ended up at expiration. While it may appear that the debit spread is better since you can gain more and lose less, the difference (3 cents in this case) is actually an interest adjustment reflecting the fact that in one case (the debit) money is leaving the account, and in the other (credit), money is coming into the account and would be earning interest. That difference is calculated by multiplying the maximum value of the spread ($5), by the risk free rate of return (assumed to be 5%) in this example, for the number of days until expiration, or: 5 x .05 x 35/365 = .03

The real key to understanding the difference between the 2 spreads discussed above is to realize that they are synthetically equivalent. Also, you must know how to compare them to each other. For example, if I could buy the Bull Call Vertical for less than $1.81 that would be a good buy relative to receiving a credit of $3.16 for the Bull Put Vertical. Likewise, if I could sell the Bull Put Vertical for more than $3.16 that would be a good sale relative to buying the Bull Call Vertical for $1.81.

While the examples I've shown generally relate to Bull Vertical Spreads, the concept is exactly the same for Bear Vertical Spreads. It would probably help your understanding, if you ran some Bear Vertical scenarios using the theoretical values in the above table.

Last edited by a moderator: